Question: 1 How much is your return? (a) Consider a hypothetical stock during the dot-com bubble period: bang.com. Its stock price equaled to $80 on January

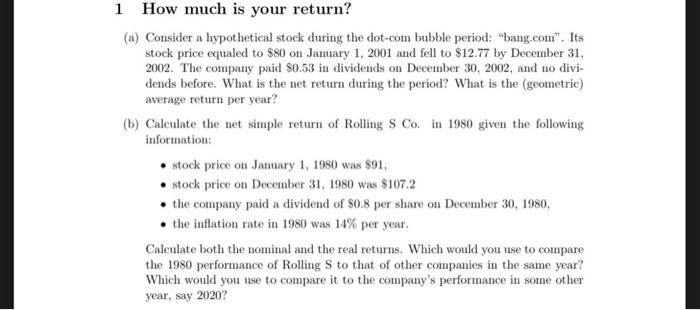

1 How much is your return? (a) Consider a hypothetical stock during the dot-com bubble period: "bang.com". Its stock price equaled to $80 on January 1, 2001 and fell to $12.77 by December 31, 2002. The company paid $0.53 in dividends on December 30, 2002, and no divi- dends before. What is the net return during the period? What is the (geometric) average return per year? (b) Calculate the net simple return of Rolling S Co in 1980 given the following information: stock price on January 1, 1980 was $91, stock price on December 31, 1980 was $107.2 the company paid a dividend of $0.8 per share on December 30, 1980, the inflation rate in 1980 was 14% per year. Calculate both the nominal and the real returns. Which would you use to compare the 1980 performance of Rolling Sto that of other companies in the same year? Which would you use to compare it to the company's performance in some other year, say 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts