Question: 1. How would a debit memo be treated on a bank reconciliation? a) Bank b) Book 2. How would a credit memo be treated on

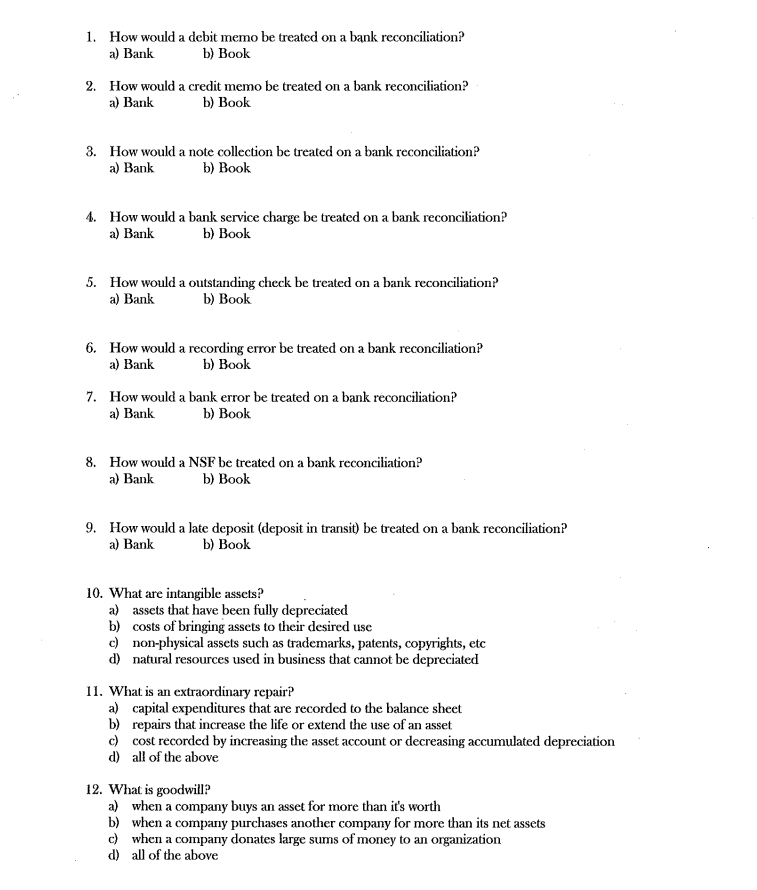

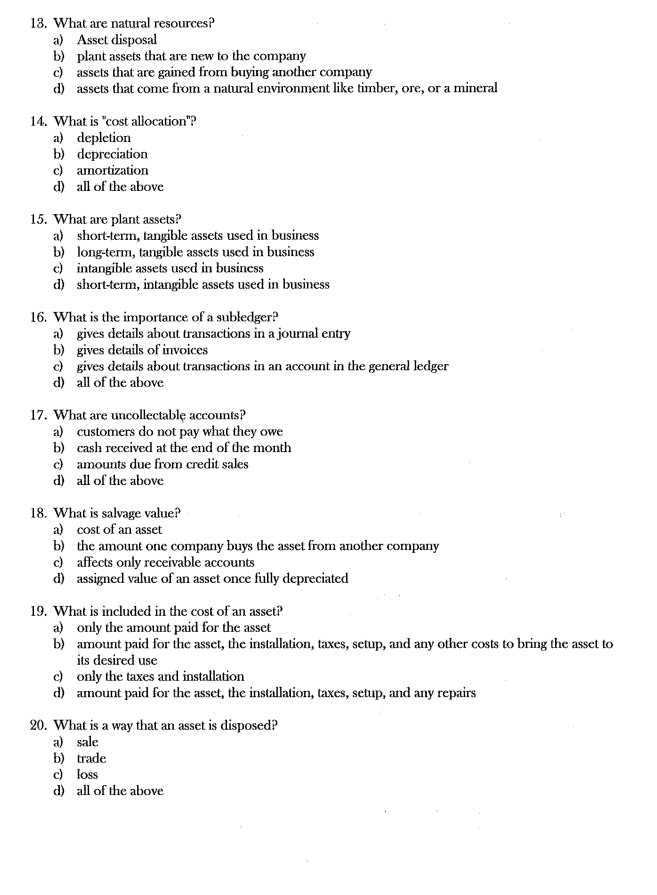

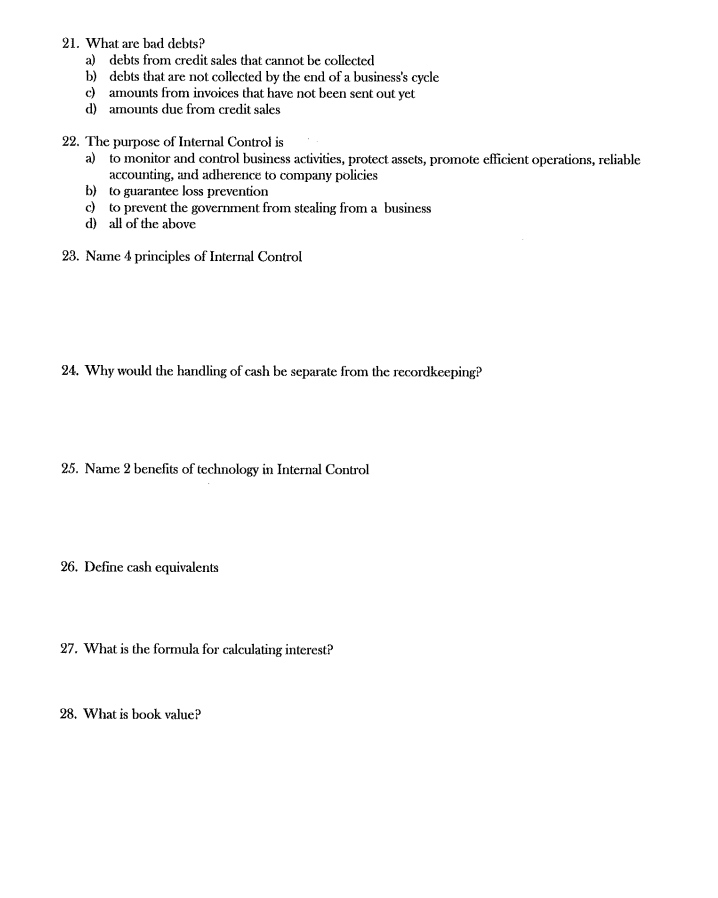

1. How would a debit memo be treated on a bank reconciliation? a) Bank b) Book 2. How would a credit memo be treated on a bank reconciliation? a) Bank b) Book 8. How would a note collection be treated on a bank reconciliation? a) Bank b) Book 4. How would a bank service charge be treated on a bank reconciliation? a) Bank b) Book 5. How would a outstanding check be treated on a bank reconciliation? a) Bank b) Book 6. How would a recording error be treated on a bank reconciliation? a) Bank b) Book 7. How would a bank error be treated on a bank reconciliation? a) Bank b) Book 8. How would a NSF be treated on a bank reconciliation? a) Bank b) Book 9. How would a late deposit (deposit in transit) be treated on a bank reconciliation? a) Bank b) Book 10. What are intangible asscts? a) assets that have been fully depreciated b) costs of bringing assets to their desired use c) non-physical assets such as trademarks, patents, copyrights, etc d) natural resources used in business that cannot be depreciated II. What is an extraordinary repairP a) capital expenditures that are recorded to the balance sheet b) repairs that increase the life or extend the use of an asset c) cost recorded by increasing the asset account or decreasing accumulated depreciation d) a of the above 12. What is goodwillP a) b) c) d) when a company buys an asset for more than it's worth when a company purchases another company for more than its net assets when a company donates large sums of money to an organization all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts