Question: 1 ) I want a complete and clear solution to this question with a screenshot of the solution tables. Task 1 (Capital Investment Appraisal) Magna

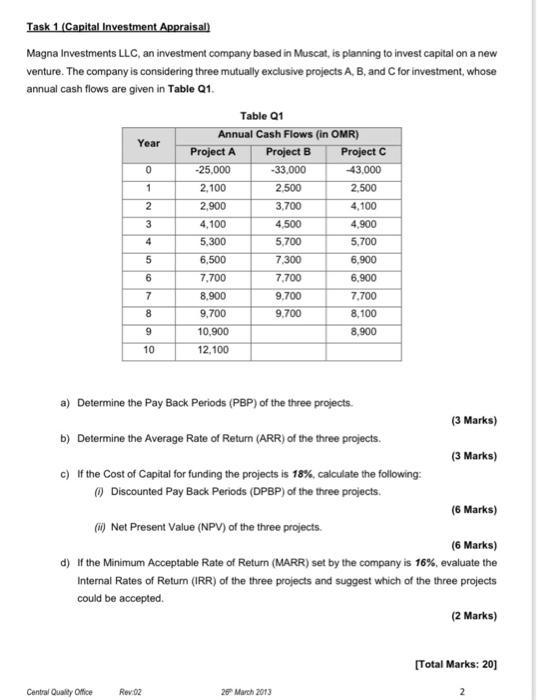

Task 1 (Capital Investment Appraisal) Magna Investments LLC, an investment company based in Muscat, is planning to invest capital on a new venture. The company is considering three mutually exclusive projects A,B, and C for investment, whose annual cash flows are given in Table Q1. a) Determine the Pay Back Periods (PBP) of the three projects. (3 Marks) b) Determine the Average Rate of Return (ARR) of the three projects. (3 Marks) c) If the Cost of Capital for funding the projects is 18%, calculate the following: (i) Discounted Pay Back Periods (DPBP) of the three projects. (6 Marks) (ii) Net Present Value (NPV) of the three projects. (6 Marks) d) If the Minimum Acceptable Rate of Return (MARR) set by the company is 16\%, evaluate the Internal Rates of Retum (IRR) of the three projects and suggest which of the three projects could be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts