Question: 1. IBM plans to issue a $1,000 bond with 10 years to maturity and an annual coupon of $80. Calculate the price of this bond

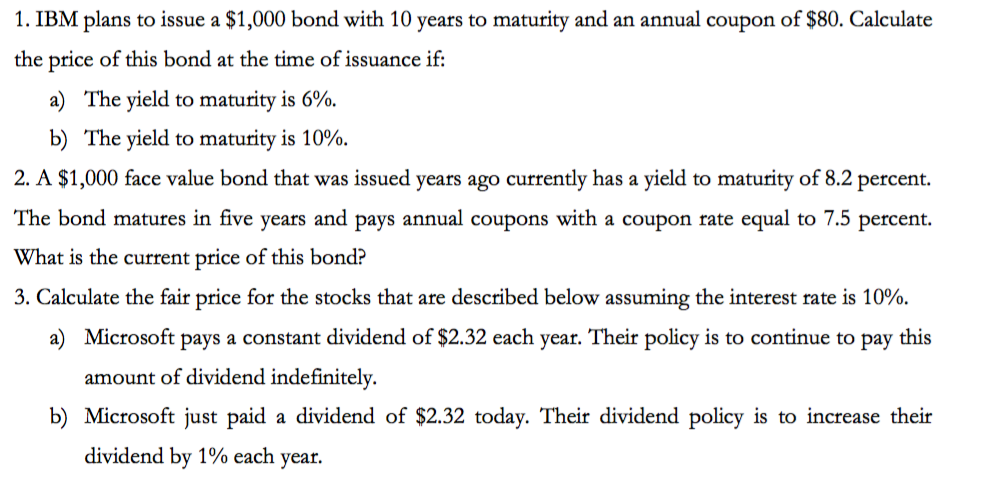

1. IBM plans to issue a $1,000 bond with 10 years to maturity and an annual coupon of $80. Calculate the price of this bond at the time of issuance if a) The yield to maturity is 6%. b) The yield to maturity is 10% 2. A $1,000 face value bond that was issued years ago currently has a yield to maturity of 8.2 percent. The bond matures in five years and pays annual coupons with a coupon rate equal to 7.5 percent. What is the current price of this bond? 3. Calculate the fair price for the stocks that are described below assuming the interest rate is 10%. Microsoft pays a constant dividend of $2.32 each year. Their policy is to continue to pay this amount of dividend indefinitely. a) b) Microsoft just paid a dividend of $2.32 today. Their dividend policy is to increase their dividend by 1% each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts