Question: 1. Identify and explain four changes that are likely to be required to the asset allocation that will result from moving to an LDI strategy.

1. Identify and explain four changes that are likely to be required to the asset allocation that will result from moving to an LDI strategy. Explain the reason why each of these changes will be made and, where appropriate, how derivatives can be used to implement these changes. (30 marks)

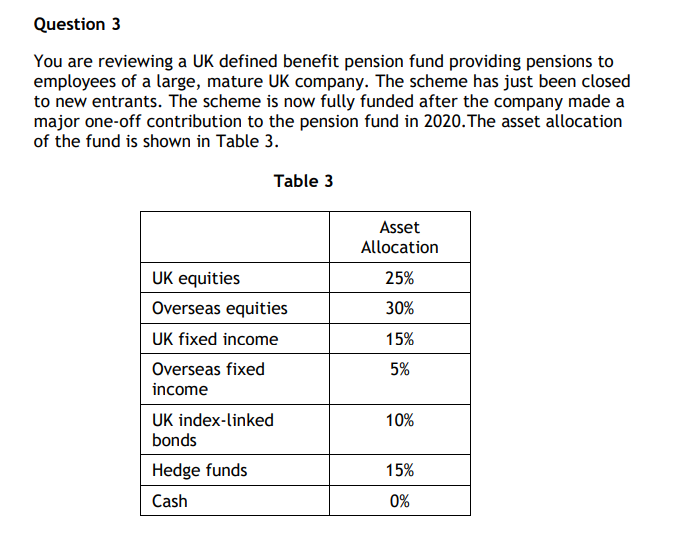

Question 3 You are reviewing a UK defined benefit pension fund providing pensions to employees of a large, mature UK company. The scheme has just been closed to new entrants. The scheme is now fully funded after the company made a major one-off contribution to the pension fund in 2020. The asset allocation of the fund is shown in Table 3. Table 3 Asset Allocation 25% 30% 15% 5% UK equities Overseas equities UK fixed income Overseas fixed income UK index-linked bonds Hedge funds Cash 10% 15% 0% Question 3 You are reviewing a UK defined benefit pension fund providing pensions to employees of a large, mature UK company. The scheme has just been closed to new entrants. The scheme is now fully funded after the company made a major one-off contribution to the pension fund in 2020. The asset allocation of the fund is shown in Table 3. Table 3 Asset Allocation 25% 30% 15% 5% UK equities Overseas equities UK fixed income Overseas fixed income UK index-linked bonds Hedge funds Cash 10% 15% 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts