Question: 1. Identify the Books applicable for each transactions 2. Prepare for General Journal 3. Prepared for Special Journal a. Sales Journal b. Purchase Journal

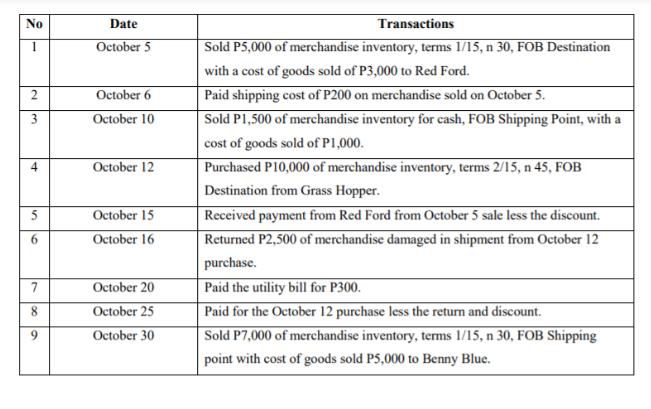

1. Identify the Books applicable for each transactions 2. Prepare for General Journal 3. Prepared for Special Journal a. Sales Journal b. Purchase Journal c. Cash Receipts Journal d. Cash Disbursement Journal No 1 2 3 t 5 6 7 8 la 9 Date October 5 October 6 October 10 October 12 October 15 October 16 October 20 October 25 October 30 Transactions Sold P5,000 of merchandise inventory, terms 1/15, n 30, FOB Destination with a cost of goods sold of P3,000 to Red Ford. Paid shipping cost of P200 on merchandise sold on October 5. Sold P1,500 of merchandise inventory for cash, FOB Shipping Point, with a cost of goods sold of P1,000. Purchased P10,000 of merchandise inventory, terms 2/15, n 45, FOB Destination from Grass Hopper. Received payment from Red Ford from October 5 sale less the discount. Returned P2,500 of merchandise damaged in shipment from October 12 purchase. Paid the utility bill for P300. Paid for the October 12 purchase less the return and discount. Sold P7,000 of merchandise inventory, terms 1/15, n 30, FOB Shipping point with cost of goods sold P5,000 to Benny Blue. 1. Identify the Books applicable for each transactions 2. Prepare for General Journal 3. Prepared for Special Journal a. Sales Journal b. Purchase Journal c. Cash Receipts Journal d. Cash Disbursement Journal No 1 2 3 t 5 6 7 8 la 9 Date October 5 October 6 October 10 October 12 October 15 October 16 October 20 October 25 October 30 Transactions Sold P5,000 of merchandise inventory, terms 1/15, n 30, FOB Destination with a cost of goods sold of P3,000 to Red Ford. Paid shipping cost of P200 on merchandise sold on October 5. Sold P1,500 of merchandise inventory for cash, FOB Shipping Point, with a cost of goods sold of P1,000. Purchased P10,000 of merchandise inventory, terms 2/15, n 45, FOB Destination from Grass Hopper. Received payment from Red Ford from October 5 sale less the discount. Returned P2,500 of merchandise damaged in shipment from October 12 purchase. Paid the utility bill for P300. Paid for the October 12 purchase less the return and discount. Sold P7,000 of merchandise inventory, terms 1/15, n 30, FOB Shipping point with cost of goods sold P5,000 to Benny Blue. 1. Identify the Books applicable for each transactions 2. Prepare for General Journal 3. Prepared for Special Journal a. Sales Journal b. Purchase Journal c. Cash Receipts Journal d. Cash Disbursement Journal No 1 2 3 t 5 6 7 8 la 9 Date October 5 October 6 October 10 October 12 October 15 October 16 October 20 October 25 October 30 Transactions Sold P5,000 of merchandise inventory, terms 1/15, n 30, FOB Destination with a cost of goods sold of P3,000 to Red Ford. Paid shipping cost of P200 on merchandise sold on October 5. Sold P1,500 of merchandise inventory for cash, FOB Shipping Point, with a cost of goods sold of P1,000. Purchased P10,000 of merchandise inventory, terms 2/15, n 45, FOB Destination from Grass Hopper. Received payment from Red Ford from October 5 sale less the discount. Returned P2,500 of merchandise damaged in shipment from October 12 purchase. Paid the utility bill for P300. Paid for the October 12 purchase less the return and discount. Sold P7,000 of merchandise inventory, terms 1/15, n 30, FOB Shipping point with cost of goods sold P5,000 to Benny Blue.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Transaction 1 Applicable Book Sales Journal Journal Entry in Sales Journal Date October 5 Account Credited Sales Account Debited Accounts Receivable R... View full answer

Get step-by-step solutions from verified subject matter experts