Question: 1. Identify the key problem in the case and explaining why it is the key problem. 2. Why has Clarkson Lumber borrowed increasing amounts despite

1. Identify the key problem in the case and explaining why it is the key problem.

2. Why has Clarkson Lumber borrowed increasing amounts despite its consistent profitability?

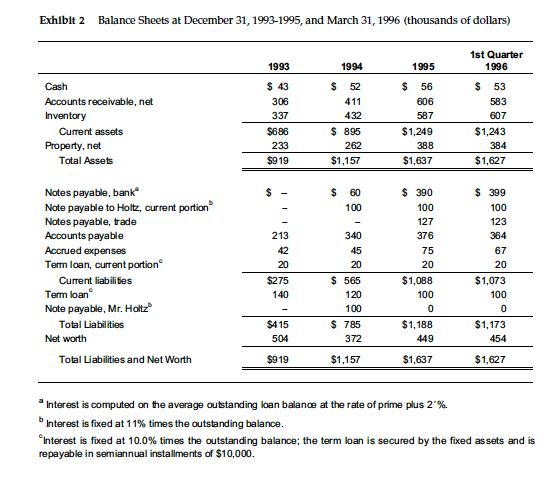

3. How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

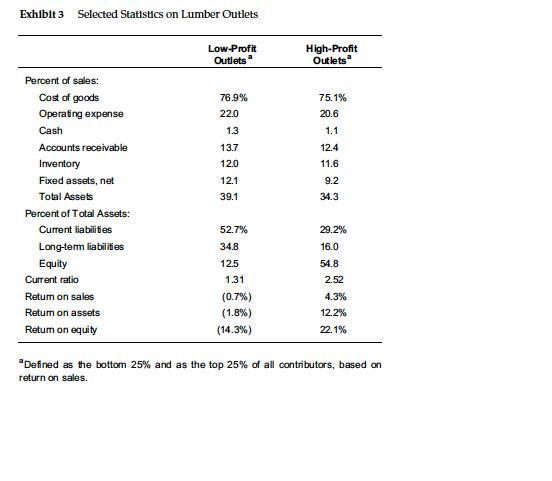

4. How attractive is it to take the trade discounts?

5. Do you agree with Mr. Clarkson’s estimate of the company’s loan requirements? How much will he need to finance the expected expansion in sales to $5.5 million in 1996, and to take all trade discounts?

6. As Mr. Clarkson’s financial adviser, would you urge him to go ahead with, or to reconsider, his anticipated expansion and his plans for additional debt financing?

7. What do you think Mr. Dodge should do and why do you think so. If you were the banker, would you approve Mr. Clarkson’s loan request, and if so, what conditions would you put on the loan?

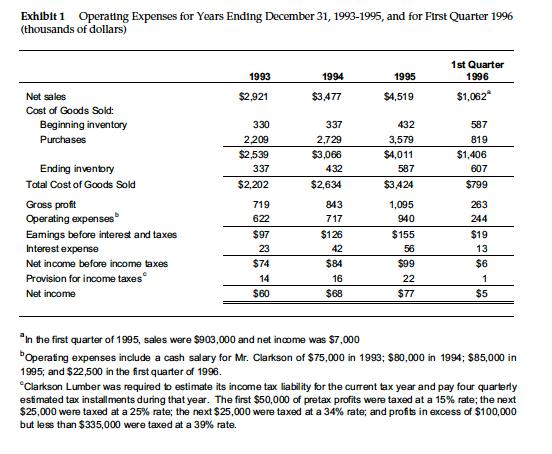

After a rapid growth in Its business during recent years, the Clarkson Lumber Company, in the spring of 1996, anticipated a further substantial increase in sales. Despite good profits, the company had experlenced a shortage of cash and had found It necessary to increase its borrowing from the Suburban National Bank to $399,000 in the spring of 1996. The maximum loan that Suburban National would make to any one borrower was $400,000 and Clarkson had been able to stay within this limit only by relying very heavily on trade credit. In addition, Suburban was now asking that Mr. Clarkson guarantee the loan personally. Ketth Clarkson, sole owner and president of the Clarkson Lumber Company, was therefore actively looking elsewhere for a new banking relationship where he would be able to negotlate a larger loan that did not require a personal guarantee. Mr. Clarkson had recently been introduced by a friend to George Dodge, an officer of a much larger bank, the Northrup Natonal Bank. The two men had tentatively discussed the possibility that the Northrup bank might extend a line of credit to Clarkson Lumber up to a maximum amount of S750,000. Mr. Clarkson thought that a loan of this size would improve profitability by allowing him to take full advantage of trade discounts. Subsequent to this discussion, Mr. Dodge had arrange for the credit department of the Northrup National Bank to investigate Mr. Clarkson and his company. The Clarkson Lumber Company had been founded in 1981 as a partnership by Mr. Clarkson and his brother-in-law, Henry Holtz. In 1994, Mr. Clarkson bought out Mr. Holtz's interest for $200,000. Mr. Holtz had taken a note for $200,000, to be patd off in 1995 and 1996 in order to gtve Mr. Clarkson time to arrange for the necessary financing. This note carrted an interest rate of 11%, and was repayable in semi-annual installments of $50,000, beginning June 30, 1995. The business was located in a growing suburb of a large dty in the Pactftc Northwest. The company owned land with access to a ratlroad siding, and four large storage buildings had been erected on this land. The company's operations were limited to the retail distributton of lumber products in the local area. Typical products included plywood moldings and sash and door products. Quantity discounts and credit terms of net 30 days on open account were usually offered to customers. Sales volume had been butlt up largely on the basis of successful price competition, made aterials at possible by careful control of operating expenses and by quantity purchases of substantlal discounts. Most of the moldings and sash and door products, which constituted significant Items of sales, were used for repatr work. About 55% of total sales were made in the six months from April through September. Annual sales of $2,921,000 in 1993, $3,477,000 in 1994, and $4,519,000 in 1995 ytelded aftertax profits of $60,000 tin 1993, $68,000 in 1994, and $77,000 in 1995.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

1 Clarkson Lumber Companys biggest problem by far is the fact that Mr Clarkson had agreed to buy out Mr Holtz for 200000 with semiannual installments of 50000 It wasnt necessarily a bad idea for Mr Cl... View full answer

Get step-by-step solutions from verified subject matter experts