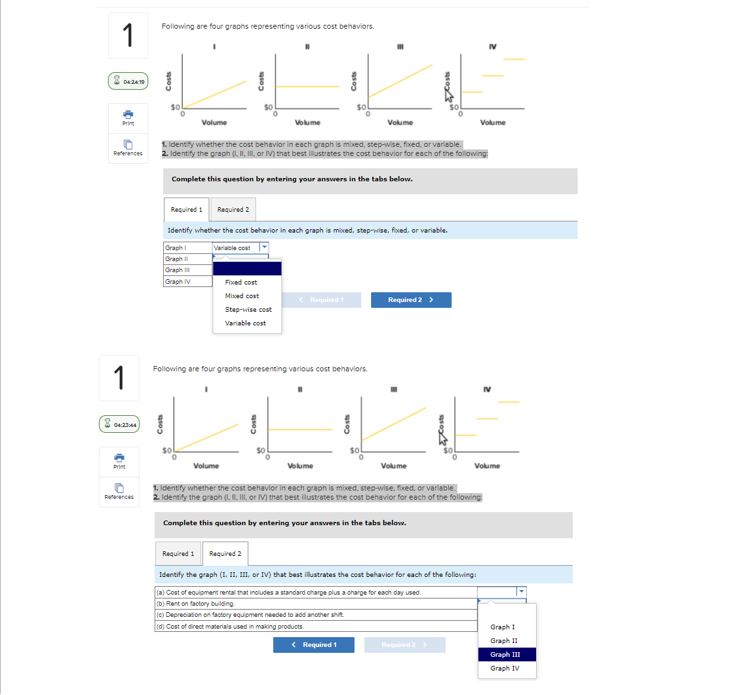

Question: 1) - Identify whether the cost behavior in each graph is mixed, step-wise, fixed, or variable. - Identify the graph (I, II, III, or IV)

1)

- Identify whether the cost behavior in each graph is mixed, step-wise, fixed, or variable. - Identify the graph (I, II, III, or IV) that best illustrates the cost behavior for each of the following:

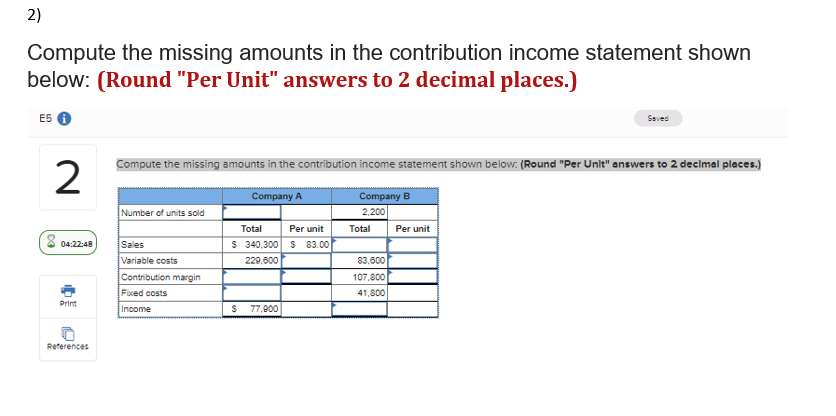

2)

Compute the missing amounts in the contribution income statement shown below: (Round "Per Unit" answers to 2 decimal places.)

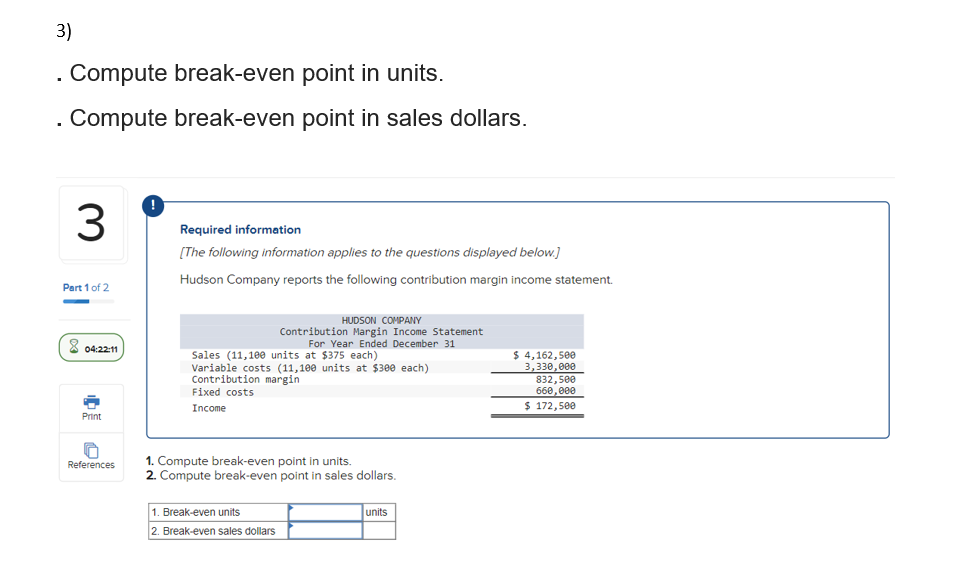

3)

. Compute break-even point in units.

. Compute break-even point in sales dollars.

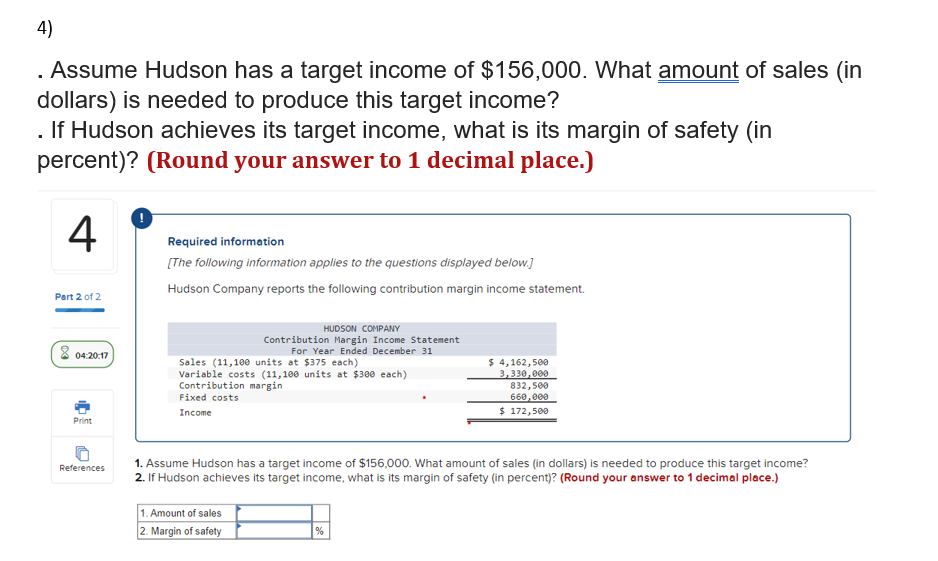

4)

. Assume Hudson has a target income of $156,000. What amount of sales (in dollars) is needed to produce this target income? . If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)

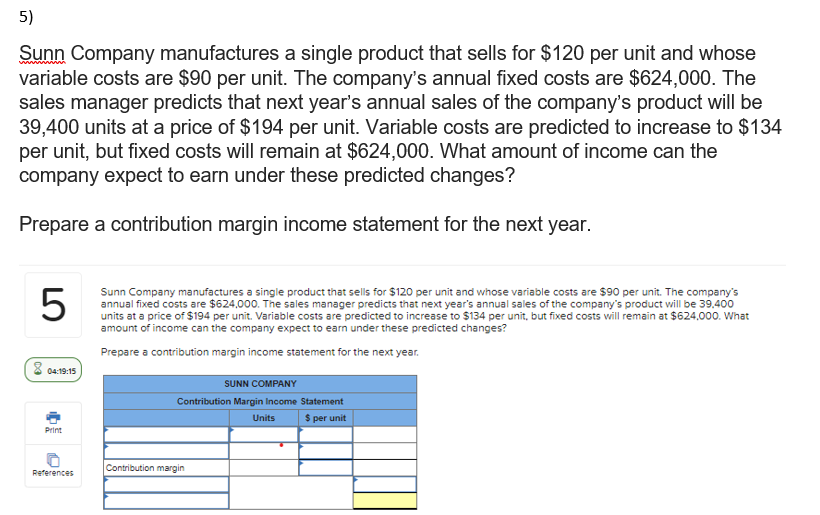

5)

Sunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The companys annual fixed costs are $624,000. The sales manager predicts that next years annual sales of the companys product will be 39,400 units at a price of $194 per unit. Variable costs are predicted to increase to $134 per unit, but fixed costs will remain at $624,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year.

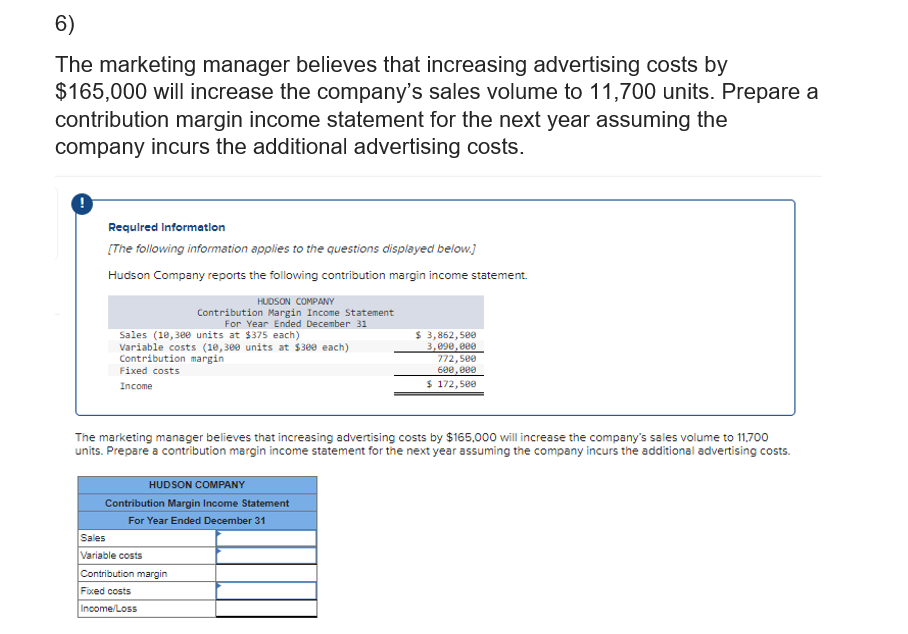

6)

The marketing manager believes that increasing advertising costs by $165,000 will increase the companys sales volume to 11,700 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs.

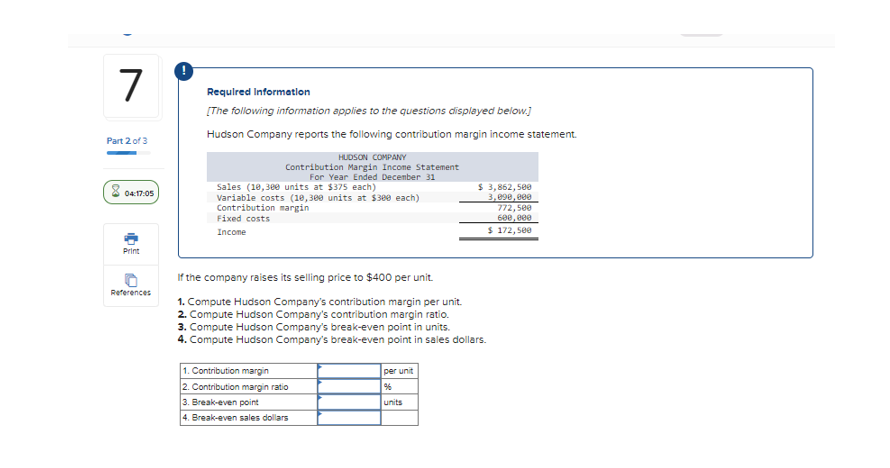

7)

If the company raises its selling price to $400 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars

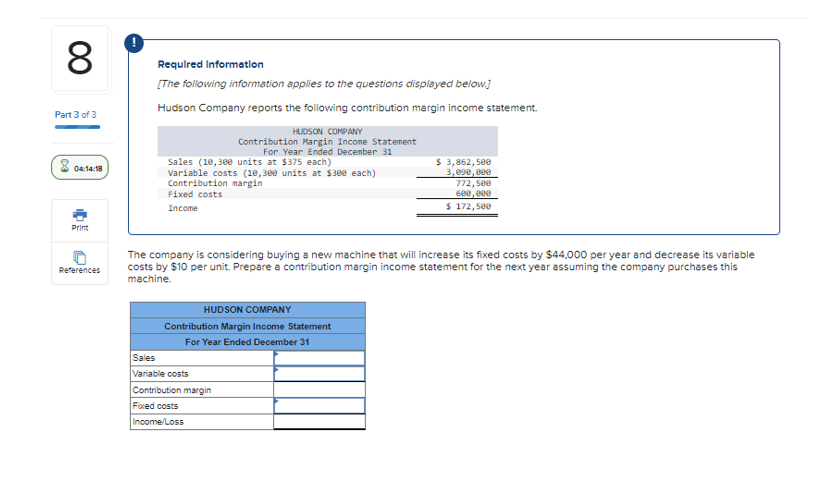

8)

The company is considering buying a new machine that will increase its fixed costs by $44,000 per year and decrease its variable costs by $10 per unit. Prepare a contribution margin income statement for the next year assuming the company purchases this machine.

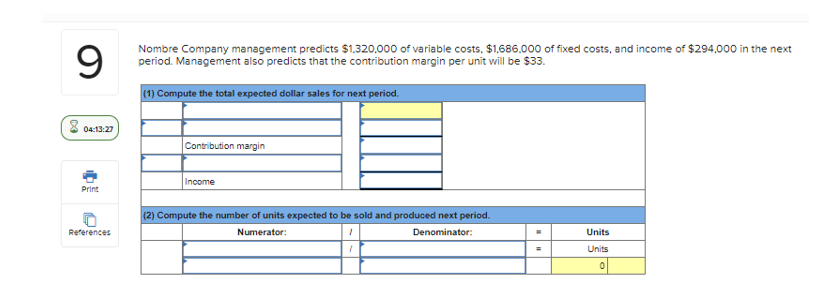

9)

Nombre Company management predicts $1,320,000 of variable costs, $1,686,000 of fixed costs, and income of $294,000 in the next period. Management also predicts that the contribution margin per unit will be $33

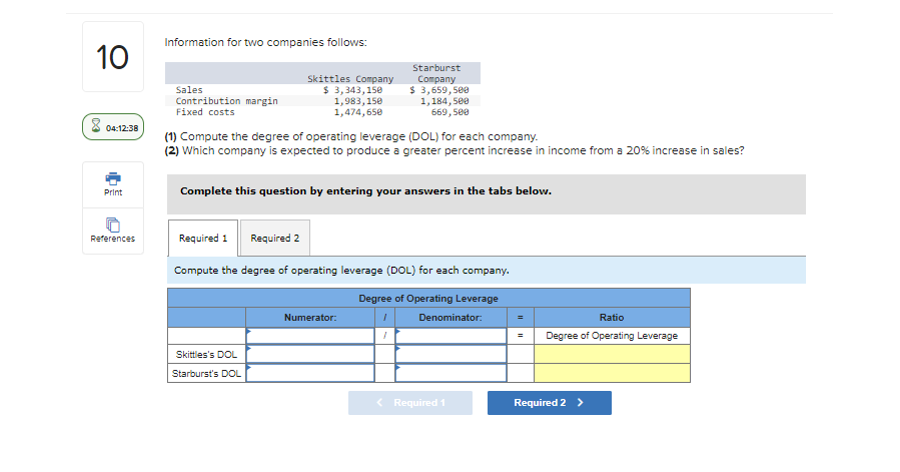

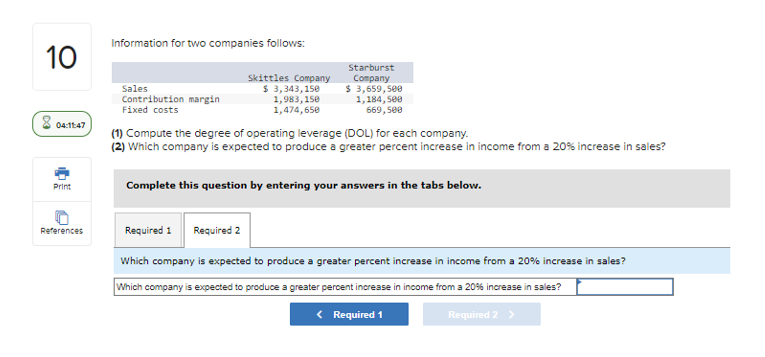

10)

- Compute the degree of operating leverage (DOL) for each company. - Which company is expected to produce a greater percent increase in income from a 20% increase in sales?

Following are four graphs representing various cost behaviors. Compute the missing amounts in the contribution income statement shown below: (Round "Per Unit" answers to 2 decimal places.) E5 (i) Compute the missing amounts in the contribution income statement shown below. (Round "Per Unlt" onswers to 2 declmal ploces.) 3) . Compute break-even point in units. . Compute break-even point in sales dollars. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. References 1. Compute break-even point in units. 2. Compute break-even point in sales dollars. . Assume Hudson has a target income of $156,000. What amount of sales (in dollars) is needed to produce this target income? . If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) 1. Assume Hudson has a target income of $156,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) Sunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The company's annual fixed costs are $624,000. The sales manager predicts that next year's annual sales of the company's product will be 39,400 units at a price of $194 per unit. Variable costs are predicted to increase to $134 per unit, but fixed costs will remain at $624,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. Sunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The company's annual fixed costs are $624,000. The sales manager predicts that next year's annual sales of the company's product will be 39.400 units at a price of $194 per unit. Variable costs are predicted to increase to $134 per unit, but fixed costs will remain at $624.000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. The marketing manager believes that increasing advertising costs by $165,000 will increase the company's sales volume to 11,700 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Requlred Information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The marketing manager believes that increasing advertising costs by $165.000 will increase the company's sales volume to 11.700 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Requlred Information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. If the company raises its selling price to $400 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. Requlred Informetion [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The company is considering buying a new machine that will increase its fixed costs by $44,000 per year and decrease its variable costs by $10 per unit. Prepare a contribution margin income statement for the next year assuming the company purchases this machine. Nombre Company management predicts $1,320,000 of variable costs. $1,686.000 of fixed costs, and income of $294,000 in the next period. Management also predicts that the contribution margin per unit will be $33. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Complete this question by entering your answers in the tabs below. Compute the degree of operating leverage (DOL) for each company. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Complete this question by entering your answers in the tabs below. Which company is expected to produce a greater percent increase in income from a 20% increase in sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts