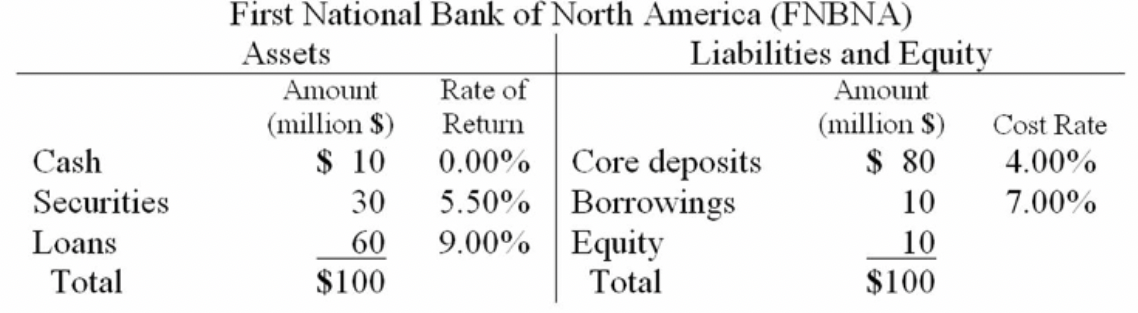

Question: 1 ) If FNBNA is expecting a $ 1 0 million net deposit drain and use the securities to fullfil the drain. The securities liquidity

If FNBNA is expecting a $ million net deposit drain and use the securities to fullfil the drain. The securities liquidity index is by how much will pretax net income change if the drain is funded entirely through securities sales?

$

$

$

$

$

If FNBNA is expecting a $ million net deposit drain and the bank wishes to fund the drain by borrowing more money, how much will pretax net income change if the borrowing cost is the same as on its existing borrowed funds?

Group of answer choices

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock