Question: 1. If T-bills currently offer a 3% yield, the expected rate of return of this stock is ........% 2. At the end of the year,

1. If T-bills currently offer a 3% yield, the expected rate of return of this stock is ........%

2. At the end of the year, you see that the actual factor realizations are:

Market = 9%, Industrial Production = 7%, Oil Prices = 3%

Based on these values of these "surprises", the "expected" return on the stock is ........%

3. Suppose the stock actually returns 15%. Your alpha is ..........%

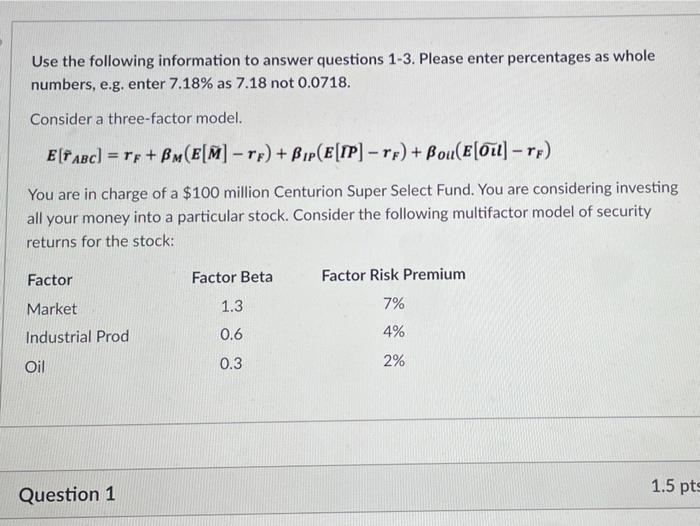

Use the following information to answer questions 1-3. Please enter percentages as whole numbers, e.g. enter 7.18% as 7.18 not 0.0718. Consider a three-factor model. E[fAbc) = Tp + BM(E[M] - rp) + Bip(E[IP] - rp) + Bou(E[Oul] rp) You are in charge of a $100 million Centurion Super Select Fund. You are considering investing all your money into a particular stock. Consider the following multifactor model of security returns for the stock: Factor Factor Beta Factor Risk Premium 7% Market 1.3 0.6 Industrial Prod 4% Oil 0.3 2% 1.5 pts Question 1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock