Question: 1. If your Ponzi scheme advisor told you that if you invested $1000 with him today (Oct. 25), that he would pay you $200 in

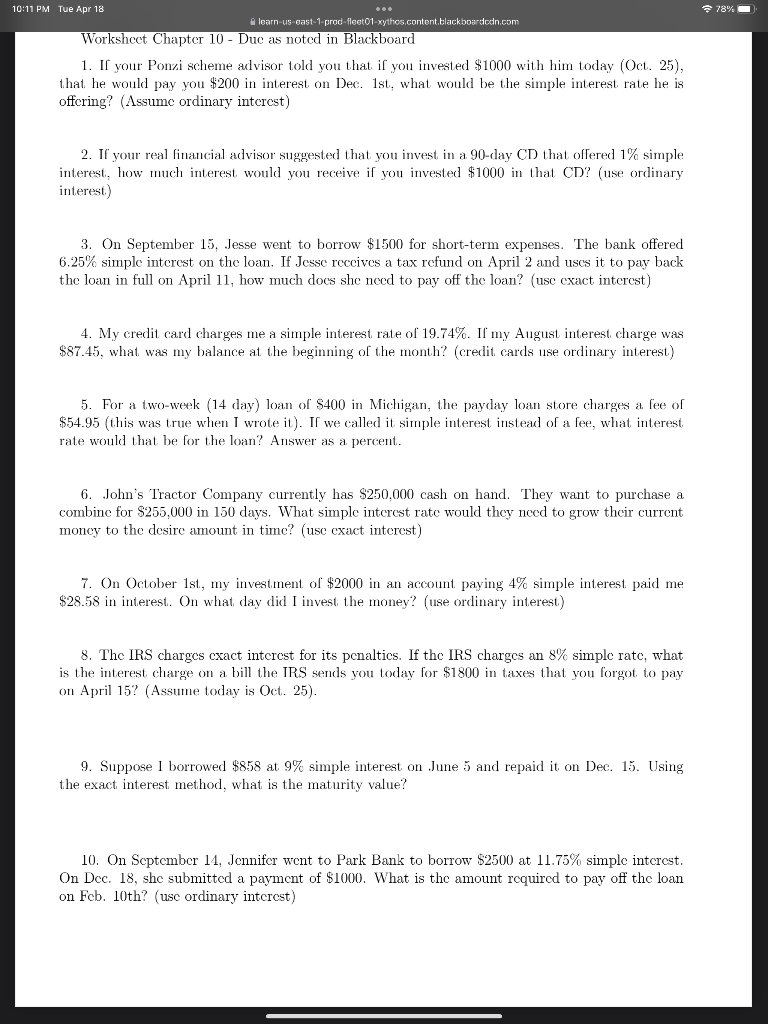

1. If your Ponzi scheme advisor told you that if you invested $1000 with him today (Oct. 25), that he would pay you $200 in interest on Dec. 1st, what would be the simple interest rate he is offering? (Assume ordinary interest) 2. If your real financial advisor suggested that you invest in a 90 -day CD that offered 1% simple interest, how much interest would you receive if you invested $1000 in that CD? (use ordinary interest.) 3. On September 15, Jesse went to borrow $1500 for short-term expenses. The bank offered 6.25% simple interest on the loan. If Jesse receives a tax refund on April 2 and uses it to pay back the loan in full on April 11, how much does she need to pay off the loan? (use exact interest) 4. My credit card charges me a simple interest, rate of 19.74%. If my August interest, charge was $87.45, what was my balance at the beginning of the month? (credit cards use ordinary interest) 5. For a two-week (14 day) loan of $400 in Michigan, the payday loan store charges a fee of $54.95 (this was true when I wrote it). If we called it simple interest instead of a fee, what interest. rate would that be for the loan? Answer as a percent. 6. John's Tractor Company currently has $250,000 cash on hand. They want to purchase a combine for $255,000 in 150 days. What simple interest rate would they need to grow their current moncy to the desire amount in time? (use exact interest) 7. On October 1st, my investment of $2000 in an account paying 4% simple interest paid me $28.58 in interest. On what day did I invest the money? (use ordinary interest) 8. The IRS charges exact interest for its penaltics. If the IRS charges an 8% simple rate, what is the interest charge on a bill the IRS sends you today for $1800 in taxes that you forgot to pay on April 15? (Assume today is Oct. 25). 9. Suppose I borrowed $858 at 9% simple interest on June 5 and repaid it on Dec. 15 . Using the exact interest method, what is the maturity value? 10. On September 14, Jennifer went to Park Bank to borrow $2500 at 11.75% simple interest. On Dec. 18 , she submitted a payment of $1000. What is the amount required to pay off the loan on Feb. 10th? (usc ordinary interest) 1. If your Ponzi scheme advisor told you that if you invested $1000 with him today (Oct. 25), that he would pay you $200 in interest on Dec. 1st, what would be the simple interest rate he is offering? (Assume ordinary interest) 2. If your real financial advisor suggested that you invest in a 90 -day CD that offered 1% simple interest, how much interest would you receive if you invested $1000 in that CD? (use ordinary interest.) 3. On September 15, Jesse went to borrow $1500 for short-term expenses. The bank offered 6.25% simple interest on the loan. If Jesse receives a tax refund on April 2 and uses it to pay back the loan in full on April 11, how much does she need to pay off the loan? (use exact interest) 4. My credit card charges me a simple interest, rate of 19.74%. If my August interest, charge was $87.45, what was my balance at the beginning of the month? (credit cards use ordinary interest) 5. For a two-week (14 day) loan of $400 in Michigan, the payday loan store charges a fee of $54.95 (this was true when I wrote it). If we called it simple interest instead of a fee, what interest. rate would that be for the loan? Answer as a percent. 6. John's Tractor Company currently has $250,000 cash on hand. They want to purchase a combine for $255,000 in 150 days. What simple interest rate would they need to grow their current moncy to the desire amount in time? (use exact interest) 7. On October 1st, my investment of $2000 in an account paying 4% simple interest paid me $28.58 in interest. On what day did I invest the money? (use ordinary interest) 8. The IRS charges exact interest for its penaltics. If the IRS charges an 8% simple rate, what is the interest charge on a bill the IRS sends you today for $1800 in taxes that you forgot to pay on April 15? (Assume today is Oct. 25). 9. Suppose I borrowed $858 at 9% simple interest on June 5 and repaid it on Dec. 15 . Using the exact interest method, what is the maturity value? 10. On September 14, Jennifer went to Park Bank to borrow $2500 at 11.75% simple interest. On Dec. 18 , she submitted a payment of $1000. What is the amount required to pay off the loan on Feb. 10th? (usc ordinary interest)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts