Question: 1. Ihe program will ask the user the residence state. Ihe user can make only two answers: MS or LA. 2. The program will ask

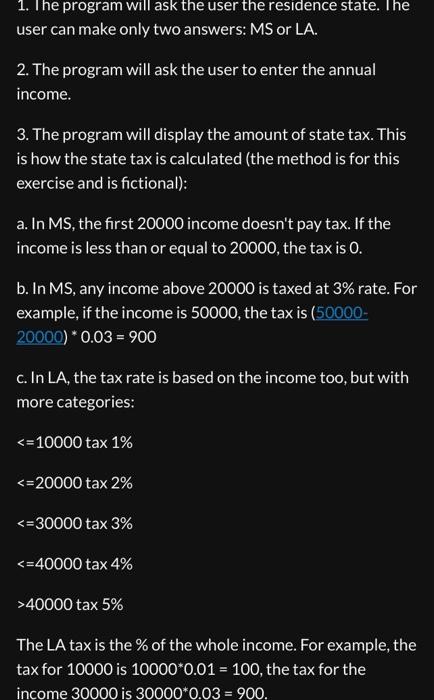

1. Ihe program will ask the user the residence state. Ihe user can make only two answers: MS or LA. 2. The program will ask the user to enter the annual income. 3. The program will display the amount of state tax. This is how the state tax is calculated (the method is for this exercise and is fictional): a. In MS, the first 20000 income doesn't pay tax. If the income is less than or equal to 20000 , the tax is 0. b. In MS, any income above 20000 is taxed at 3% rate. For example, if the income is 50000 , the tax is (5000020000)0.03=900 c. In LA, the tax rate is based on the income too, but with more categories: 40000tax5% The LA tax is the \% of the whole income. For example, the tax for 10000 is 100000.01=100, the tax for the income 30000 is 300000.03=900. income. 3. The program will display the amount of state tax. This is how the state tax is calculated (the method is for this exercise and is fictional): a. In MS, the first 20000 income doesn't pay tax. If the income is less than or equal to 20000 , the tax is 0 . b. In MS, any income above 20000 is taxed at 3% rate. For example, if the income is 50000 , the tax is (50000 20000)0.03=900 c. In LA, the tax rate is based on the income too, but with more categories: 40000tax5% The LA tax is the \% of the whole income. For example, the tax for 10000 is 100000.01=100, the tax for the income 30000 is 300000.03=900. Hint: use nested if and else if

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts