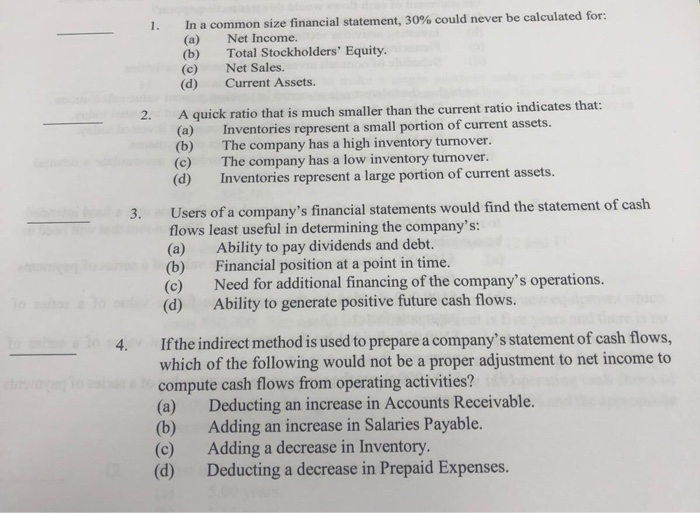

Question: 1. In a common size financial statement, 30% could never be calculated for: (a) Net Income. (b) Total Stockholders' Equity. (c) Net Sales. (d) Current

1. In a common size financial statement, 30% could never be calculated for: (a) Net Income. (b) Total Stockholders' Equity. (c) Net Sales. (d) Current Assets. 2. A quick ratio that is much smaller than the current ratio indicates that: (a) Inventories represent a small portion of current assets. The company has a high inventory turnover. The company has a low inventory turnover. Inventories represent a large portion of current assets. (b) (c) (d) The 3. Users of a company's financial statements would find the statement of cash flows least useful in determining the company's: (a) Ability to pay dividends and debt. (b) Financial position at a point in time. (c) Need for additional financing of the company's operations. (d) Ability to generate positive future cash flows. 4. If the indirect method is used to prepare a company's statement of cash flows, which of the following would not be a proper adjustment to net income to compute cash flows from operating activities? (a) Deducting an increase in Accounts Receivable. (b) Adding an increase in Salaries Payable. Adding a decrease in Inventory. Deducting a decrease in Prepaid Expenses. (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts