Question: 1. In a two-date (date 0 and ) binomial model with perfect market assumption, Company AA has existing projects that generate a cash flow worth

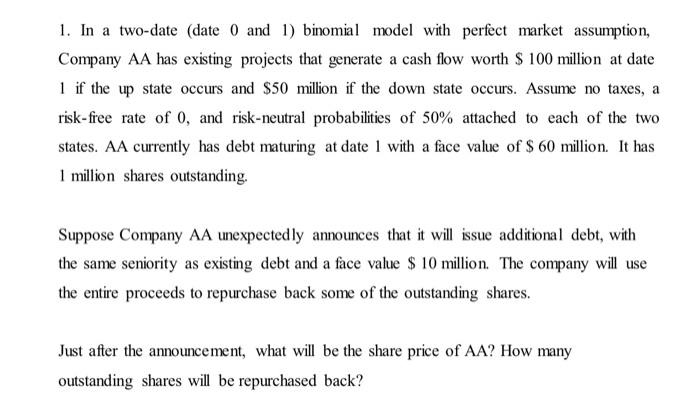

1. In a two-date (date 0 and ) binomial model with perfect market assumption, Company AA has existing projects that generate a cash flow worth S 100 million at date 1 if the up state occurs and S50 million if the down state occurs. Assume no taxes, a risk-free rate of 0, and risk-neutral probabilities of 50% attached to each of the two states. AA currently has debt maturing at date 1 with a face value of S 60 million. It has 1 million shares outstanding. Suppose Company AA unexpectedly announces that it will issue additional debt, with the same seniority as existing debt and a face value S 10 million. The company will use the entire proceeds to repurchase back some of the outstanding shares Just after the announcement, what will be the share price of AA? How many outstanding shares will be repurchased back

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts