Question: 1. In class we learnt about the broad classifications of financial markets. How will you explain any three of these classifications to your friends in

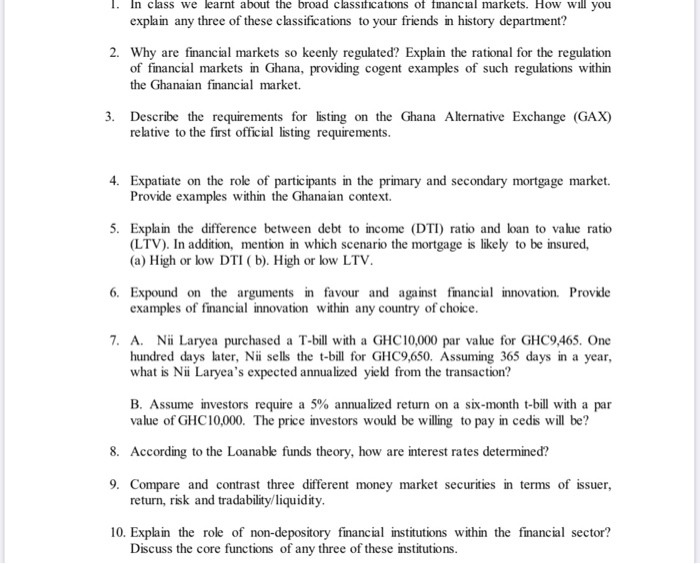

1. In class we learnt about the broad classifications of financial markets. How will you explain any three of these classifications to your friends in history department? 2. Why are financial markets so keenly regulated? Explain the rational for the regulation of financial markets in Ghana, providing cogent examples of such regulations within the Ghanaian financial market. 3. Describe the requirements for listing on the Ghana Alternative Exchange (AX) relative to the first official listing requirements. 4. Expatiate on the role of participants in the primary and secondary mortgage market. Provide examples within the Ghanaian context. 5. Explain the difference between debt to income (DTI) ratio and loan to vahie ratio (LTV). In addition, mention in which scenario the mortgage is likely to be insured, (a) High or low DTI (b). High or low LTV. 6. Expound on the arguments in favour and against financial innovation. Provide examples of financial innovation within any country of choice. 7. A. Nii Laryea purchased a T-bill with a GHC10,000 par value for GHC9,465. One hundred days later, Nii sells the t-bill for GHC9,650. Assuming 365 days in a year, what is Nii Laryea's expected annualized yield from the transaction? B. Assume investors require a 5% annualized return on a six-month t-bill with a par value of GHC10,000. The price investors would be willing to pay in cedis will be? 8. According to the Loanable funds theory, how are interest rates determined? 9. Compare and contrast three different money market securities in terms of issuer, return, risk and tradability/liquidity. 10. Explain the role of non-depository financial institutions within the financial sector? Discuss the core functions of any three of these institutions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts