Question: 1. In E18 calculate the Break-Even Contribution Margin (contribution margin for the break-even units rather than just a single unit.) 2. In E19 calculate the

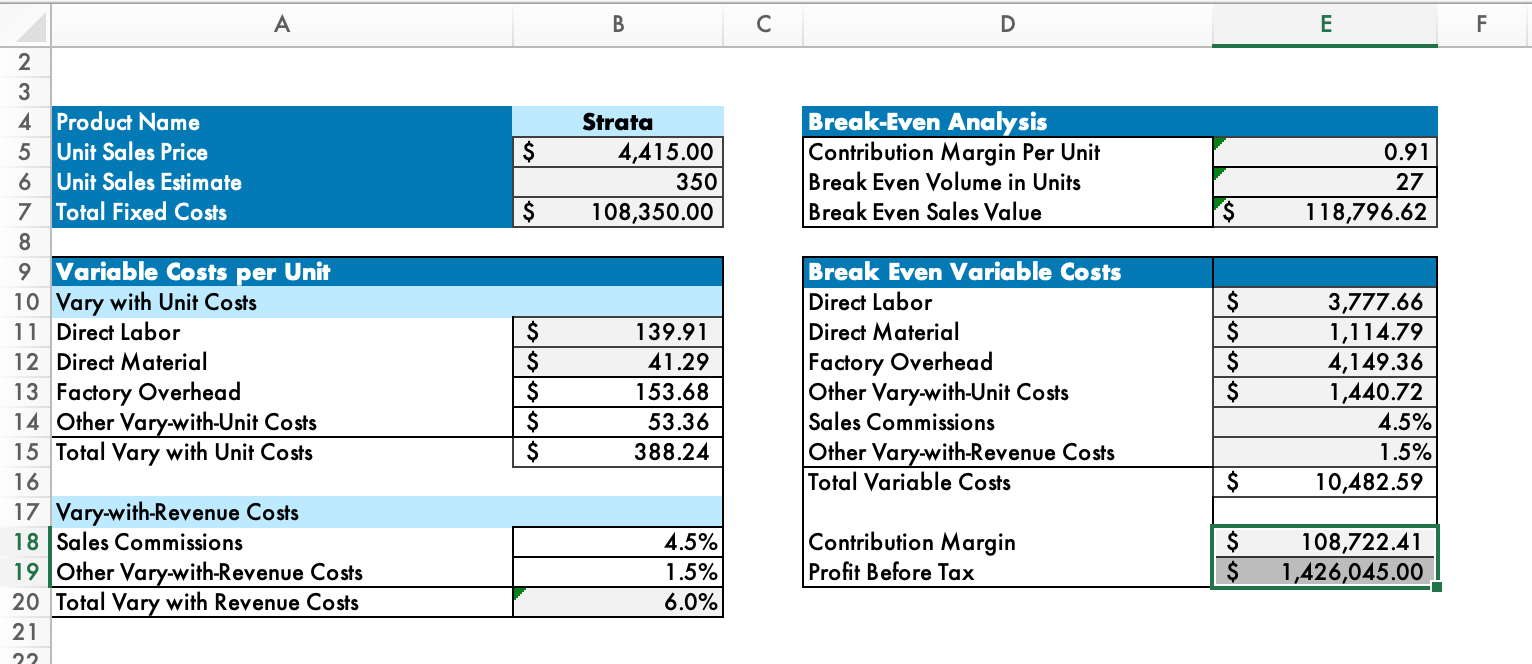

1. In E18 calculate the Break-Even Contribution Margin (contribution margin for the break-even units rather than just a single unit.)

2. In E19 calculate the Break-Even Profit Before Tax. (If we hadn't rounded Break-Even Units this should be 0, i.e. when we sell the required number of units to break even, we dont make a profit or a loss.)

B D E F $ Strata 4,415.00 350 108,350.00 Break-Even Analysis Contribution Margin Per Unit Break Even Volume in Units Break Even Sales Value 0.91 27 118,796.62 $ $ $ $ 2 3 4. Product Name 5 Unit Sales Price 6 Unit Sales Estimate 7 Total Fixed Costs 8 9 Variable Costs per Unit 10 Vary with Unit Costs 11 Direct Labor 12 Direct Material 13 Factory Overhead 14 Other Vary-with-Unit Costs 15 Total Vary with Unit Costs 16 17 Vary-with-Revenue Costs 18 Sales Commissions 19 Other Vary-with-Revenue Costs 20 Total Vary with Revenue Costs 21 $ $ $ $ 139.91 41.29 153.68 53.36 388.24 Break Even Variable Costs Direct Labor Direct Material Factory Overhead Other Vary-with-Unit Costs Sales Commissions Other Vary-with-Revenue Costs Total Variable Costs 3,777.66 1,114.79 4,149.36 1,440.72 4.5% 1.5% 10,482.59 $ 4.5% 1.5% 6.0% Contribution Margin Profit Before Tax $ $ 108,722.41 1,426,045.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts