Question: 1. In the Exponentially weighted moving average model (EWMA), future variance is a weighted average of its immediate past estimation and the most recent observation

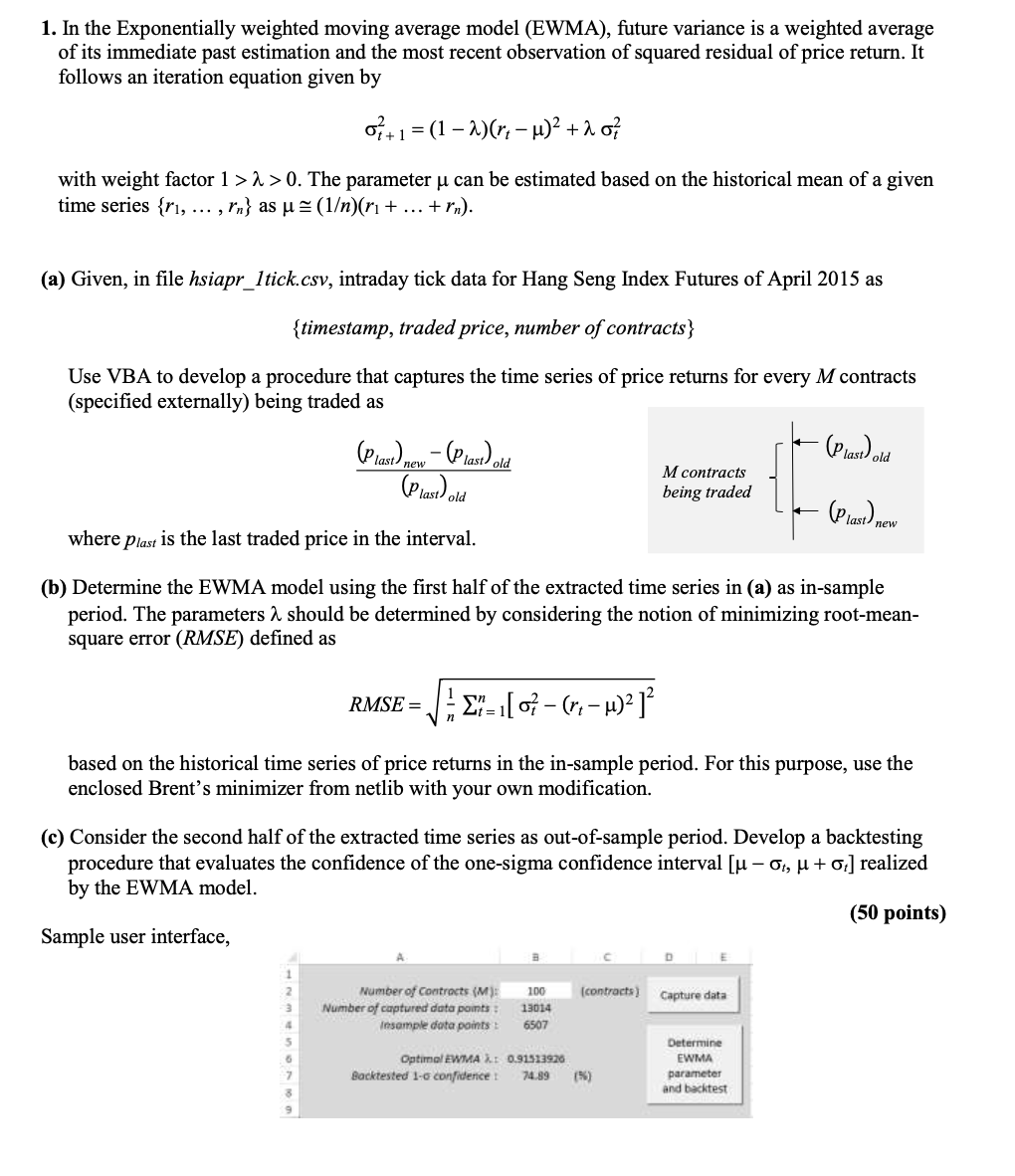

1. In the Exponentially weighted moving average model (EWMA), future variance is a weighted average of its immediate past estimation and the most recent observation of squared residual of price return. It follows an iteration equation given by 0+1 = (1 2)(r; - u)2 + 2 o} with weight factor 1>2 > 0. The parameter u can be estimated based on the historical mean of a given time series {r1, ... , rn} as u = (1)(r + ... +rn). (a) Given, in file hsiapr_ltick.csv, intraday tick data for Hang Seng Index Futures of April 2015 as {timestamp, traded price, number of contracts} Use VBA to develop a procedure that captures the time series of price returns for every M contracts (specified externally) being traded as (plast) new - (plast) old (plast) old (plast ) old M contracts being traded (plast ) new where plast is the last traded price in the interval. (b) Determine the EWMA model using the first half of the extracted time series in (a) as in-sample period. The parameters a should be determined by considering the notion of minimizing root-mean- square error (RMSE) defined as RMSE= Z=1[0} - (, u)2 ] n based on the historical time series of price returns in the in-sample period. For this purpose, use the enclosed Brent's minimizer from netlib with your own modification. (c) Consider the second half of the extracted time series as out-of-sample period. Develop a backtesting procedure that evaluates the confidence of the one-sigma confidence interval [u Ot, u +0] realized by the EWMA model. (50 points) Sample user interface, (contracts) Capture data Number of Contracts (M): Number of captured data points: Insample data points 100 13014 6507 Optimal EWMAX 0.91533926 Backtested 1-6 confidence 74.89 Determine EWMA parameter and backtest 195) 3 1. In the Exponentially weighted moving average model (EWMA), future variance is a weighted average of its immediate past estimation and the most recent observation of squared residual of price return. It follows an iteration equation given by 0+1 = (1 2)(r; - u)2 + 2 o} with weight factor 1>2 > 0. The parameter u can be estimated based on the historical mean of a given time series {r1, ... , rn} as u = (1)(r + ... +rn). (a) Given, in file hsiapr_ltick.csv, intraday tick data for Hang Seng Index Futures of April 2015 as {timestamp, traded price, number of contracts} Use VBA to develop a procedure that captures the time series of price returns for every M contracts (specified externally) being traded as (plast) new - (plast) old (plast) old (plast ) old M contracts being traded (plast ) new where plast is the last traded price in the interval. (b) Determine the EWMA model using the first half of the extracted time series in (a) as in-sample period. The parameters a should be determined by considering the notion of minimizing root-mean- square error (RMSE) defined as RMSE= Z=1[0} - (, u)2 ] n based on the historical time series of price returns in the in-sample period. For this purpose, use the enclosed Brent's minimizer from netlib with your own modification. (c) Consider the second half of the extracted time series as out-of-sample period. Develop a backtesting procedure that evaluates the confidence of the one-sigma confidence interval [u Ot, u +0] realized by the EWMA model. (50 points) Sample user interface, (contracts) Capture data Number of Contracts (M): Number of captured data points: Insample data points 100 13014 6507 Optimal EWMAX 0.91533926 Backtested 1-6 confidence 74.89 Determine EWMA parameter and backtest 195) 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts