Question: 1. In the real world, dividends * a. Are usually more stable than earnings. b. Fluctuate more widely than earnings. c. Tend to be a

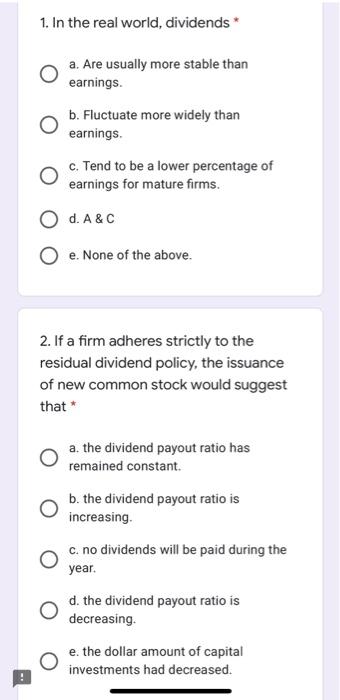

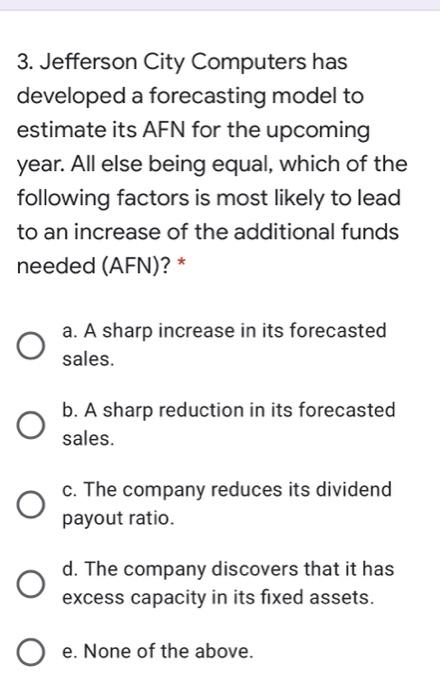

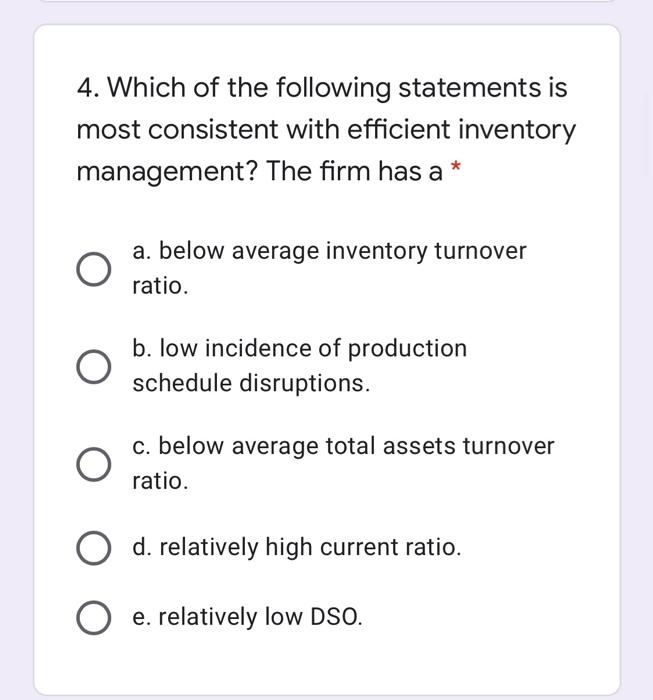

1. In the real world, dividends * a. Are usually more stable than earnings. b. Fluctuate more widely than earnings. c. Tend to be a lower percentage of earnings for mature firms. O d. A&C e. None of the above. 2. If a firm adheres strictly to the residual dividend policy, the issuance of new common stock would suggest that a. the dividend payout ratio has remained constant. b. the dividend payout ratio is increasing. c. no dividends will be paid during the year. d. the dividend payout ratio is decreasing. e. the dollar amount of capital investments had decreased. 3. Jefferson City Computers has developed a forecasting model to estimate its AFN for the upcoming year. All else being equal, which of the following factors is most likely to lead to an increase of the additional funds needed (AFN)? * a. A sharp increase in its forecasted sales. b. A sharp reduction in its forecasted sales. c. The company reduces its dividend payout ratio. d. The company discovers that it has excess capacity in its fixed assets. e. None of the above. 4. Which of the following statements is most consistent with efficient inventory management? The firm has a * a. below average inventory turnover ratio. b. low incidence of production schedule disruptions. c. below average total assets turnover ratio. d. relatively high current ratio. e. relatively low DSO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts