Question: 1. In the spreadsheet , fill in an appropriate formula for each cell showing FORMULA and answer the questions. 2019 2,103,934 1,504,555 599,379 2018 1,847,931

1. In the spreadsheet , fill in an appropriate formula for each cell showing FORMULA and answer the questions.

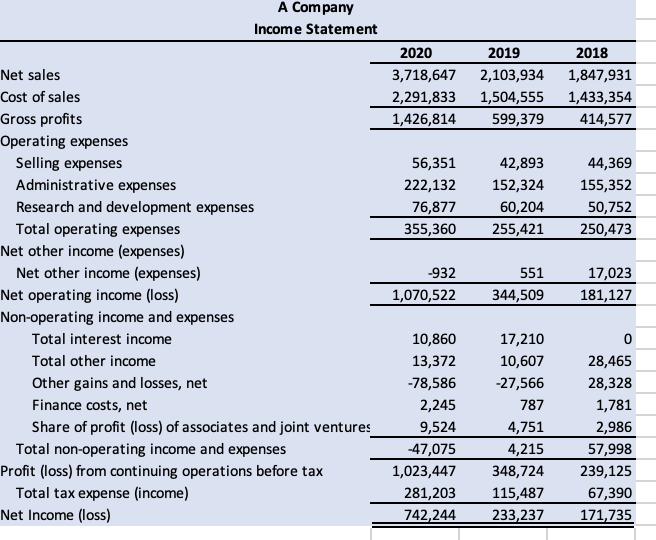

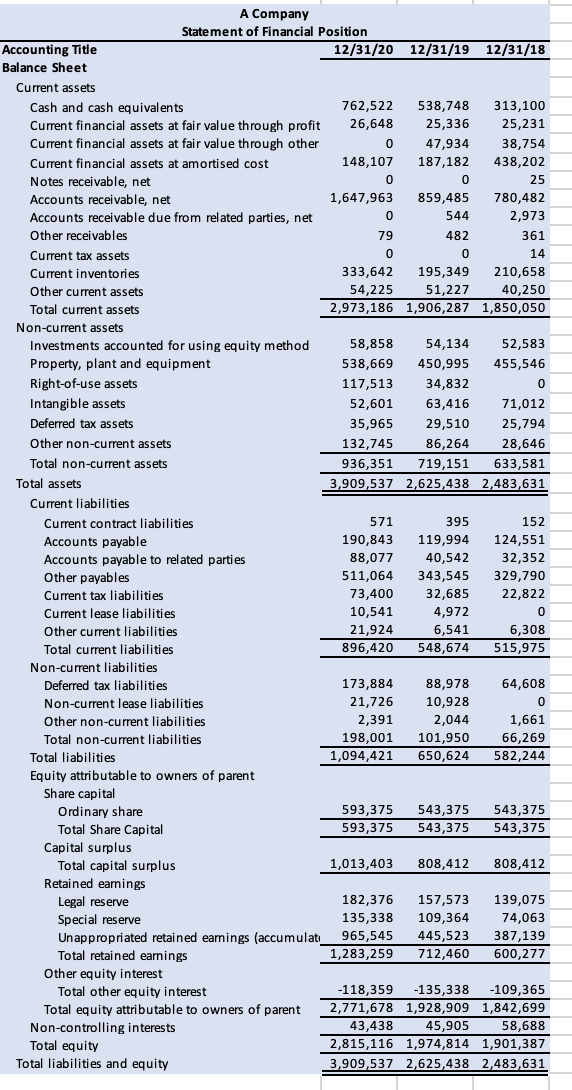

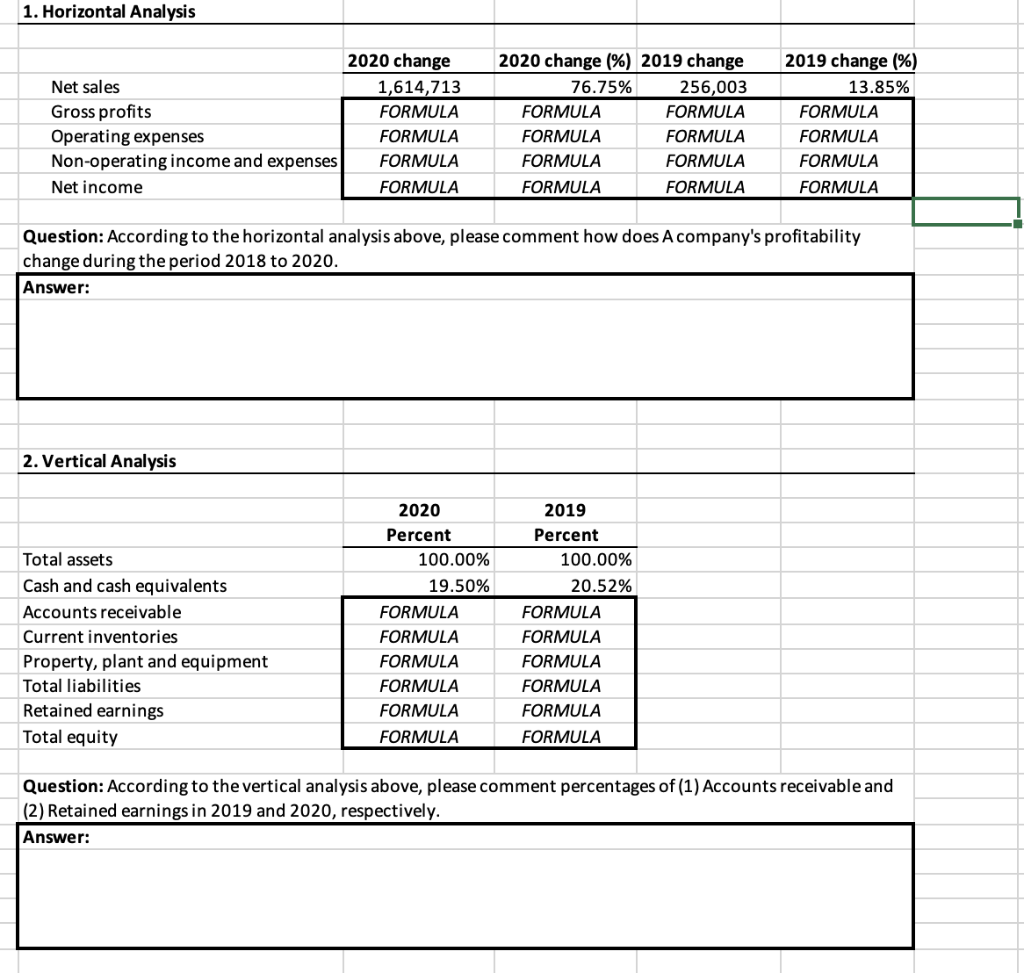

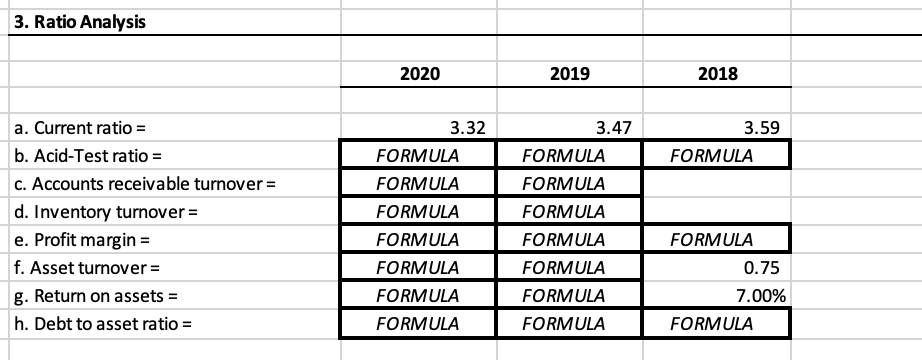

2019 2,103,934 1,504,555 599,379 2018 1,847,931 1,433,354 414,577 42,893 152,324 60,204 255,421 44,369 155,352 50,752 250,473 A Company Income Statement 2020 Net sales 3,718,647 Cost of sales 2,291,833 Gross profits 1,426,814 Operating expenses Selling expenses 56,351 Administrative expenses 222,132 Research and development expenses 76,877 Total operating expenses 355,360 Net other income (expenses) Net other income (expenses) -932 Net operating income (loss) 1,070,522 Non-operating income and expenses Total interest income 10,860 Total other income 13,372 Other gains and losses, net -78,586 Finance costs, net 2,245 Share of profit (Loss) of associates and joint ventures 9,524 Total non-operating income and expenses -47,075 Profit (loss) from continuing operations before tax 1,023,447 Total tax expense (income) 281,203 Net Income (loss) 742,244 551 344,509 17,023 181,127 17,210 10,607 -27,566 787 4,751 4,215 348,724 115,487 233,237 28,465 28,328 1,781 2,986 57,998 239,125 67,390 171,735 A Company Statement of Financial Position Accounting Title 12/31/20 12/31/19 12/31/18 Balance Sheet Current assets Cash and cash equivalents 762,522 538,748 313,100 Current financial assets at fair value through profit 26,648 25,336 25,231 Current financial assets at fair value through other 0 47,934 38,754 Current financial assets at amortised cost 148,107 187,182 438,202 Notes receivable, net 0 0 25 Accounts receivable, net 1,647,963 859,485 780,482 Accounts receivable due from related parties, net 0 544 2,973 Other receivables 79 482 361 Current tax assets 0 0 14 Current inventories 333,642 195,349 210,658 Other current assets 54,225 51,227 40,250 Total current assets 2,973,186 1,906,287 1,850,050 Non-current assets Investments accounted for using equity method 58,858 54,134 52,583 Property, plant and equipment 538,669 450,995 455,546 Right-of-use assets 117,513 34,832 0 Intangible assets 52,601 63,416 71,012 Deferred tax assets 35,965 29,510 25,794 Other non-current assets 132,745 86,264 28,646 Total non-current assets 936,351 719,151 633,581 Total assets 3,909,537 2,625,438 2,483,631 Current liabilities Current contract liabilities 571 395 152 Accounts payable 190,843 119,994 124,551 Accounts payable to related parties 88,077 40,542 32,352 Other payables 511,064 343,545 329,790 Current tax liabilities 73,400 32,685 22,822 Current lease liabilities 10,541 4,972 0 Other current liabilities 21,924 6,541 6,308 Total current liabilities 896,420 548,674 515,975 Non-current liabilities Deferred tax liabilities 173,884 88,978 64,608 Non-current lease liabilities 21,726 10,928 0 Other non-current liabilities 2,391 2,044 1,661 Total non-current liabilities 198,001 101,950 66,269 Total liabilities 1,094,421 650,624 582,244 Equity attributable to owners of parent Share capital Ordinary share 593,375 543,375 543,375 Total Share Capital 593,375 543,375 543,375 Capital surplus Total capital surplus 1,013,403 808,412 808,412 Retained earnings Legal reserve 182,376 157,573 139,075 Special reserve 135,338 109,364 74,063 Unappropriated retained earnings (accumulati 965,545 445,523 387,139 Total retained earnings 1,283,259 712,460 600,277 Other equity interest Total other equity interest -118,359 -135,338 -109,365 Total equity attributable to owners of parent 2,771,678 1,928,909 1,842,699 Non-controlling interests 43,438 45,905 58,688 Total equity 2,815,116 1,974,814 1,901,387 Total liabilities and equity 3,909,537 2,625,438 2,483,631 1. Horizontal Analysis Net sales Gross profits Operating expenses Non-operating income and expenses Net income 2020 change 1,614,713 FORMULA FORMULA FORMULA FORMULA 2020 change (%) 2019 change 76.75% 256,003 FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA 2019 change (%) 13.85% FORMULA FORMULA FORMULA FORMULA Question: According to the horizontal analysis above, please comment how does A company's profitability change during the period 2018 to 2020. Answer: 2. Vertical Analysis 2020 Total assets Cash and cash equivalents Accounts receivable Current inventories Property, plant and equipment Total liabilities Retained earnings Total equity Percent 100.00% 19.50% FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA 2019 Percent 100.00% 20.52% FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA Question: According to the vertical analysis above, please comment percentages of (1) Accounts receivable and (2) Retained earnings in 2019 and 2020, respectively. Answer: 3. Ratio Analysis 2020 2019 2018 3.47 FORMULA FORMULA 3.59 FORMULA a. Current ratio = b. Acid-Test ratio = c. Accounts receivable turnover = d. Inventory turnover = e. Profit margin = f. Asset turnover = g. Return on assets = h. Debt to asset ratio = 3.32 FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA FORMULA 0.75 7.00% FORMULA FORMULA FORMULA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts