Question: 1. In this problem we will explore how a lump sum payment is 'equivalent to an annuity. John has won $1,000,000. He must choose to

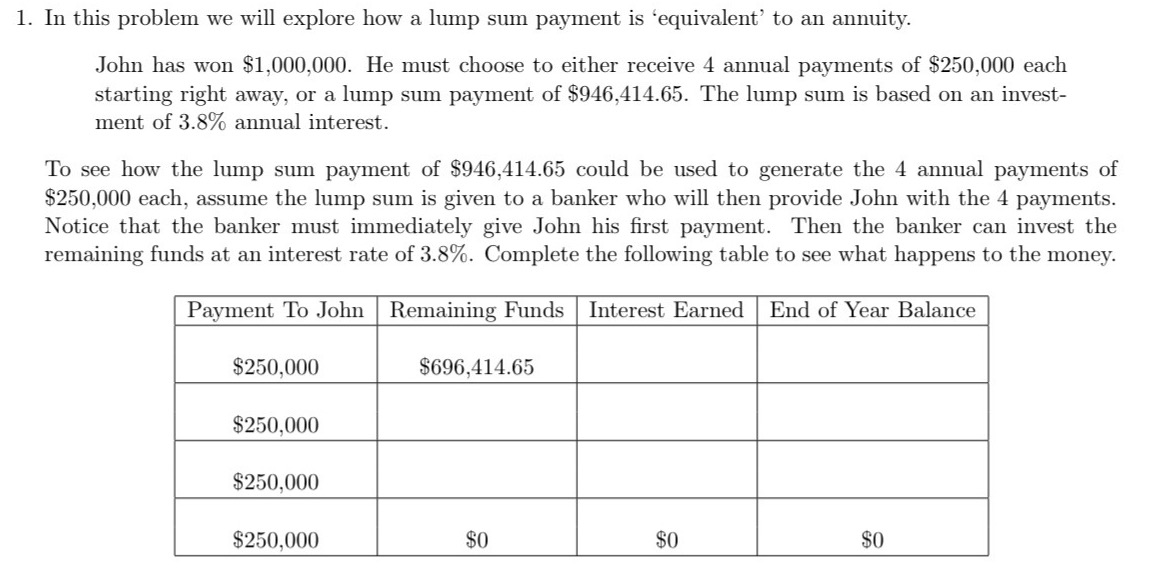

1. In this problem we will explore how a lump sum payment is 'equivalent to an annuity. John has won $1,000,000. He must choose to either receive 4 annual payments of $250,000 each starting right away, or a lump sum payment of $946,414.65. The lump sum is based on an invest- ment of 3.8% annual interest. To see how the lump sum payment of $946,414.65 could be used to generate the 4 annual payments of $250,000 each, assume the lump sum is given to a banker who will then provide John with the 4 payments. Notice that the banker must immediately give John his first payment. Then the banker can invest the remaining funds at an interest rate of 3.8%. Complete the following table to see what happens to the money. Payment To John Remaining Funds Interest Earned End of Year Balance $250,000 $696,414.65 $250,000 $250,000 $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts