Question: 1. In this question, you will use some high level information to calculate the impact of various patronage income distribution decisions on the patron and

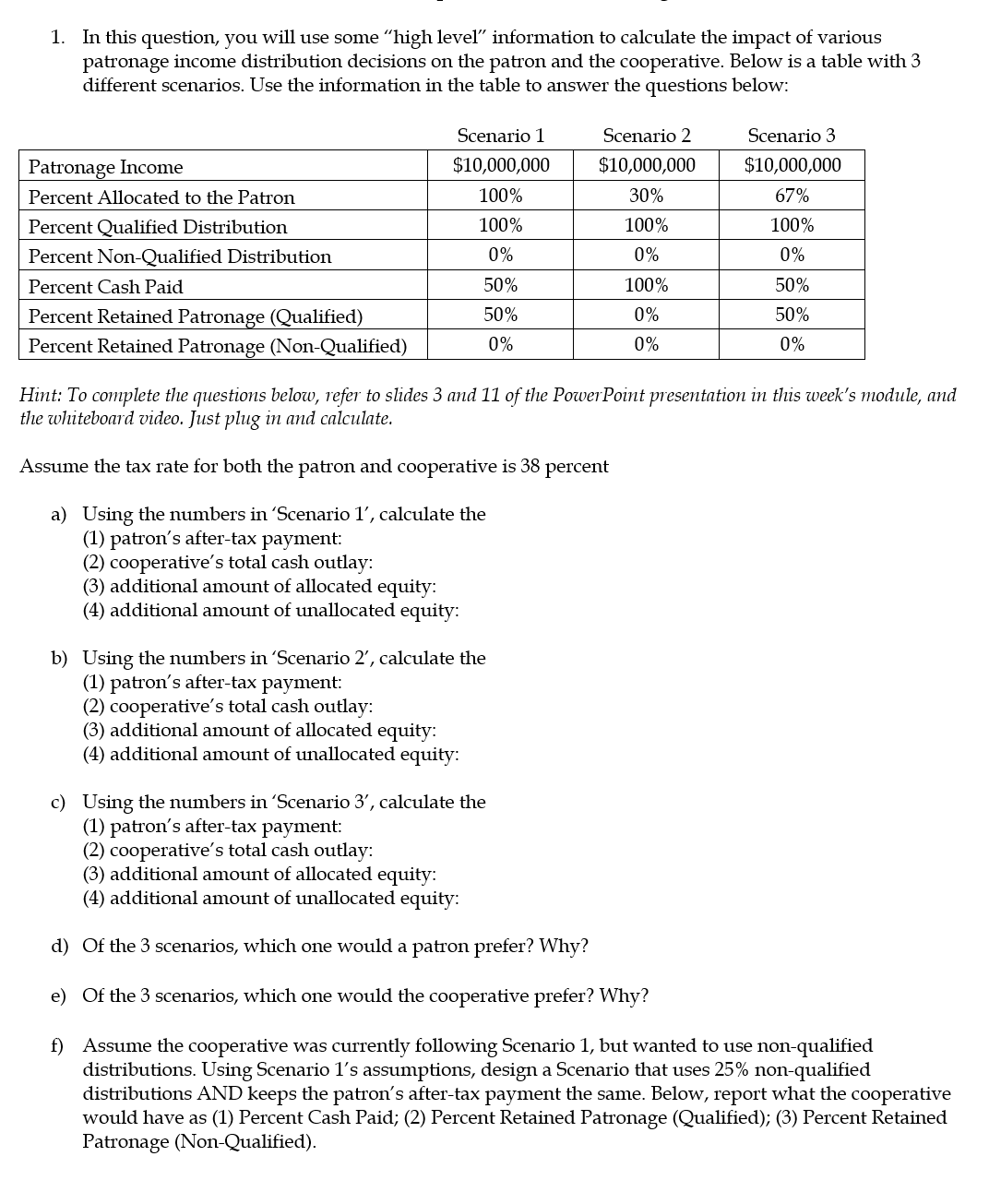

1. In this question, you will use some "high level" information to calculate the impact of various patronage income distribution decisions on the patron and the cooperative. Below is a table with 3 different scenarios. Use the information in the table to answer the questions below: Hint: To complete the questions below, refer to slides 3 and 11 of the PowerPoint presentation in this week's module, and the whiteboard video. Just plug in and calculate. Assume the tax rate for both the patron and cooperative is 38 percent a) Using the numbers in 'Scenario 1', calculate the (1) patron's after-tax payment: (2) cooperative's total cash outlay: (3) additional amount of allocated equity: (4) additional amount of unallocated equity: b) Using the numbers in 'Scenario 2', calculate the (1) patron's after-tax payment: (2) cooperative's total cash outlay: (3) additional amount of allocated equity: (4) additional amount of unallocated equity: c) Using the numbers in 'Scenario 3', calculate the (1) patron's after-tax payment: (2) cooperative's total cash outlay: (3) additional amount of allocated equity: (4) additional amount of unallocated equity: d) Of the 3 scenarios, which one would a patron prefer? Why? e) Of the 3 scenarios, which one would the cooperative prefer? Why? f) Assume the cooperative was currently following Scenario 1, but wanted to use non-qualified distributions. Using Scenario 1's assumptions, design a Scenario that uses 25% non-qualified distributions AND keeps the patron's after-tax payment the same. Below, report what the cooperative would have as (1) Percent Cash Paid; (2) Percent Retained Patronage (Qualified); (3) Percent Retained Patronage (Non-Qualified)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts