Question: . . 1. Individual Assignment Write a 1500-word (plus or minus 10%) analytical report on the performance of equity shares of the top 5 listed

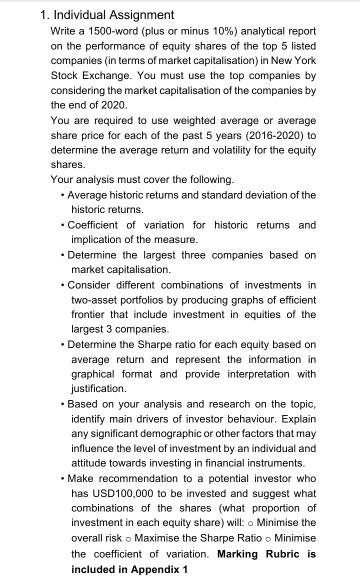

. . 1. Individual Assignment Write a 1500-word (plus or minus 10%) analytical report on the performance of equity shares of the top 5 listed companies (in terms of market capitalisation) in New York Stock Exchange. You must use the top companies by considering the market capitalisation of the companies by the end of 2020 You are required to use weighted average or average share price for each of the past 5 years (2016-2020) to determine the average return and volatility for the equity shares. Your analysis must cover the following- Average historic retums and standard deviation of the historic returns. Coefficient of variation for historic returns and implication of the measure. Determine the largest three companies based on market capitalisation . Consider different combinations of investments in two-asset portfolios by producing graphs of efficient frontier that include investment in equities of the largest 3 companies Determine the Sharpe ratio for each equity based on average return and represent the information in graphical format and provide interpretation with justification . Based on your analysis and research on the topic, identify main drivers of investor behaviour. Explain any significant demographic or other factors that may influence the level of investment by an individual and attitude towards investing in financial instruments Make recommendation to a potential investor who has USD 100,000 to be invested and suggest what combinations of the shares (what proportion of investment in each equity share) will: o Minimise the overall risk o Maximise the Sharpe Ratio o Minimise the coefficient of variation. Marking Rubric is included in Appendix 1 . . . 1. Individual Assignment Write a 1500-word (plus or minus 10%) analytical report on the performance of equity shares of the top 5 listed companies (in terms of market capitalisation) in New York Stock Exchange. You must use the top companies by considering the market capitalisation of the companies by the end of 2020 You are required to use weighted average or average share price for each of the past 5 years (2016-2020) to determine the average return and volatility for the equity shares. Your analysis must cover the following- Average historic retums and standard deviation of the historic returns. Coefficient of variation for historic returns and implication of the measure. Determine the largest three companies based on market capitalisation . Consider different combinations of investments in two-asset portfolios by producing graphs of efficient frontier that include investment in equities of the largest 3 companies Determine the Sharpe ratio for each equity based on average return and represent the information in graphical format and provide interpretation with justification . Based on your analysis and research on the topic, identify main drivers of investor behaviour. Explain any significant demographic or other factors that may influence the level of investment by an individual and attitude towards investing in financial instruments Make recommendation to a potential investor who has USD 100,000 to be invested and suggest what combinations of the shares (what proportion of investment in each equity share) will: o Minimise the overall risk o Maximise the Sharpe Ratio o Minimise the coefficient of variation. Marking Rubric is included in Appendix 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts