Question: 1. Internal controls are concerned with A) only manual systems of accounting. B) the extent of government regulations. safeguarding assets. C) D) preparing income

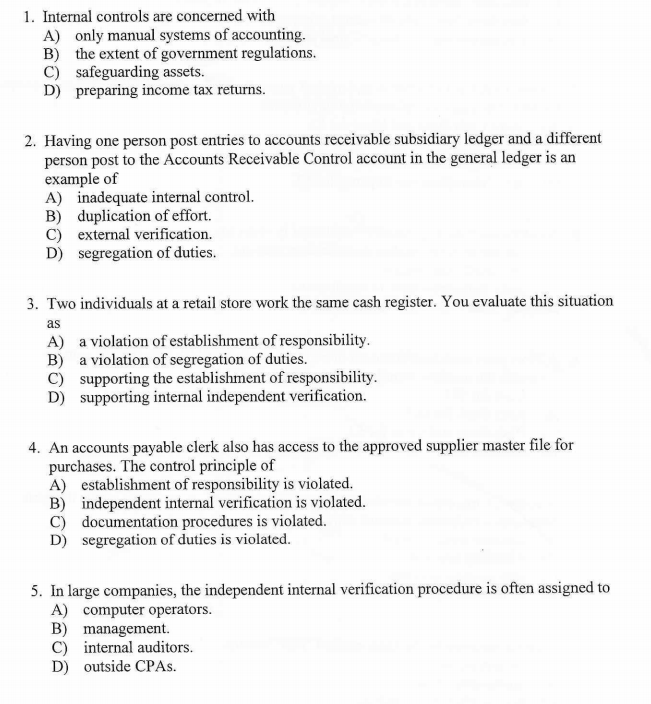

1. Internal controls are concerned with A) only manual systems of accounting. B) the extent of government regulations. safeguarding assets. C) D) preparing income tax returns. 2. Having one person post entries to accounts receivable subsidiary ledger and a different person post to the Accounts Receivable Control account in the general ledger is an example of A) inadequate internal control. B) duplication of effort. C) external verification. D) segregation of duties. 3. Two individuals at a retail store work the same cash register. You evaluate this situation as A) a violation of establishment of responsibility. B) a violation of segregation of duties. C) supporting the establishment of responsibility. D) supporting internal independent verification. 4. An accounts payable clerk also has access to the approved supplier master file for purchases. The control principle of A) establishment of responsibility is violated. B) independent internal verification is violated. C) documentation procedures is violated. D) segregation of duties is violated. 5. In large companies, the independent internal verification procedure is often assigned to A) computer operators. B) management. C) internal auditors. D) outside CPAs.

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

ANSWER 1 C Safeguarding assets Safeguarding of assets is defined in paragraph 7 as those policies and procedures that provide reasonable assurance regarding prevention or timely detection of unauthori... View full answer

Get step-by-step solutions from verified subject matter experts