Question: 1) Is it possible to make an entry which changes only one account? A) Yes ONo 2) How many of the following transactions would affect

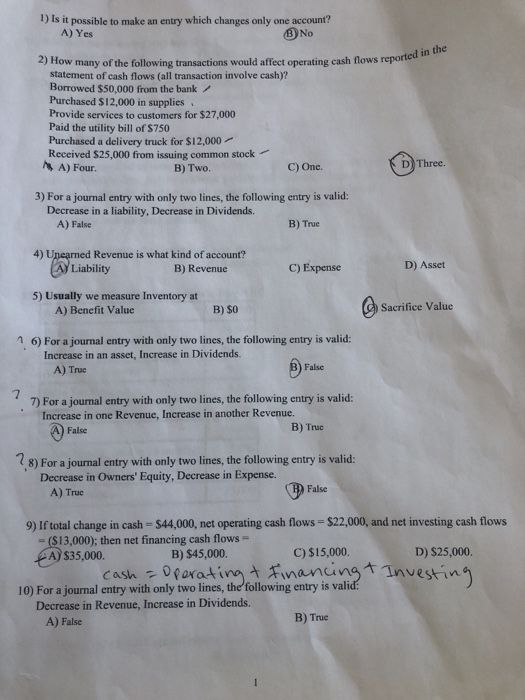

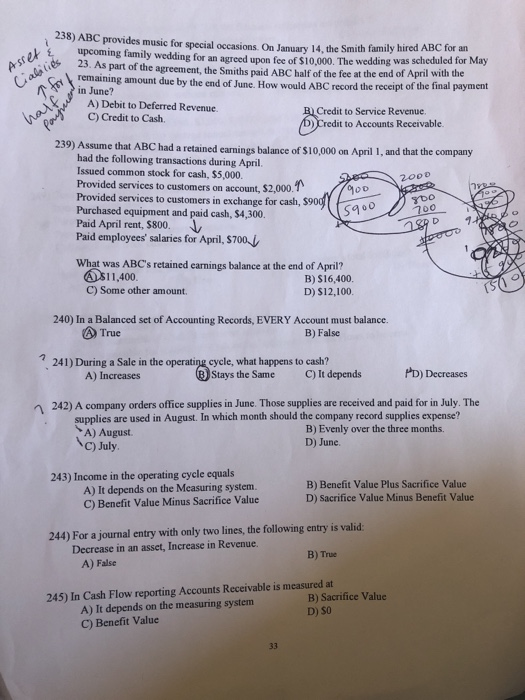

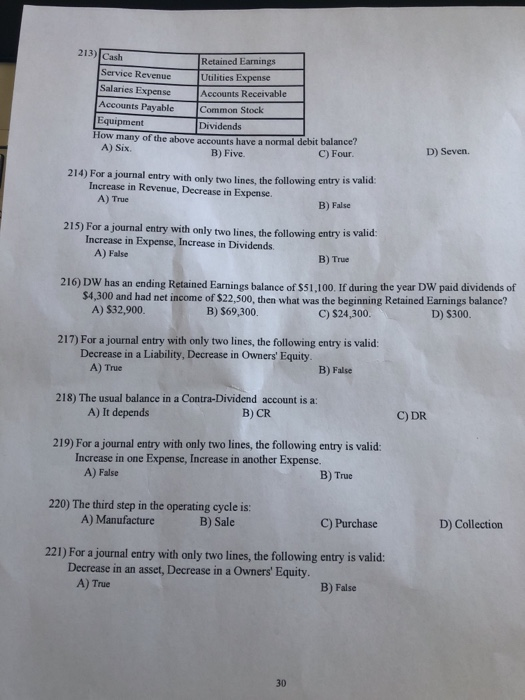

1) Is it possible to make an entry which changes only one account? A) Yes ONo 2) How many of the following transactions would affect operating cash tlows reported in the statement of cash flows (all transaction involve cash)? Borrowed $50,000 from the bank Purchased $12,000 in supplies Provide services to customers for $27,000 Paid the utility bill of $750 Purchased a delivery truck for $12,000 Received $25,000 from issuing common stock A) Four. B) Two. C) One. D Three. 3) For a journal entry with only two lines, the following entry is valid: Decrease in a liability, Decrease in Dividends. A) False B) True 4) Revenue is what kind of account? Liability B) Revenue C) Expense D) Asset 5) Usually we measure Inventory at @ Sacrifice Valtue A) Benefit Value B) SO 1 6) For a journal entry with only two lines, the following entry is valid: Increase in an asset, Increase in Dividends A) Truc False 7) For a journal entry with only two lines, the following entry is valid: Increase in one Revenue, Increase in another Revenue. B) True Fal False 8) For a journal entry with only two lines, the following entry is valic: Decrease in Owners' Equity, Decrease in Expense. A) Truc False 9) If total change in cash $44,000, net operating cash flows-$22,000, and net investing cash flows (S13,000); then net financing cash flows - A) $35,000 B) $45,000. C) $15,000 D) S25,000. cas-Dferat ing.Financing t Investi n 10) For a journal entry with only two lines, the' following entry is vali Decrease in Revenue, Increase in Dividends. A) False B) True 238) ABC provides music for special occasions. On January 14, the Smith family hired ABC for an upcoming family wedding for an agreed upon fee of $10,000. The wedding was 23. As part of the agreement, the Smiths paid ABC in June? A)Debit to Deferred Revenue. scheduled for May p:sS half of the fee at the end of April with the remaining amount due by the end of June. How would ABC record the rec eipt of the final payment Credit to Service Revenue )Credit to Accounts Receivable C) Credit to Cash. 239) Assume that ABC had a retained earnings balance of $10,000 on April 1, and that the company had the following transactions during April. Issued common stock for cash, $5,000. Provided services to customers on account, $2,000 Provided services to customers in exchange for cash, S9 Purchased equipment and paid cash, $4,300. Paid April rent, $800. Paid employees salaries for April, $700 2000 sDo 900 What was ABC's retained earnings balance at the end of April? 11,400 C) Some other amount B) S16,400. D) S12,100. (s 240) In a Balanced set of Accounting Records 7 241) During a Sale in the operating cycle, what happens to cash? 1 242) A company orders office supplies in June. Those supplies are received and paid for in July. The EVERY Account must balance. B) False True A) Increases Stays the Same C) It depends PD) Decreases supplies are used in August. In which month should the company record supplies expense? A) August B) Evenly over the three months. D) June. C) July 243) Income in the operating cycle equals A) It depends on the Measuring system. C) Benefit Value Minus Sacrifice Value B) Benefit Value Plus Sacrifice Value D) Sacrifice Value Minus Benefit Value 244) For a journal entry with only two lines, the following entry is valid Decrease in an asset, Increase in Revenue. B) True A) False B) Sacrifice Value D) so 245) In Cash Flow reporting Accounts Receivable is measured at A) It depends on the measuring system C) Benefit Value 213) Cash Retained Earnings Utilities Expense Accounts Receivable Service Revenue Salaries Expense Accounts PayableCommon Stock Equipment Dividends How many of the above accounts have a normal debit balance B) Five A) Six. C) Four. D) Seven. 214) For a journal entry with only two lines, the following entry is valid Increase in Revenue, Decrease in Expense. A) True B) False 215) For a journal entry with only two lines, the following entry is valid Increase in Expense, Increase in Dividends A) False B) True 216) DW has an ending Retained Earnings balance of $51,100. If during the year DW paid dividends of $4,300 and had net income of $22,500, then what was the beginning Retained Earnings balance? A) $32,900. B) $69,300. C) $24,300. D) S300. 217) For a journal entry with only two lines, the following entry is valid Decrease in a Liability, Decrease in Owners' Equity B) False A) True 218) The usual balance in a Contra-Dividend account is a: A) It depends B) CR C) DR 219) For a journal entry with only two lines, the following entry is valid Increase in one Expense, Increase in another Expense. A) False B) True 220) The third step in the operating cycle is: A) Manufacture B) Sale C) Purchase D) Collection 221) For a journal entry with only two lines, the following entry is valid: Decrease in an asset, Decrease in a Owners' Equity. A) True B) False 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts