Question: 1. Is the estimated beta statistically significant? Why or why not? 2. Find the 95% confidence interval of the beta. ( in excel) 3. What

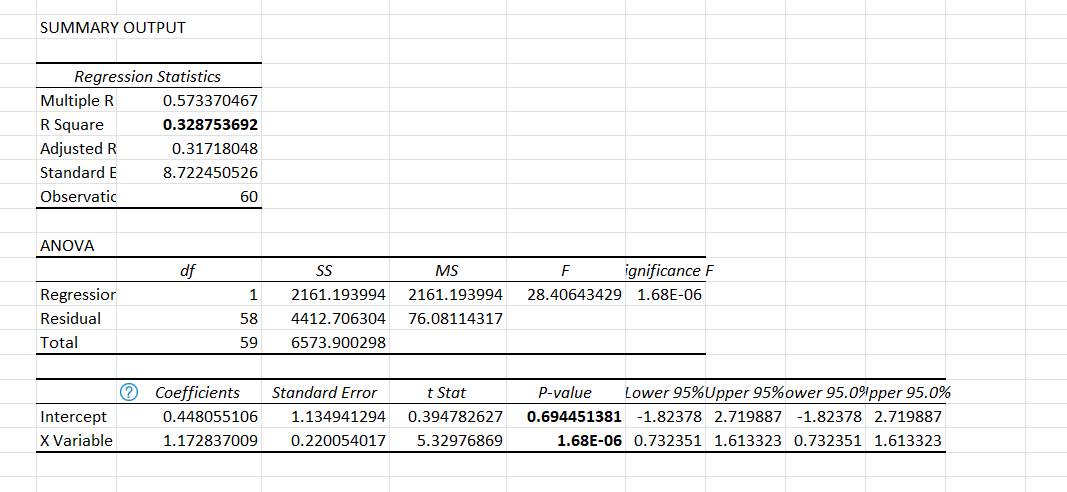

1. Is the estimated beta statistically significant? Why or why not?

2. Find the 95% confidence interval of the beta. ( in excel)

3. What is the R2 of this regression model? What does the R2 tell us about the stock?

SUMMARY OUTPUT Regression Statistics Multiple R 0.573370467 R Square 0.328753692 Adjusted R 0.31718048 Standard E 8.722450526 Observatic 60 ANOVA df SS F ignificance F 28.40643429 1.68E-06 1 Regressior Residual Total MS 2161.193994 76.08114317 2161.193994 4412.706304 6573.900298 58 59 Coefficients Intercept 0.448055106 X Variable 1.172837009 Standard Error 1.134941294 0.220054017 t Stat 0.394782627 5.32976869 P-value Lower 95%Upper 95%ower 95.0%pper 95.0% 0.694451381 -1.82378 2.719887 -1.82378 2.719887 1.68E-06 0.732351 1.613323 0.732351 1.613323

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts