Question: 1). John, age 43 and single, is the sole proprietor of a construction firm. The firm generated $100,000 in revenues and $50,000 of ordinary

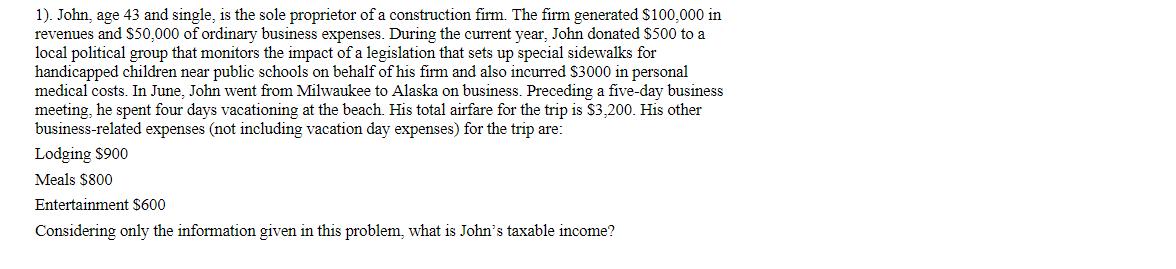

1). John, age 43 and single, is the sole proprietor of a construction firm. The firm generated $100,000 in revenues and $50,000 of ordinary business expenses. During the current year, John donated $500 to a local political group that monitors the impact of a legislation that sets up special sidewalks for handicapped children near public schools on behalf of his firm and also incurred $3000 in personal medical costs. In June, John went from Milwaukee to Alaska on business. Preceding a five-day business meeting, he spent four days vacationing at the beach. His total airfare for the trip is $3,200. His other business-related expenses (not including vacation day expenses) for the trip are: Lodging $900 Meals $800 Entertainment $600 Considering only the information given in this problem, what is John's taxable income?

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

To calculate Johns taxable income we need to determine his total income and subtract his allowable d... View full answer

Get step-by-step solutions from verified subject matter experts