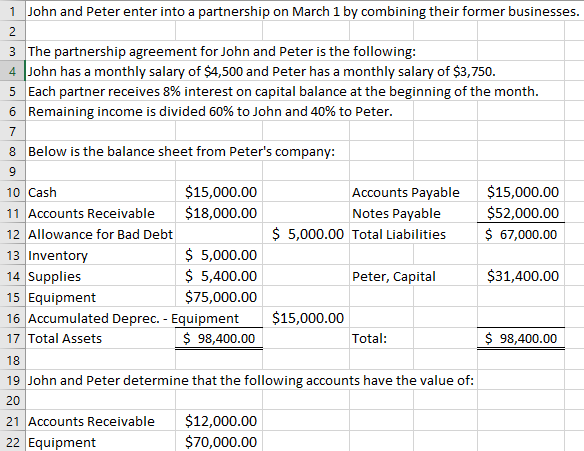

Question: 1 John and Peter enter into a partnership on March 1 by combining their former businesses. 2 3. The partnership agreement for John and Peter

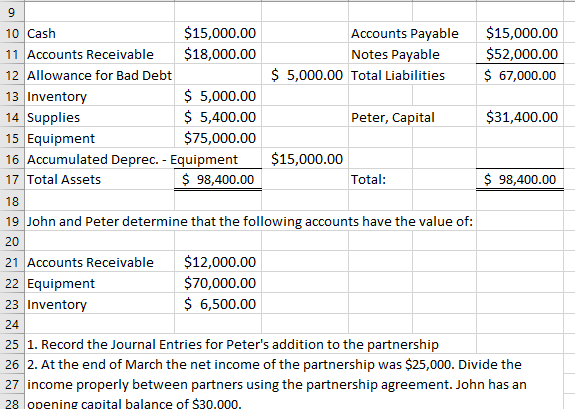

1 John and Peter enter into a partnership on March 1 by combining their former businesses. 2 3. The partnership agreement for John and Peter is the following: 4 John has a monthly salary of $4,500 and Peter has a monthly salary of $3,750. 5 Each partner receives 8% interest on capital balance at the beginning of the month. 6 Remaining income is divided 60% to John and 40% to Peter. 7 8 Below is the balance sheet from Peter's company: 9 10 Cash $15,000.00 Accounts Payable $15,000.00 11 Accounts Receivable $18,000.00 Notes Payable $52,000.00 12 Allowance for Bad Debt $ 5,000.00 Total Liabilities $ 67,000.00 13 Inventory $ 5,000.00 14 Supplies $ 5,400.00 Peter, Capital $31,400.00 15 Equipment $75,000.00 16 Accumulated Deprec. - Equipment $15,000.00 17 Total Assets $ 98,400.00 Total: $ 98,400.00 18 19 John and Peter determine that the following accounts have the value of: 20 21 Accounts Receivable $12,000.00 22 Equipment $70,000.00 9 10 Cash $15,000.00 Accounts Payable $15,000.00 11 Accounts Receivable $18,000.00 Notes Payable $52,000.00 12 Allowance for Bad Debt $ 5,000.00 Total Liabilities $ 67,000.00 13 Inventory $ 5,000.00 14 Supplies $ 5,400.00 Peter, Capital $31,400.00 15 Equipment $75,000.00 16 Accumulated Deprec. - Equipment $15,000.00 17 Total Assets $ 98,400.00 Total: $ 98,400.00 18 19 John and Peter determine that the following accounts have the value of: 20 21 Accounts Receivable $12,000.00 22 Equipment $70,000.00 23 Inventory $ 6,500.00 24 25 1. Record the Journal Entries for Peter's addition to the partnership 26 2. At the end of March the net income of the partnership was $25,000. Divide the 27 income properly between partners using the partnership agreement. John has an 28 opening capital balance of $30.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts