Question: 1. Journalize the adjusting entries 2. Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (Post entries in the

1. Journalize the adjusting entries

2. Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (Post entries in the order of journal entries presented in the previous question.)

3. Prepare an adjusted trial balance on May 31.

4. Prepare an income statement for the month of May.

5. Prepare a retained earnings statement for the month of May.

6. Prepare a classified balance sheet at May 31. (List current assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment .)

7.

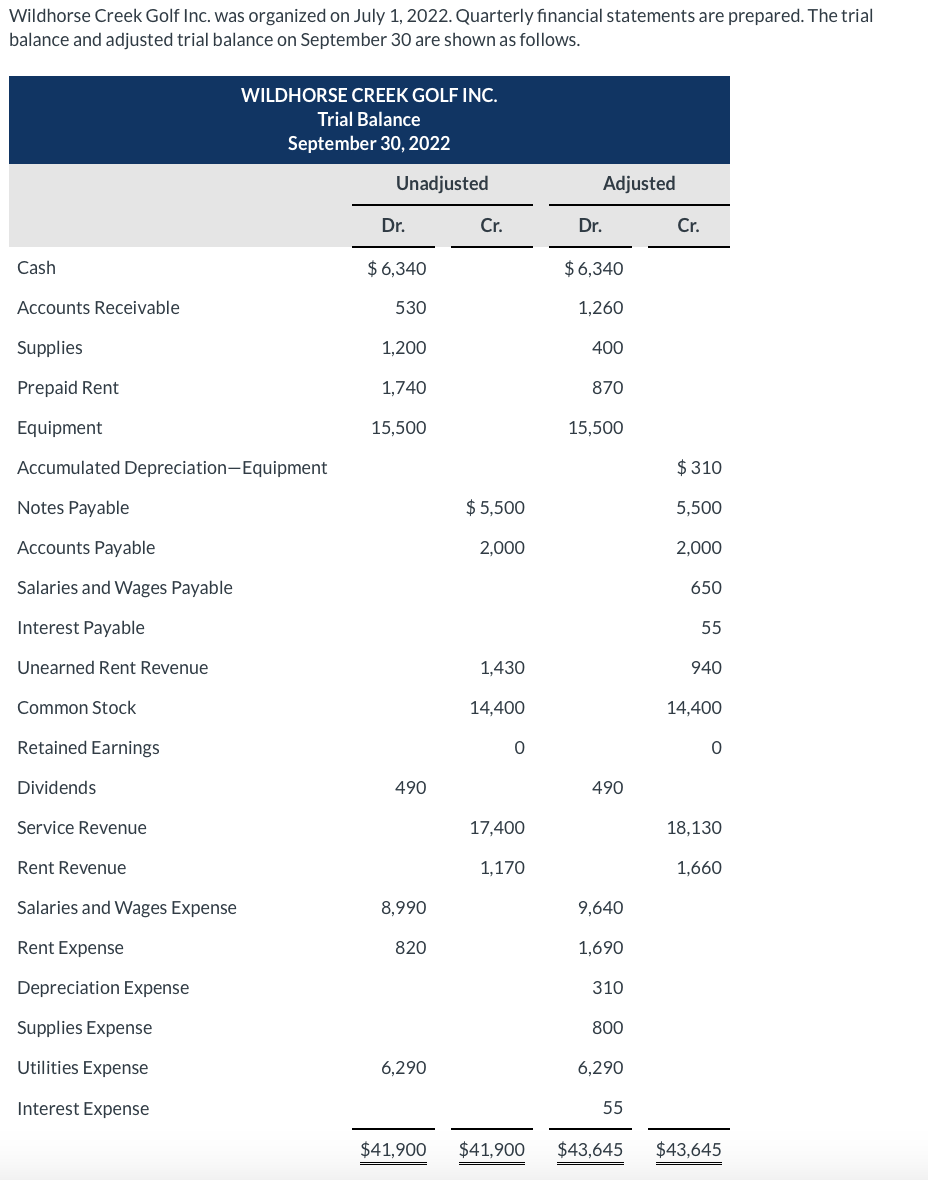

Wildhorse Creek Golf Inc. was organized on July 1, 2022. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown as follows. WILDHORSE CREEK GOLF INC. Trial Balance September 30, 2022 Unadjusted Adjusted Dr. Cr. Dr. Cr. Cash $ 6,340 $ 6,340 Accounts Receivable 530 1,260 Supplies 1,200 400 Prepaid Rent 1,740 870 Equipment 15,500 15,500 Accumulated Depreciation-Equipment $ 310 Notes Payable $5,500 5,500 Accounts Payable 2,000 2,000 Salaries and Wages Payable 650 Interest Payable 55 Unearned Rent Revenue 1,430 940 Common Stock 14,400 14,400 Retained Earnings 0 0 Dividends 490 490 Service Revenue 17,400 18,130 Rent Revenue 1,170 1,660 Salaries and Wages Expense 8,990 9,640 Rent Expense 820 1,690 Depreciation Expense 310 Supplies Expense 800 Utilities Expense 6,290 6,290 Interest Expense 55 $41,900 $41,900 $43,645 $43,645

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts