Question: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense.

1. Journalize the adjusting entries using the following additional

accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense;

Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and

Supplies Expense. Refer to the Chart of Accounts for exact wording of

account titles.

2. Determine the balances of the accounts affected by the adjusting

entries, and prepare an adjusted trial balance.

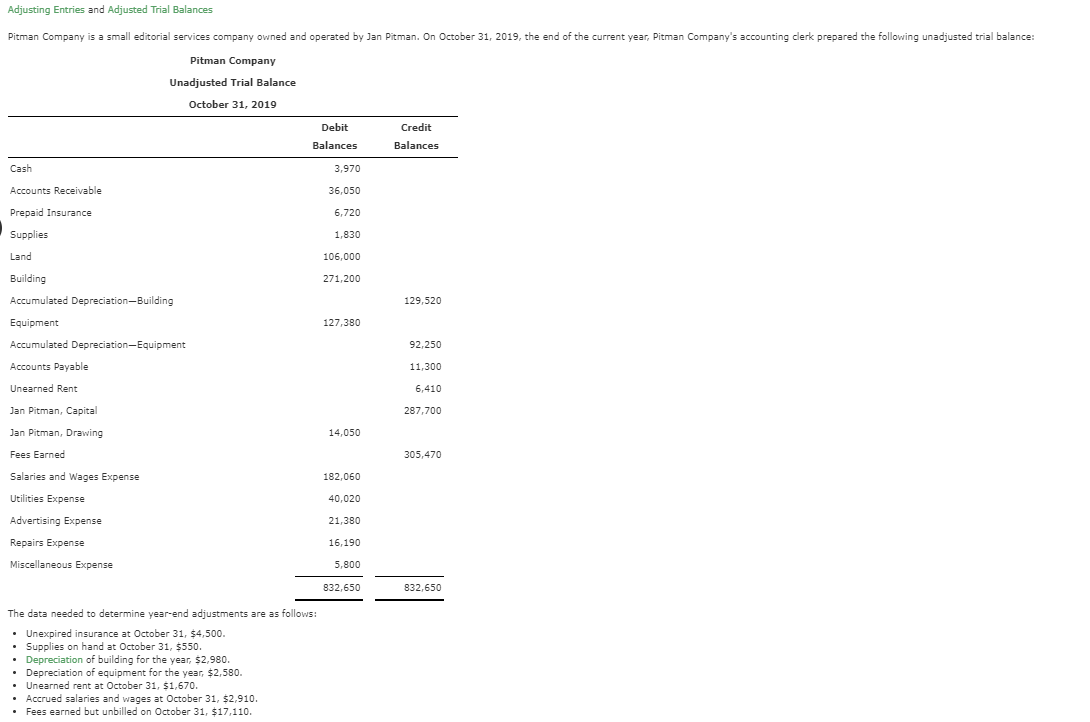

Adjusting Entries and Adjusted Trial Balances Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019, the end of the current year, Pitman Company's accounting clerk prepared the following unadjusted trial balance: Pitman Company Unadjusted Trial Balance October 31, 2019 Credit Debit Balances Balances Cash 3,970 36,050 Accounts Receivable Prepaid Insurance 6,720 Supplies 1,830 Land 106,000 Building 271,200 Accumulated Depreciation-Building 129,520 Equipment 127,380 Accumulated Depreciation-Equipment 92,250 11,300 Accounts Payable Unearned Rent 6,410 287,700 Jan Pitman, Capital Jan Pitman, Drawing 14,050 Fees Earned 305,470 Salaries and Wages Expense 182,060 Utilities Expense 40,020 Advertising Expense 21,380 Repairs Expense 16,190 Miscellaneous Expense 5,800 832,650 832,650 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $4,500. Supplies on hand at October 31, $550. Depreciation of building for the year, 52,980. Depreciation of equipment for the year, $2,580. Unearned rent at October 31, 51,670. Accrued salaries and wages at October 31, $2.910. Fees earned but unbilled on October 31, $17,110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts