Question: 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $500. b. Salaries (Selling) accrued, $2,400. c. Depreciation ExpenseEquipment (Administrative), $1,295. d.

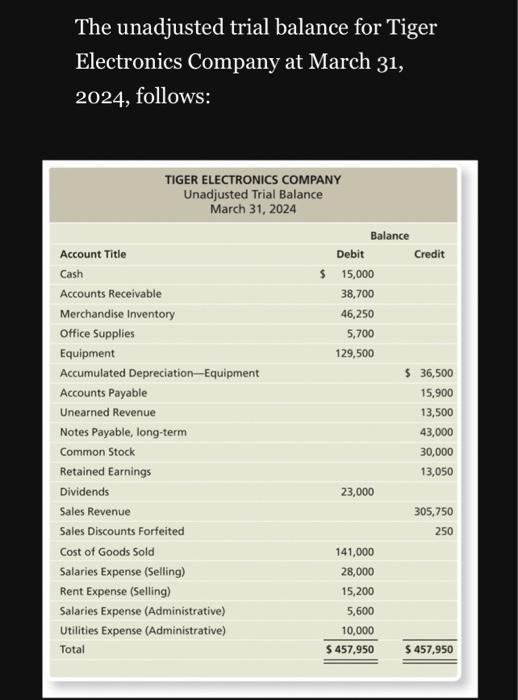

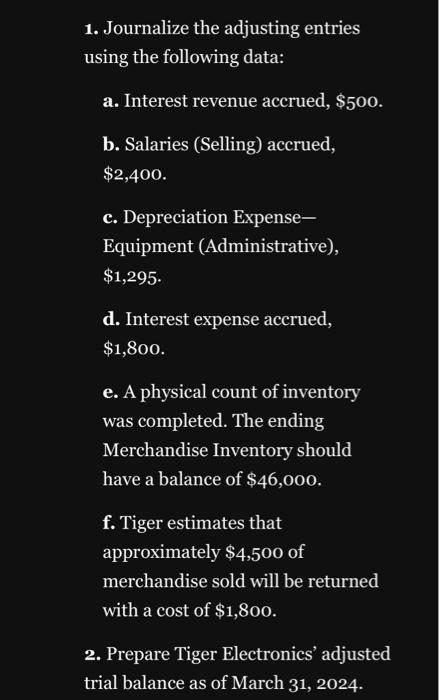

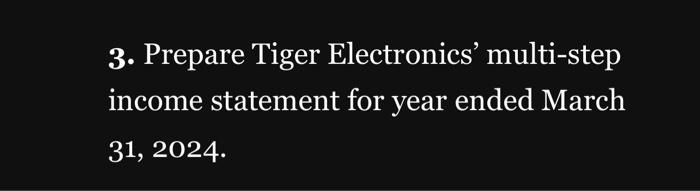

1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $500. b. Salaries (Selling) accrued, $2,400. c. Depreciation ExpenseEquipment (Administrative), $1,295. d. Interest expense accrued, $1,800. e. A physical count of inventory was completed. The ending Merchandise Inventory should have a balance of $46,000. f. Tiger estimates that approximately $4,500 of merchandise sold will be returned with a cost of $1,800. 2. Prepare Tiger Electronics' adjusted trial balance as of March 31, 2024 . 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $500. b. Salaries (Selling) accrued, $2,400. c. Depreciation ExpenseEquipment (Administrative), $1,295. d. Interest expense accrued, $1,800. e. A physical count of inventory was completed. The ending Merchandise Inventory should have a balance of $46,000. f. Tiger estimates that approximately $4,500 of merchandise sold will be returned with a cost of $1,800. 2. Prepare Tiger Electronics' adjusted trial balance as of March 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts