Question: 1. Journalize the April transactions using a periodic inventory system. (If no entry is required, select No Entry for the account titles and enter 0

1. Journalize the April transactions using a periodic inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.)

2. Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions. (Post entries in the order of journal entries posted in part a. Round answers to 0 decimal places, e.g. 5,275. For accounts that have a zero balance select "4/30 Bal." from the list and enter 0 for the amount.)

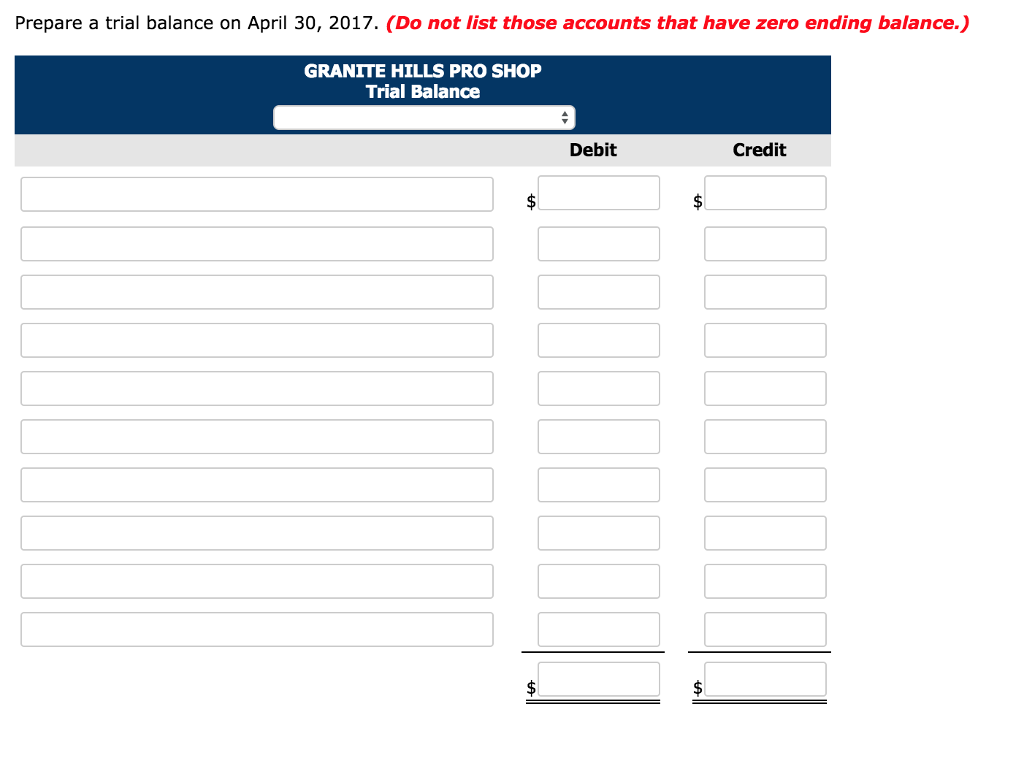

4. Prepare an income statement through gross profit, assuming inventory on hand at April 30 is $4,263.

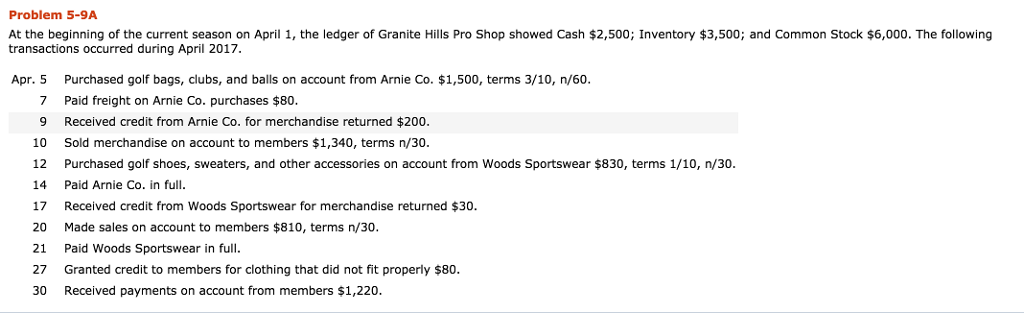

Problem 5-9A At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash $2,500; Inventory $3,500; and Common Stock $6,000. The following transactions occurred during April 2017. Apr. 5 Purchased golf bags, clubs, and balls on account from Arnie Co. $1,500, terms 3/10, n/60. 7 Paid freight on Arnie Co. purchases $80. 9 Received credit from Arnie Co. for merchandise returned $200. 10 Sold merchandise on account to members $1,340, terms n/30. 12 Purchased golf shoes, sweaters, and other accessories on account from Woods Sportswear $830, terms 1/10, n/30 14 Paid Arnie Co. in ful 17 Received credit from Woods Sportswear for merchandise returned $30 20 Made sales on account to members $810, terms n/30. 21 Paid Woods Sportswear in full. 27 Granted credit to members for clothing that did not fit properly $80 30 Received payments on account from members $1,220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts