Question: 1. Journalize the entries to record the summarized operations. Record each item (items a-f) as an individual entry on January 31. Record item g as

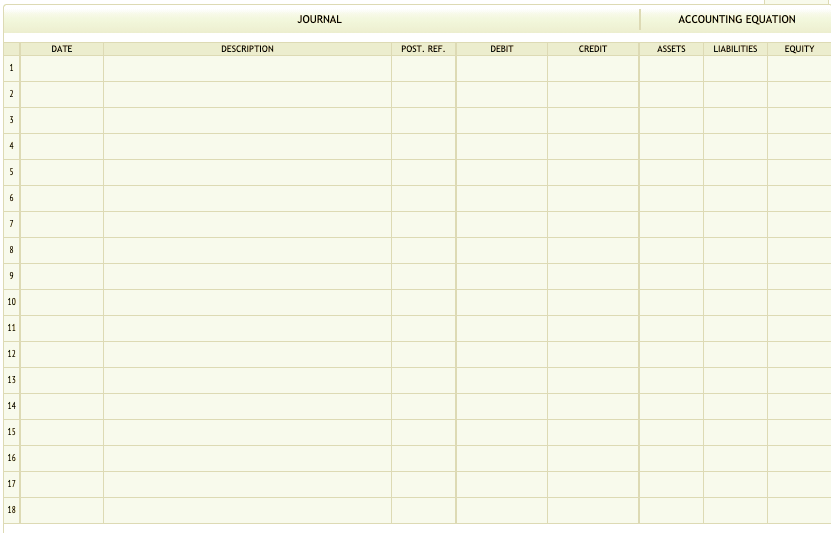

1. Journalize the entries to record the summarized operations. Record each item (items a-f) as an individual entry on January 31. Record item g as 2 entries. Refer to the Chart of Accounts for exact wording of account titles.

(drop down options): a, b, c, d, e, f, g

(drop down options): a, b, c, d, e, f, g

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tybee Industries Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

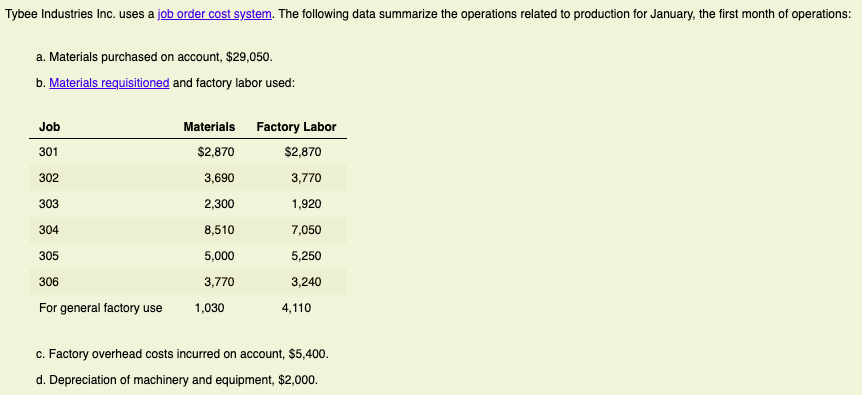

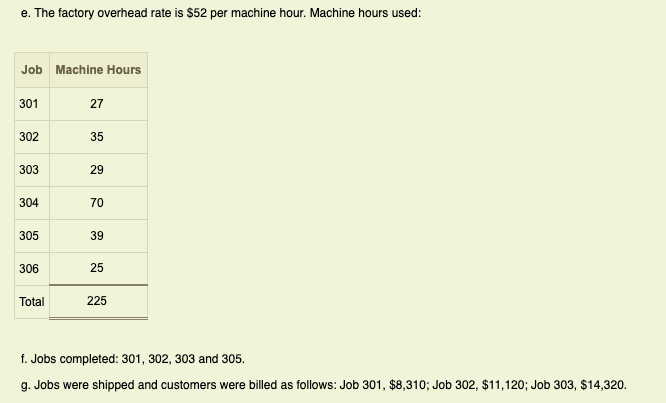

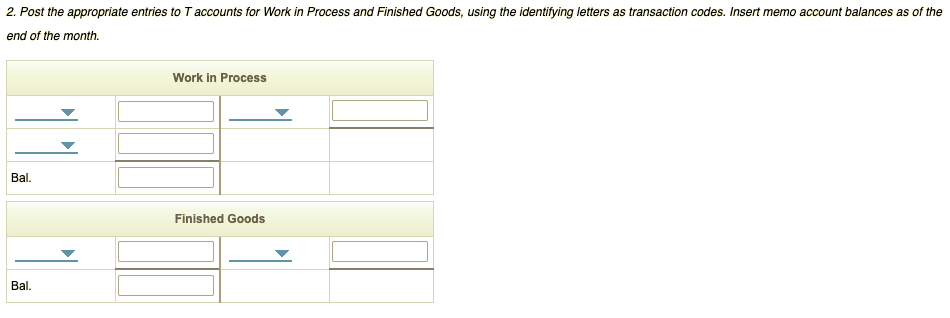

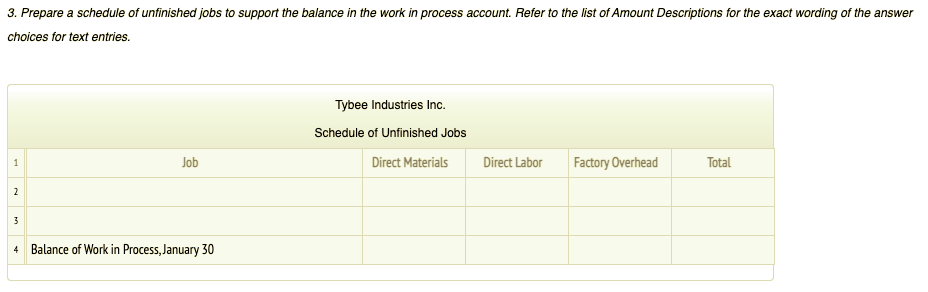

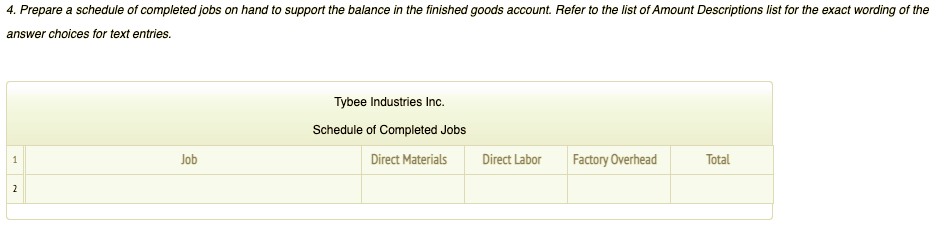

Tybee Industries Inc. uses a job order cost system. The following data summarize the operations related to production for January, the first month of operations: a. Materials purchased on account, $29,050. b. Materials requisitioned and factory labor used: Job Materials Factory Labor $2,870 $2,870 301 302 3,690 3,770 303 1,920 2,300 8,510 304 7,050 305 5,000 5,250 306 3,240 3,770 1,030 For general factory use 4,110 c. Factory overhead costs incurred on account, $5,400. d. Depreciation of machinery and equipment, $2,000. e. The factory overhead rate is $52 per machine hour. Machine hours used: Job Machine Hours 301 27 302 35 303 29 304 70 305 39 306 25 Total 225 f. Jobs completed: 301, 302, 303 and 305. g. Jobs were shipped and customers were billed as follows: Job 301, $8,310; Job 302, $11,120; Job 303, $14,320. JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account balances as of the end of the month. Work in Process Bal. Finished Goods Bal. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. Refer to the list of Amount Descriptions list for the exact wording of the answer choices for text entries. Tybee Industries Inc. Schedule of Completed Jobs 1 Job Direct Materials Direct Labor Factory Overhead Total 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts