Question: 1. Journalize the transactions. 2. Prepare a table showing the total charges for each Job and in total. 3. Answer the following: (1) What is

1. Journalize the transactions.

2. Prepare a table showing the total charges for each Job and in total.

3. Answer the following: (1) What is the balance of the work in process (2) What is the balance of the finished goods (3) What is the total cost of goods sold

4. Prepare the statement of cost of goods sold and determine the gross profit per job and in total. For PR2-1A, assume that sales is $1,500,000.

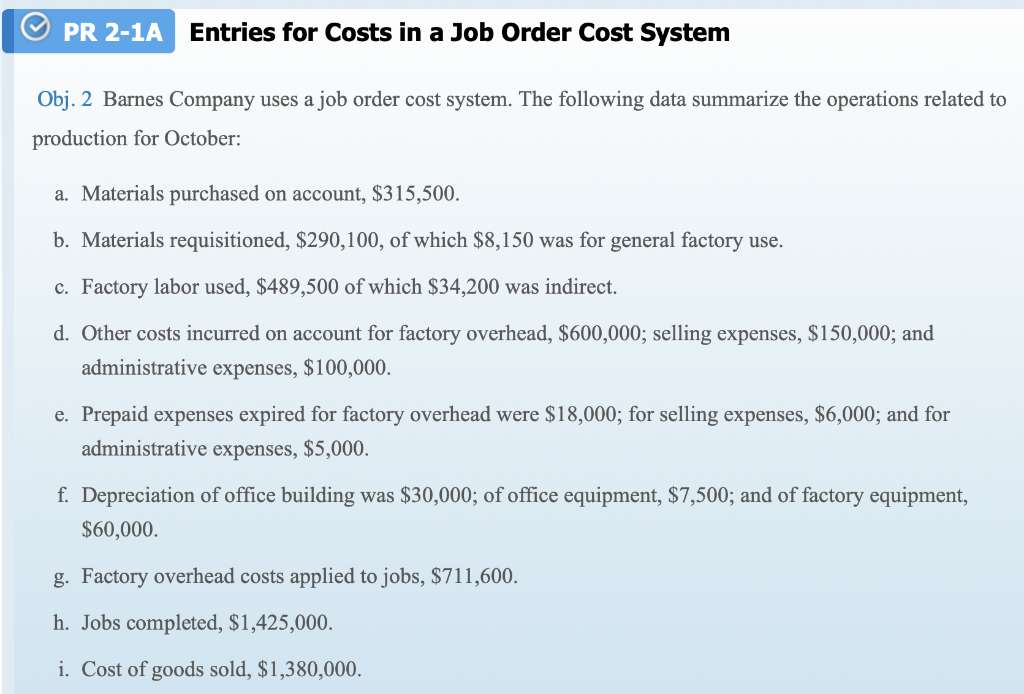

PR 2-1A Entries for Costs in a Job Order Cost System Obj. 2 Barnes Company uses a job order cost system. The following data summarize the operations related to production for October: a. Materials purchased on account, $315,500. b. Materials requisitioned, $290,100, of which $8,150 was for general factory use. c. Factory labor used, $489,500 of which $34,200 was indirect. d. Other costs incurred on account for factory overhead, $600,000; selling expenses, $150,000; and administrative expenses, $100,000. e. Prepaid expenses expired for factory overhead were $18,000; for selling expenses, $6,000; and for administrative expenses, $5,000. f. Depreciation of office building was $30,000; of office equipment, $7,500; and of factory equipment, $60,000. g. Factory overhead costs applied to jobs, $711,600. h. Jobs completed, $1,425,000. i. Cost of goods sold, $1,380,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts