Question: 1 Jumper Company uses the weighted-average method in its process costing system. The following data pertain to operations in the first processing department for a

1

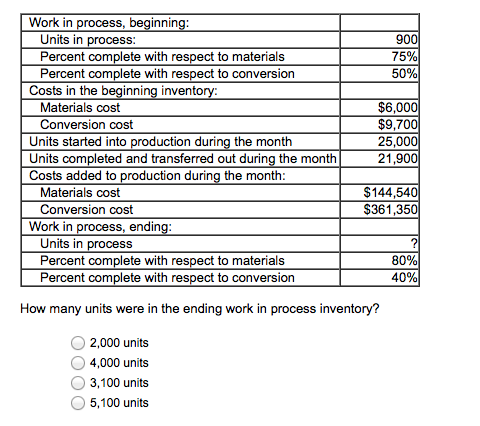

Jumper Company uses the weighted-average method in its process costing system. The following data pertain to operations in the first processing department for a recent month:

2]

3

![a recent month: 2] 3 4 How many units were in the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e83e48638f8_32866e83e4814392.jpg)

4

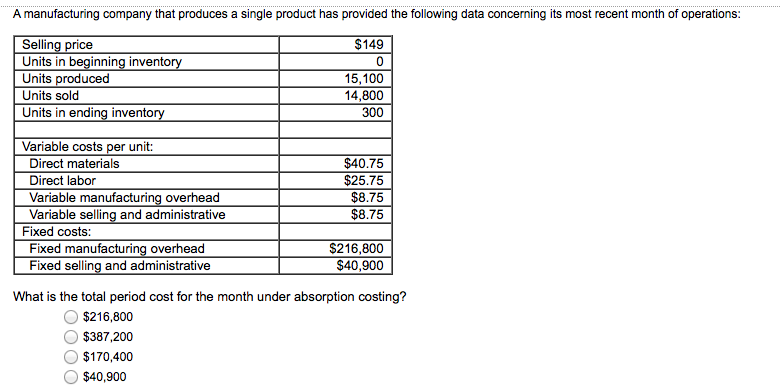

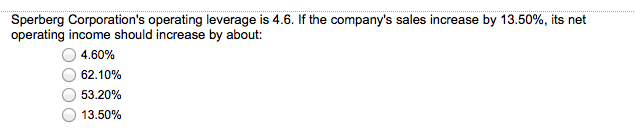

How many units were in the ending work in process inventory? 2,000 units 4,000 units 3,100 units 5,100 units A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: What is the total period cost for the month under absorption costing? $216,800 $387,200 $170,400 $40,900 James Company has a margin of safety percentage of 19% based on its actual sales. The break-even point is $370,000 and the variable expenses are 39% of sales. Given this information, the actual profit is (Do not round your intermediate calculations. Round your final answer to the nearest dollar amount.): $43,383 $42,883 $27,417 $52,942 Sperberg Corporation's operating leverage is 4.6. If the company's sales increase by 13.50%, its net operating income should increase by about: 4.60% 62.10% 53.20% 13.50% How many units were in the ending work in process inventory? 2,000 units 4,000 units 3,100 units 5,100 units A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: What is the total period cost for the month under absorption costing? $216,800 $387,200 $170,400 $40,900 James Company has a margin of safety percentage of 19% based on its actual sales. The break-even point is $370,000 and the variable expenses are 39% of sales. Given this information, the actual profit is (Do not round your intermediate calculations. Round your final answer to the nearest dollar amount.): $43,383 $42,883 $27,417 $52,942 Sperberg Corporation's operating leverage is 4.6. If the company's sales increase by 13.50%, its net operating income should increase by about: 4.60% 62.10% 53.20% 13.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts