Question: 1. Kris Reeves is evaluating projects using the IRR rule and a required return of 12%. Should she accept the following project given estimated cash

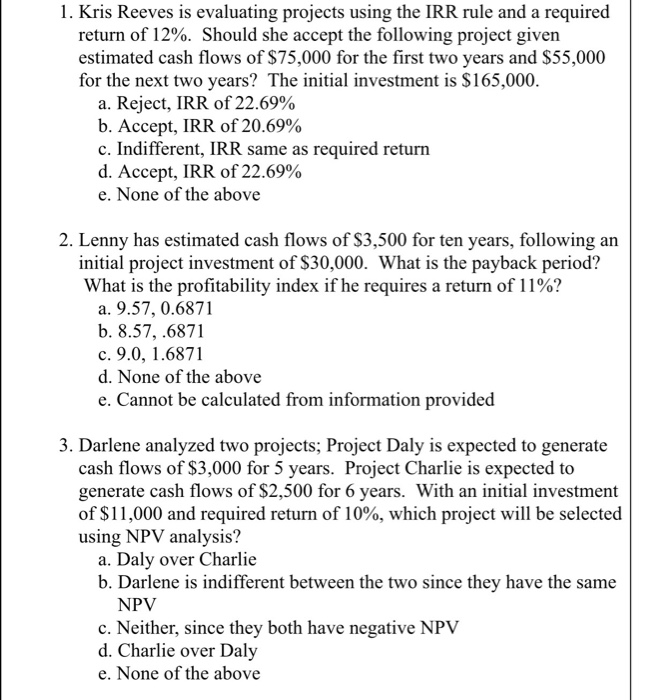

1. Kris Reeves is evaluating projects using the IRR rule and a required return of 12%. Should she accept the following project given estimated cash flows of $75,000 for the first two years and $55,000 for the next two years? The initial investment is $165,000. a. Reject, IRR of 22.69% b. Accept, IRR of 20.69% c. Indifferent, IRR same as required return d. Accept, IRR of 22.69% e. None of the above 2. Lenny has estimated cash flows of $3,500 for ten years, following an initial project investment of $30,000. What is the payback period? What is the profitability index if he requires a return of 11%? a. 9.57, 0.6871 b. 8.57, .6871 c. 9.0, 1.6871 d. None of the above e. Cannot be calculated from information provided 3. Darlene analyzed two projects; Project Daly is expected to generate cash flows of $3,000 for 5 years. Project Charlie is expected to generate cash flows of $2,500 for 6 years. With an initial investment of $11,000 and required return of 10%, which project will be selected using NPV analysis? a. Daly over Charlie b. Darlene is indifferent between the two since they have the same NPV c. Neither, since they both have negative NPV d. Charlie over Daly e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts