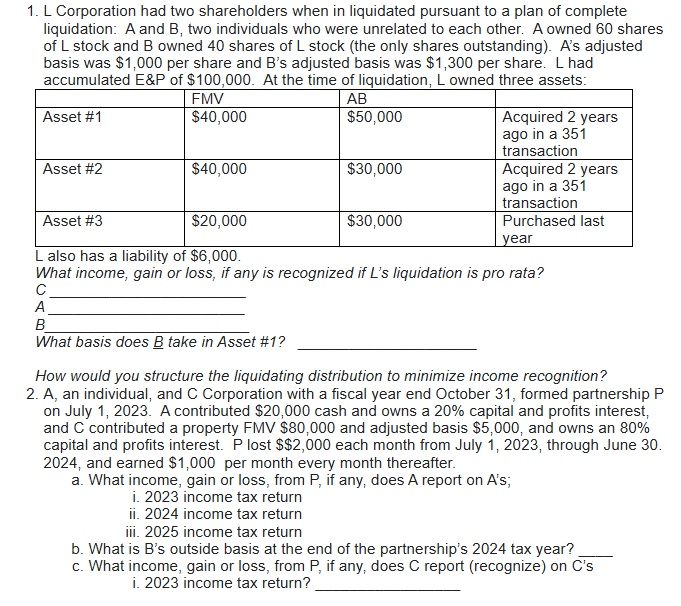

Question: 1 . L Corporation had two shareholders when in liquidated pursuant to a plan of complete liquidation: A and B , two individuals who were

L Corporation had two shareholders when in liquidated pursuant to a plan of complete liquidation: A and B two individuals who were unrelated to each other. A owned shares of L stock and B owned shares of L stock the only shares outstanding As adjusted basis was $ per share and Bs adjusted basis was $ per share. L had accumulated E&P of $ At the time of liquidation, L owned three assets:Acquired years ago in a transactionAcquired years ago in a transactionPurchased last year L also has a liability of $ What income, gain or loss, if any is recognized if Ls liquidation is pro rata? C A B What basis does B take in Asset # How would you structure the liquidating distribution to minimize income recognition? A an individual, and C Corporation with a fiscal year end October formed partnership P on July A contributed $ cash and owns a capital and profits interest, and C contributed a property FMV $ and adjusted basis $ and owns an capital and profits interest. P lost $ each month from July through June and earned $ per month every month thereafter. a What income, gain or loss, from P if any, does A report on As; i income tax return ii income tax return iii. income tax return b What is Bs outside basis at the end of the partnership's tax year? c What income, gain or loss, from P if any, does C report recognize on Cs i income tax return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock