Question: 1. Labor Burden a) Increases b) Decreases Not affected c) d) Payroll taxes e) Income taxes f) Allowance FUTA 2. a) Increases b) Decreases c)

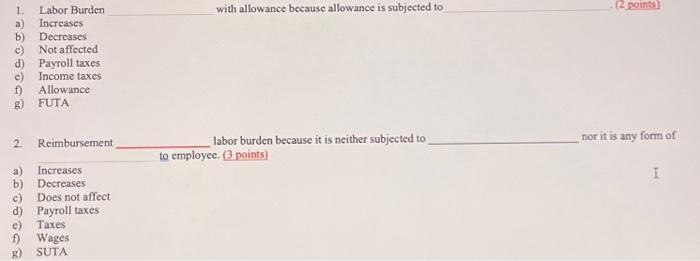

1. Labor Burden a) Increases b) Decreases Not affected c) d) Payroll taxes e) Income taxes f) Allowance FUTA 2. a) Increases b) Decreases c) d) e) Reimbursement 09 Does not affect Payroll taxes Taxes f) Wages SUTA with allowance because allowance is subjected to labor burden because it is neither subjected to to employee. (3 points) (2 points) nor it is any form of I

1. Labor Burden with allowance because allowance is subjected to (2 points ] a) Increases b) Decreases c) Not affected d) Payroll taxes e) Income taxes f) Allowance g) FUTA 2. Reimbursement labor burden because it is neither subjected to nor it is any form of a) Increases b) Decreases c) Does not affect d) Payroll taxes e) Taxes f) Wages g) SUTA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock