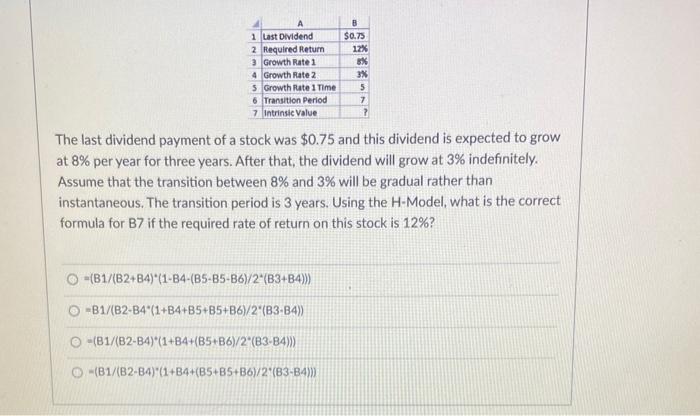

Question: 1 Last Dividend 2 Required Return 3 Growth Rate 1 4 Growth Rate 2 5 Growth rate 1 Time 6 Transition Period 7 Intrinsic Value

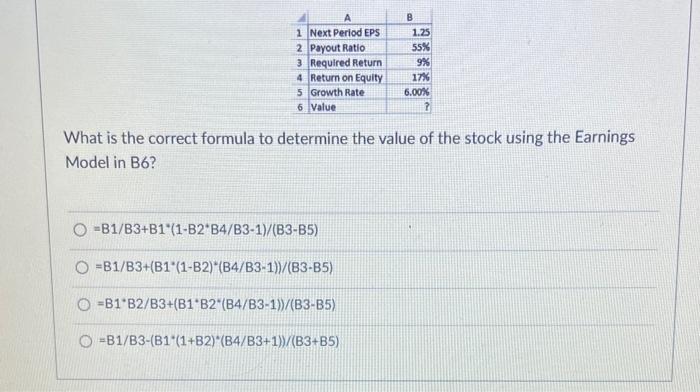

1 Last Dividend 2 Required Return 3 Growth Rate 1 4 Growth Rate 2 5 Growth rate 1 Time 6 Transition Period 7 Intrinsic Value $0.75 12% sk 3 5 7 ? The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%? =(B1/(B2+B4)" (1-B4-(B5-B5-B6)/2"(B3+B4)) -B1/B2-B4*(1+B4+B5-B5-B6)/2"(B3-B4)) -(B1/B2-B4)*(1+B4+(B5-B6)/2*(83-84>>> -(B1/(B2-B4)(1+B4+(B5+B5+B6)/2 (83-B4) B 1 Next Period EPS 2 Payout Ratio 3 Required Return 4 Return on Equity 5 Growth Rate 6 Value 1.25 55% 9% 17% 6.00% 7 What is the correct formula to determine the value of the stock using the Earnings Model in B6? O =B1/B3+B1"(1-B2 B4/B3-1)/(B3-B5) O =B1/B3+(B1"(1-B2)*(B4/B3-1)/(B3-B5) =B1 B2/B3+(B1-B2"(B4/B3-1)/(B3-B5) =B1/B3-B1'(1+B2)*(B4/B3+1)/(B3+B5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts