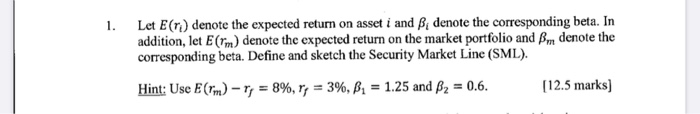

Question: 1. Let E(n) denote the expected return on asset i and B. denote the corresponding beta. In addition, let E(rm) denote the expected return on

1. Let E(n) denote the expected return on asset i and B. denote the corresponding beta. In addition, let E(rm) denote the expected return on the market portfolio and Bm denote the corresponding beta. Define and sketch the Security Market Line (SML). Hint: Use E(rm) - r = 8%, r = 3%, B. = 1.25 and B2 = 0.6. [12.5 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock