Question: 1. Let's evaluate two separate bonds. Both bonds have 6.7% semi-annual coupons and are priced at par value. Bond A has 3 years to maturity

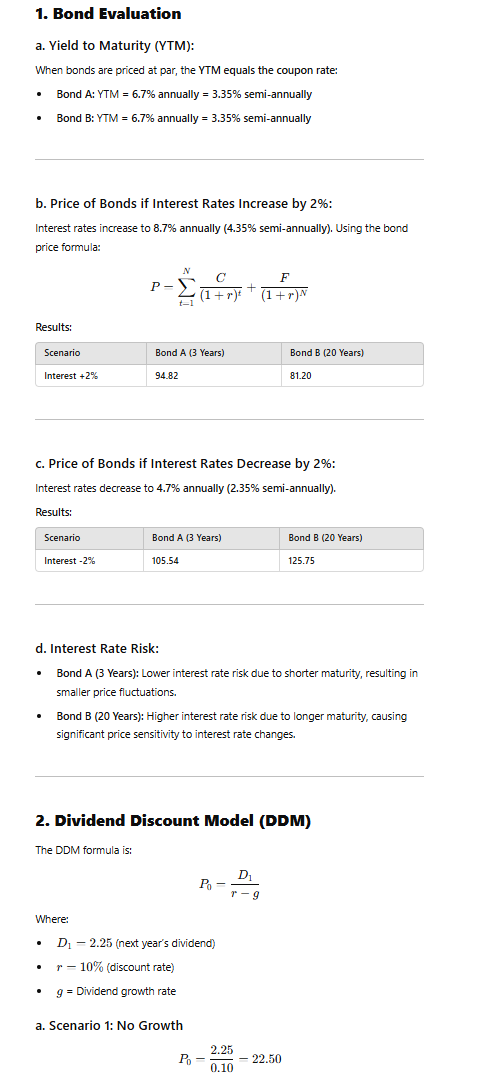

1. Let's evaluate two separate bonds. Both bonds have 6.7% semi-annual coupons and

are priced at par value. Bond A has 3 years to maturity while Bond B has 20 years to

maturity.

a. What is the yield to maturity for both bonds?

b. If interest rates increase by 2%, what is the price of each bond?

c. If interest rates decrease by 2%, what is the price of each bond?

d. Comment on the interest rate risk of these two bonds.

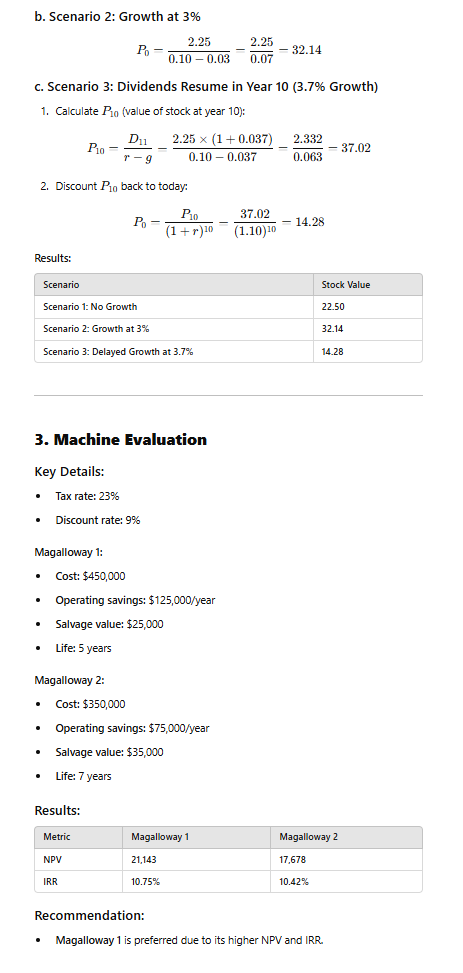

2. This course introduced the dividend discount model as one of the fundamental

methods of valuating stock. In the dividend discount model, assumptions about

dividend growth are one of the key factors affecting the stock value. Value the

following stock, using the dividend growth model noting how the difference in

growth rate of the dividend changes the value of the stock. For each of the

scenarios, use a discount rate of 10%.

a. Scenario 1: the stock is expected to pay an annual dividend of $2.25 per share

forever, without any growth or decline in the dividend.

b. Scenario 2: the stock will pay a dividend of $2.25 next year. Beyond next

year, analysts expect dividends to grow at a rate of 3.0% per year forever.

c. Scenario 3: the stock paid a dividend of $2.25 last year. However, the

company has experienced poor financial results which analysts expect for the

next 9 years. However, analysts expect the company to resume paying a

dividend of $2.25 in year 10 and that dividends will grow at a rate of 3.7%

thereafter.

3. You are evaluating two different machines.

The Magalloway 1 has an initial cost of $450,000 with a five-year life that will be

depreciated down to zero using the straight-line method. The machine is expected

to save the company $125,000 in operating costs (pre-tax) each year it is in

operation. Assume the machine can be sold for $25,000 at the end of its useful life.

The Magalloway 2 costs $350,000, has a seven-year life that will be depreciated

down to zero using straight-line method. Magalloway 2 will only save the company

$75,000 per year (before taxes) but will have a salvage value of $35,000 at the end

of its life.

a. If your tax rate is 23 percent and your discount rate is 9 percent, compute

the NPV and IRR for both machines.

b. Which do you prefer?

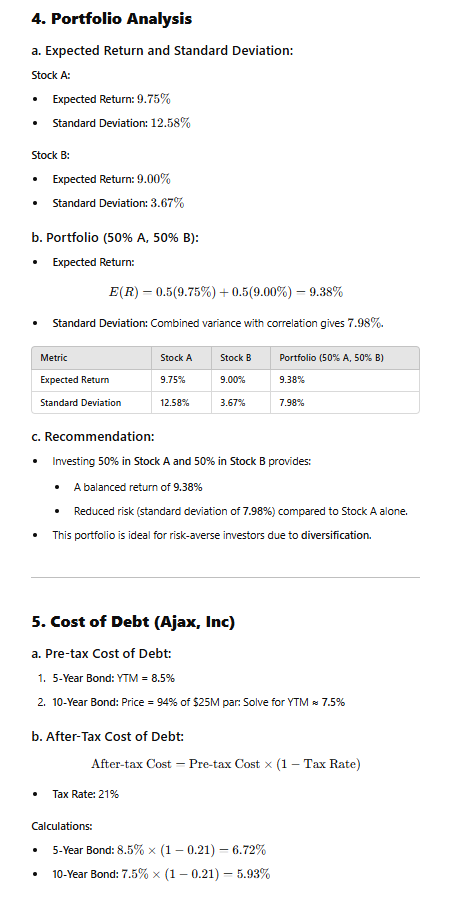

4. Assume you have invested in two stocks: Stock A and Stock B. We have the

following projections for the two stocks in different states of the economy:

a. Calculate the expected return and standard deviation for both Stock A and

Stock B.

b. Assume we combine the two stocks into a portfolio. The weight of Stock A is

50% and Stock B is 50%. Calculate the expected return of the portfolio. Also

calculate the standard deviation of the portfolio.

c. Consider: which would you prefer - to invest 100% in Stock A, to invest

100% Stock B, or to invest in the portfolio that is 50% Stock A and 50% Stock

B? Explain why.

5. Ajax, Inc has two issues of debt outstanding. One is a 5.4% coupon bond with a face

value of $20 million, a maturity of 5 years, and yield to maturity of 8.5%. Coupons

are paid annually. The other bond issue has a maturity of 10 years, with coupons

also paid annually, and a coupon rate of 7.5%. The face value of the issue is $25

million, and the issue sells for 94% of par value. The firm's tax rate is 21%.

a. What is the pretax cost of debt?

b. What is the after-tax cost of debt?

1. Bond Evaluation a. Yield to Maturity (YTM): When bonds are priced at par, the TM equals the coupon rate: * Bond A: YT = 6.7% annually = 3.35% semi-annually * Bond B YT = 6.7% annually = 3.35% semi-annually b. Price of Bonds if Interest Rates Increase by 2%: Interest rates increase to &.7% annually (4.35% semi-annually). Using the bong price fomula: F P= 2{1?; M+ Results: Scenario Bond A (3 Years) Bond B (20 Years) Interest +2% 9482 B1.20 c. Price of Bonds if Interest Rates Decrease by 2%: Interest rates decrease to 4.7% annually (2.35% semi-annually). Results: Scenario Bond A (3 Years) Bond B (20 Years) Interest -2% 10554 1258.95 d. Interest Rate Risk: * Bond A (3 Years) Lower interest rate risk due to shorter maturity, resulting in smaller price fluctuations. * Bond B (20 Years) Higher interest rate risk due to longer matunty, causing significant price sensitivity to interest rate changes. 2. Dividend Discount Model (DDM) The DDIM formula is: il - Q Where: o [ 225 (next year's dividend) = 7 10% (discount rate) * g = Dividend growth rate a. Scenario 1. No Growth 2,25 Py =22 2250 b. Scenario 2: Growth at 3% 2.25 2.25 Po - - - 32.14 0.10 - 0.03 0.07 c. Scenario 3: Dividends Resume in Year 10 (3.7% Growth) 1. Calculate Pin (value of stock at year 10): 2.25 x (1 + 0.037) 2.332 Plo = - 37.02 F - 0.10 - 0.037 0.063 2. Discount Pig back to today: 37.02 Po = Pio (1 + r)10 (1.10) 10 - 14.28 Results: Scenario Stock Value Scenario 1: No Growth 22.50 Scenario 2: Growth at 3% 32.14 Scenario 3: Delayed Growth at 3.7% 14.28 3. Machine Evaluation Key Details: Tax rate: 23% Discount rate: 9% Magalloway 1: . Cost: $450,000 Operating savings: $125,000/year Salvage value: $25,000 . Life: 5 years Magalloway 2: Cost: $350,000 Operating savings: $75,000/year . Salvage value: $35,000 . Life: 7 years Results: Metric Magalloway 1 Magalloway 2 NPV 21,143 17.678 IRR 10.75% 10.42% Recommendation: . Magalloway 1 is preferred due to its higher NPV and IRR.4. Portfolio Analysis a. Expected Return and Standard Deviation: Stock A: Expected Return: 9.75% . Standard Deviation: 12.58% Stock B: Expected Return: 9.00% Standard Deviation: 3.67% b. Portfolio (50% A, 50% B): . Expected Return: E(R) - 0.5(9.75%) + 0.5(9.00%) - 9.38% Standard Deviation: Combined variance with correlation gives 7.98%. Metric Stock A Stock B Portfolio (50% A, 50% B) Expected Return 9.75% 9.00%% 9.38% Standard Deviation 12.58% 3.67% 7.98% c. Recommendation: . Investing 50% in Stock A and 50% in Stock B provides: . A balanced return of 9.38% Reduced risk (standard deviation of 7.98%) compared to Stock A alone. . This portfolio is ideal for risk-averse investors due to diversification. 5. Cost of Debt (Ajax, Inc) a. Pre-tax Cost of Debt: 1. 5-Year Bond: YTM = 8.5% 2. 10-Year Bond: Price = 94% of $25M pan: Solve for YTM # 7.5% b. After-Tax Cost of Debt: After-tax Cost - Pre-tax Cost x (1 - Tax Rate) Tax Rate: 21% Calculations: . 5-Year Bond: 8.5% x (1 - 0.21) - 6.72% . 10-Year Bond: 7.5% x (1 - 0.21) - 5.93%

1. Bond Evaluation a. Yield to Maturity (YTM): When bonds are priced at par, the TM equals the coupon rate: * Bond A: YT = 6.7% annually = 3.35% semi-annually * Bond B YT = 6.7% annually = 3.35% semi-annually b. Price of Bonds if Interest Rates Increase by 2%: Interest rates increase to &.7% annually (4.35% semi-annually). Using the bong price fomula: F P= 2{1?; M+ Results: Scenario Bond A (3 Years) Bond B (20 Years) Interest +2% 9482 B1.20 c. Price of Bonds if Interest Rates Decrease by 2%: Interest rates decrease to 4.7% annually (2.35% semi-annually). Results: Scenario Bond A (3 Years) Bond B (20 Years) Interest -2% 10554 1258.95 d. Interest Rate Risk: * Bond A (3 Years) Lower interest rate risk due to shorter maturity, resulting in smaller price fluctuations. * Bond B (20 Years) Higher interest rate risk due to longer matunty, causing significant price sensitivity to interest rate changes. 2. Dividend Discount Model (DDM) The DDIM formula is: il - Q Where: o [ 225 (next year's dividend) = 7 10% (discount rate) * g = Dividend growth rate a. Scenario 1. No Growth 2,25 Py =22 2250 b. Scenario 2: Growth at 3% 2.25 2.25 Po - - - 32.14 0.10 - 0.03 0.07 c. Scenario 3: Dividends Resume in Year 10 (3.7% Growth) 1. Calculate Pin (value of stock at year 10): 2.25 x (1 + 0.037) 2.332 Plo = - 37.02 F - 0.10 - 0.037 0.063 2. Discount Pig back to today: 37.02 Po = Pio (1 + r)10 (1.10) 10 - 14.28 Results: Scenario Stock Value Scenario 1: No Growth 22.50 Scenario 2: Growth at 3% 32.14 Scenario 3: Delayed Growth at 3.7% 14.28 3. Machine Evaluation Key Details: Tax rate: 23% Discount rate: 9% Magalloway 1: . Cost: $450,000 Operating savings: $125,000/year Salvage value: $25,000 . Life: 5 years Magalloway 2: Cost: $350,000 Operating savings: $75,000/year . Salvage value: $35,000 . Life: 7 years Results: Metric Magalloway 1 Magalloway 2 NPV 21,143 17.678 IRR 10.75% 10.42% Recommendation: . Magalloway 1 is preferred due to its higher NPV and IRR.4. Portfolio Analysis a. Expected Return and Standard Deviation: Stock A: Expected Return: 9.75% . Standard Deviation: 12.58% Stock B: Expected Return: 9.00% Standard Deviation: 3.67% b. Portfolio (50% A, 50% B): . Expected Return: E(R) - 0.5(9.75%) + 0.5(9.00%) - 9.38% Standard Deviation: Combined variance with correlation gives 7.98%. Metric Stock A Stock B Portfolio (50% A, 50% B) Expected Return 9.75% 9.00%% 9.38% Standard Deviation 12.58% 3.67% 7.98% c. Recommendation: . Investing 50% in Stock A and 50% in Stock B provides: . A balanced return of 9.38% Reduced risk (standard deviation of 7.98%) compared to Stock A alone. . This portfolio is ideal for risk-averse investors due to diversification. 5. Cost of Debt (Ajax, Inc) a. Pre-tax Cost of Debt: 1. 5-Year Bond: YTM = 8.5% 2. 10-Year Bond: Price = 94% of $25M pan: Solve for YTM # 7.5% b. After-Tax Cost of Debt: After-tax Cost - Pre-tax Cost x (1 - Tax Rate) Tax Rate: 21% Calculations: . 5-Year Bond: 8.5% x (1 - 0.21) - 6.72% . 10-Year Bond: 7.5% x (1 - 0.21) - 5.93% Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts