Question: 1. List and define the three methods used to determine the Expected Family Contribution (EFC) for financial aid. 2. Distinguish the difference between an educational

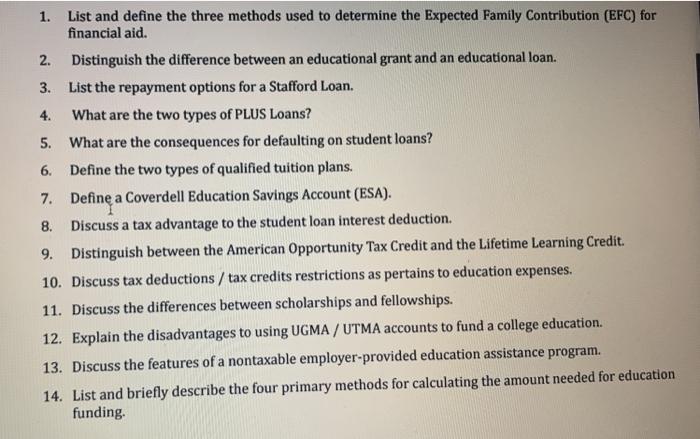

1. List and define the three methods used to determine the Expected Family Contribution (EFC) for financial aid. 2. Distinguish the difference between an educational grant and an educational loan. 3. List the repayment options for a Stafford Loan. 4. What are the two types of PLUS Loans? 5. What are the consequences for defaulting on student loans? 6. Define the two types of qualified tuition plans. 7. Define a Coverdell Education Savings Account (ESA). 8. Discuss a tax advantage to the student loan interest deduction 9. Distinguish between the American Opportunity Tax Credit and the Lifetime Learning Credit. 10. Discuss tax deductions / tax credits restrictions as pertains to education expenses. 11. Discuss the differences between scholarships and fellowships. 12. Explain the disadvantages to using UGMA / UTMA accounts to fund a college education. 13. Discuss the features of a nontaxable employer-provided education assistance program. 14. List and briefly describe the four primary methods for calculating the amount needed for education funding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts