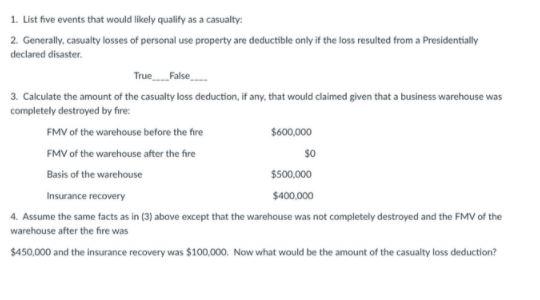

Question: 1. List five events that would likely qualify as a casualty: 2. Generally, casualty losses of personal use property are deductible only if the loss

1. List five events that would likely qualify as a casualty: 2. Generally, casualty losses of personal use property are deductible only if the loss resulted from a Presidentially declared disaster True False 3. Calculate the amount of the casualty loss deduction, if any, that would claimed given that a business warehouse was completely destroyed by fire FMV of the warehouse before the fire $600,000 FMV of the warehouse after the fire $0 Basis of the warehouse $500,000 Insurance recovery $400.000 4. Assume the same facts as in (3) above except that the warehouse was not completely destroyed and the FMV of the warehouse after the fire was $450,000 and the insurance recovery was $100,000. Now what would be the amount of the casualty loss deduction? 1. List five events that would likely qualify as a casualty: 2. Generally, casualty losses of personal use property are deductible only if the loss resulted from a Presidentially declared disaster True False 3. Calculate the amount of the casualty loss deduction, if any, that would claimed given that a business warehouse was completely destroyed by fire FMV of the warehouse before the fire $600,000 FMV of the warehouse after the fire $0 Basis of the warehouse $500,000 Insurance recovery $400.000 4. Assume the same facts as in (3) above except that the warehouse was not completely destroyed and the FMV of the warehouse after the fire was $450,000 and the insurance recovery was $100,000. Now what would be the amount of the casualty loss deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts