Question: 1. List the methods for capital budgeting (3 marks) 2. What are the options to convince managers to work in the best interest of the

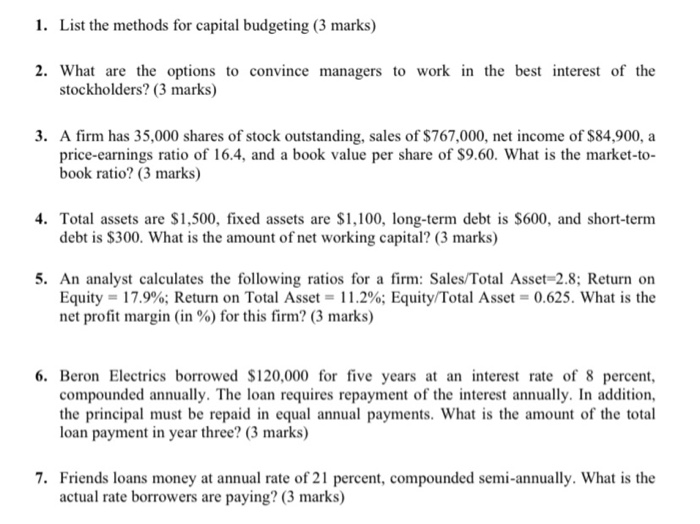

1. List the methods for capital budgeting (3 marks) 2. What are the options to convince managers to work in the best interest of the stockholders? (3 marks) 3. A firm has 35,000 shares of stock outstanding, sales of $767,000, net income of $84,900, a price-earnings ratio of 16.4, and a book value per share of $9.60. What is the market-to- book ratio? (3 marks) 4. Total assets are $1,500, fixed assets are $1,100, long-term debt is $600, and short-term debt is $300. What is the amount of net working capital? (3 marks) 5. An analyst calculates the following ratios for a firm: Sales/Total Asset=2.8; Return on Equity = 17.9%; Return on Total Asset = 11.2%; Equity/Total Asset -0.625. What is the net profit margin (in %) for this firm? (3 marks) 6. Beron Electrics borrowed $120,000 for five years at an interest rate of 8 percent, compounded annually. The loan requires repayment of the interest annually. In addition, the principal must be repaid in equal annual payments. What is the amount of the total loan payment in year three? (3 marks) 7. Friends loans money at annual rate of 21 percent, compounded semi-annually. What is the actual rate borrowers are paying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts