Question: 1. Looking at the portfolio data for the mean returns, the standard deviations of returns, and correlations among the returns of the five mutual funds.

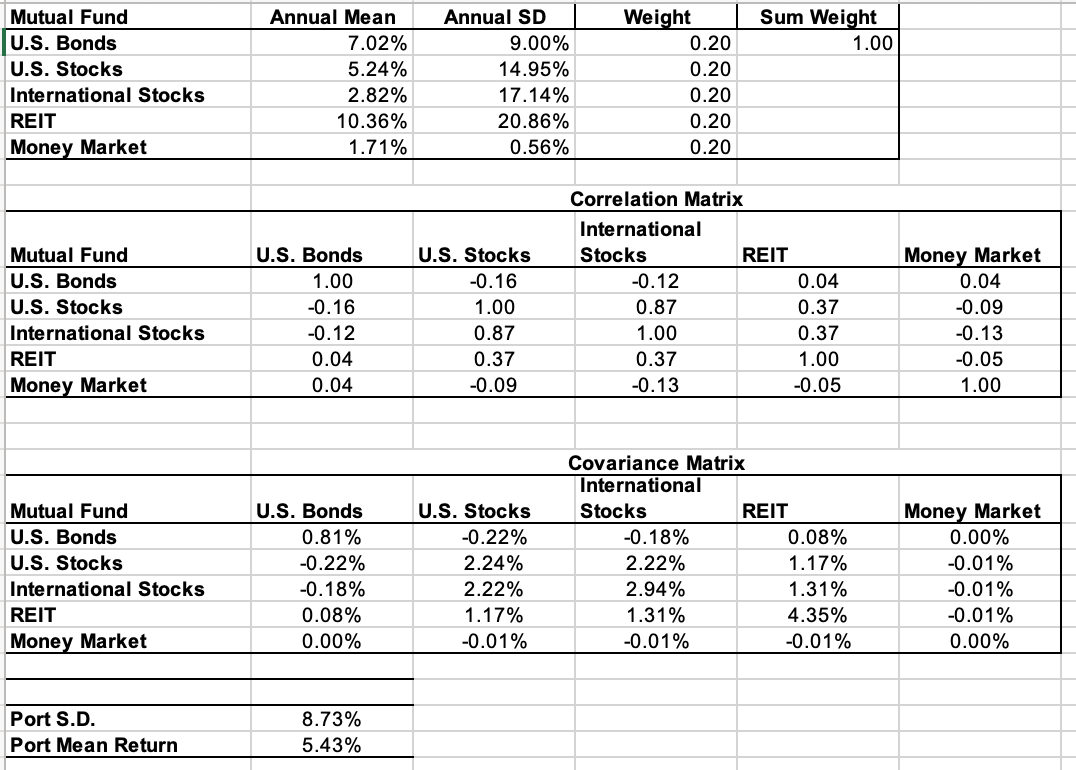

1. Looking at the portfolio data for the mean returns, the standard deviations of returns, and correlations among the returns of the five mutual funds. They are historical returns, standard deviations and correlations during the 19 years.

(a) Do you think that they are also good estimates of expected future returns, standard deviations and correlations? For example, the return of U.S. bonds exceeded the return of U.S. stocks during the period.

(b) Do you think that it is reasonable to expect this will be true in the future as well?

2. As you see in the Portfolio data, the return of the portfolio whereby the 5 funds are weighted equally (Weight = 0.20 for each fund) is 5.43% with a standard deviation of returns of 8.73%.

(a) Is the return of the portfolio equal to the mean return of the 5 funds, or is it higher or lower? o Is the standard deviation of the return of the portfolio equal to the mean standard deviation of the returns of the 5 funds, or is it higher or lower? Why is it so?

(b) Comment on the relation between the returns of each of the 5 funds and the return of the portfolio, and on the relation between the standard deviation of the returns of each of the 5 funds and the standard deviation of the returns of the portfolio.

Sum Weight 1.00 Mutual Fund U.S. Bonds U.S. Stocks International Stocks REIT Money Market Annual Mean 7.02% 5.24% 2.82% 10.36% 1.71% Annual SD 9.00% 14.95% 17.14% 20.86% 0.56% Weight 0.20 0.20 0.20 0.20 0.20 Mutual Fund U.S. Bonds U.S. Stocks International Stocks REIT Money Market U.S. Bonds 1.00 -0.16 -0.12 0.04 0.04 U.S. Stocks -0.16 1.00 0.87 0.37 -0.09 Correlation Matrix International Stocks REIT -0.12 0.04 0.87 0.37 1.00 0.37 0.37 1.00 -0.13 -0.05 Money Market 0.04 -0.09 -0.13 -0.05 1.00 Mutual Fund U.S. Bonds U.S. Stocks International Stocks REIT Money Market U.S. Bonds 0.81% -0.22% -0.18% 0.08% 0.00% U.S. Stocks -0.22% 2.24% 2.22% 1.17% -0.01% Covariance Matrix International Stocks REIT -0.18% 0.08% 2.22% 1.17% 2.94% 1.31% 1.31% 4.35% -0.01% -0.01% Money Market 0.00% -0.01% -0.01% -0.01% 0.00% Port S.D. Port Mean Return 8.73% 5.43%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts