Question: 1: Meet the Mitchells. Learn about your potential clients and their current financial situation in this file: 2: Write your 1 page engagement letter. This

1: Meet the Mitchells.

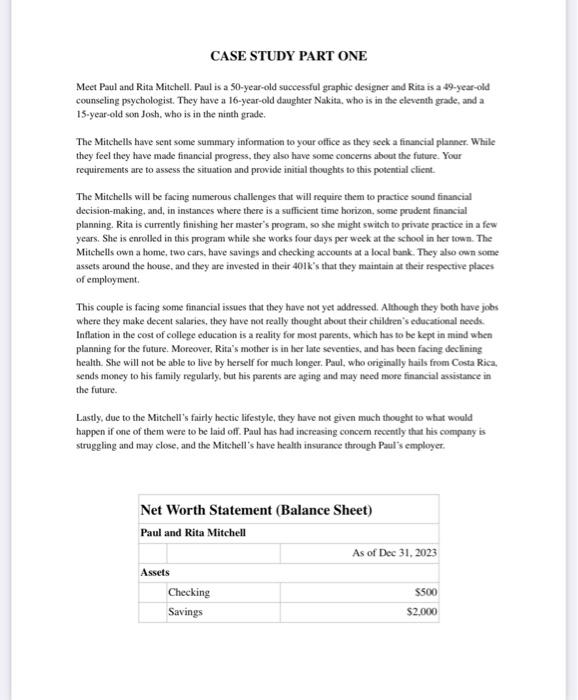

Learn about your potential clients and their current financial situation in this file:

2: Write your 1 page engagement letter.

This is an introductory one-page letter to the Mitchells that thanks them for the inquiry, outlines your initial observations / questions, lists your proposed fee, and demonstrates your mastery of financial knowledge. Rememberyou want to convince the Mitchells that you know your stuff and have the right ideas to guide them towards financial success! Use page 264 in your textbook as a reference for a professional, well-written engagement letter.

3: Write a brief, 1-2 page report to prepare for your first meeting with the Mitchells.

You must answer the following questions:

- What are the areas of financial concerns that the Mitchells are currently facing?

- The Mitchells are making some financial decisions that will help them in the future. In your estimation, what are the sound decisions theyve already made?

- Do you support the idea of Rita continuing her education?

- Do you believe the Mitchells will agree on what to do in terms of their parents?

- You will want additional information from the Mitchells when they have their first meeting with you. However, they do not know what other information you will need. Prepare a set of 4-5 questions that you would deem as being critical during your first client meeting. The answers to these questions will allow you to begin preparing a financial plan for the client yet without the answers, it will be difficult to complete a financial plan.

- Based on the family and financial information provided, advise the Mitchells on one short-term financial goal.

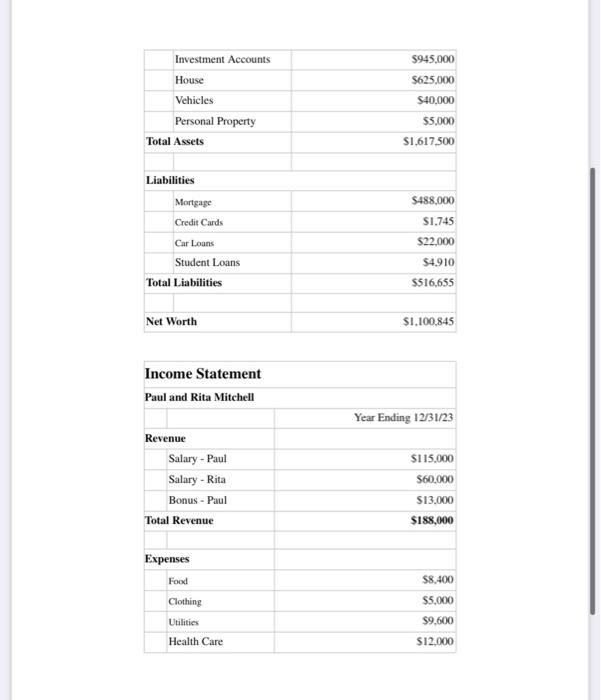

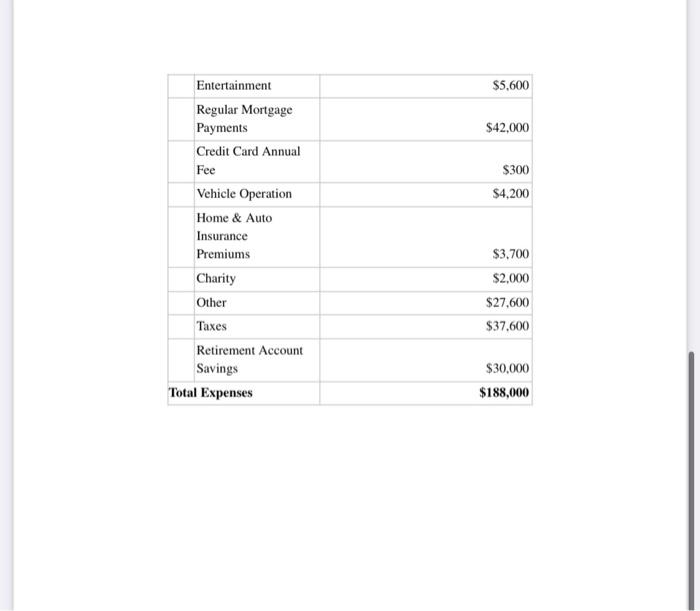

\begin{tabular}{|l|r|} \hline Investment Accounts & $945,000 \\ \hline House & $625,000 \\ \hline Vehicles & $40,000 \\ \hline Personal Property & $5,000 \\ \hline Total Assets & $1,617,500 \\ \hline & \\ \hline Liabilities & \\ \hline Mortgage & $488,000 \\ \hline Credit Cards & $1,745 \\ \hline Car Loans & $22,000 \\ \hline Student Loans & $4,910 \\ \hline Total Liabilities & $516,655 \\ \hline & \\ \hline Net Worth & $1,100,845 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts