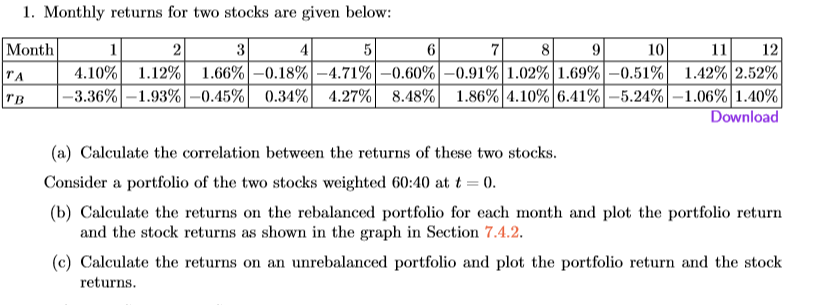

Question: 1. Monthly returns for two stocks are given below: Month | I| 2| 3| 4| 5| 6| 7| 8| 9| iol 1.66%-0.18%-1.71%-0.60%-0.91%1.02%1.69%-0.51% ill 12 -

1. Monthly returns for two stocks are given below: Month | I| 2| 3| 4| 5| 6| 7| 8| 9| iol 1.66%-0.18%-1.71%-0.60%-0.91%1.02%1.69%-0.51% ill 12 - 4.10% 1.12% 1.42% 2.52% r -3.36% 1.93% 0.45% 0.34 % 4.27% 8.48% 1.86% 410% 6.41% 5.24% 1.06% 1.40% rB Download (a) Calculate the correlation between the returns of these two stocks. Consider a portfolio of the two stocks weighted 60:40 at t 0. the returns on the rebalanced portfolio for each month and plot the portfolio return and the stock returns as shown in the graph in Section 7.4.2 (c) Calculate the returns on an unrebalanced portfolio and plot the portfolio return and the stock returns 1. Monthly returns for two stocks are given below: Month | I| 2| 3| 4| 5| 6| 7| 8| 9| iol 1.66%-0.18%-1.71%-0.60%-0.91%1.02%1.69%-0.51% ill 12 - 4.10% 1.12% 1.42% 2.52% r -3.36% 1.93% 0.45% 0.34 % 4.27% 8.48% 1.86% 410% 6.41% 5.24% 1.06% 1.40% rB Download (a) Calculate the correlation between the returns of these two stocks. Consider a portfolio of the two stocks weighted 60:40 at t 0. the returns on the rebalanced portfolio for each month and plot the portfolio return and the stock returns as shown in the graph in Section 7.4.2 (c) Calculate the returns on an unrebalanced portfolio and plot the portfolio return and the stock returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts