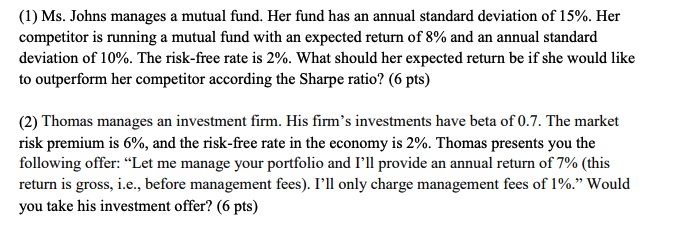

Question: ( 1 ) Ms . Johns manages a mutual fund. Her fund has an annual standard deviation of 1 5 % . Her competitor is

Ms Johns manages a mutual fund. Her fund has an annual standard deviation of Her

competitor is running a mutual fund with an expected return of and an annual standard

deviation of The riskfree rate is What should her expected return be if she would like

to outperform her competitor according the Sharpe ratio? use Excel

Thomas manages an investment firm. His firm's investments have beta of The market

risk premium is and the riskfree rate in the economy is Thomas presents you the

following offer: "Let me manage your portfolio and I'll provide an annual return of this

return is gross, ie before management fees I'll only charge management fees of Would

you take his investment offer? pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock