Question: 1. MULTIPLE CHOICE - THEORY. 2 points each 1. Statement 1 ($1): There are no uncertainties when two companies agree on a business combination. Statement

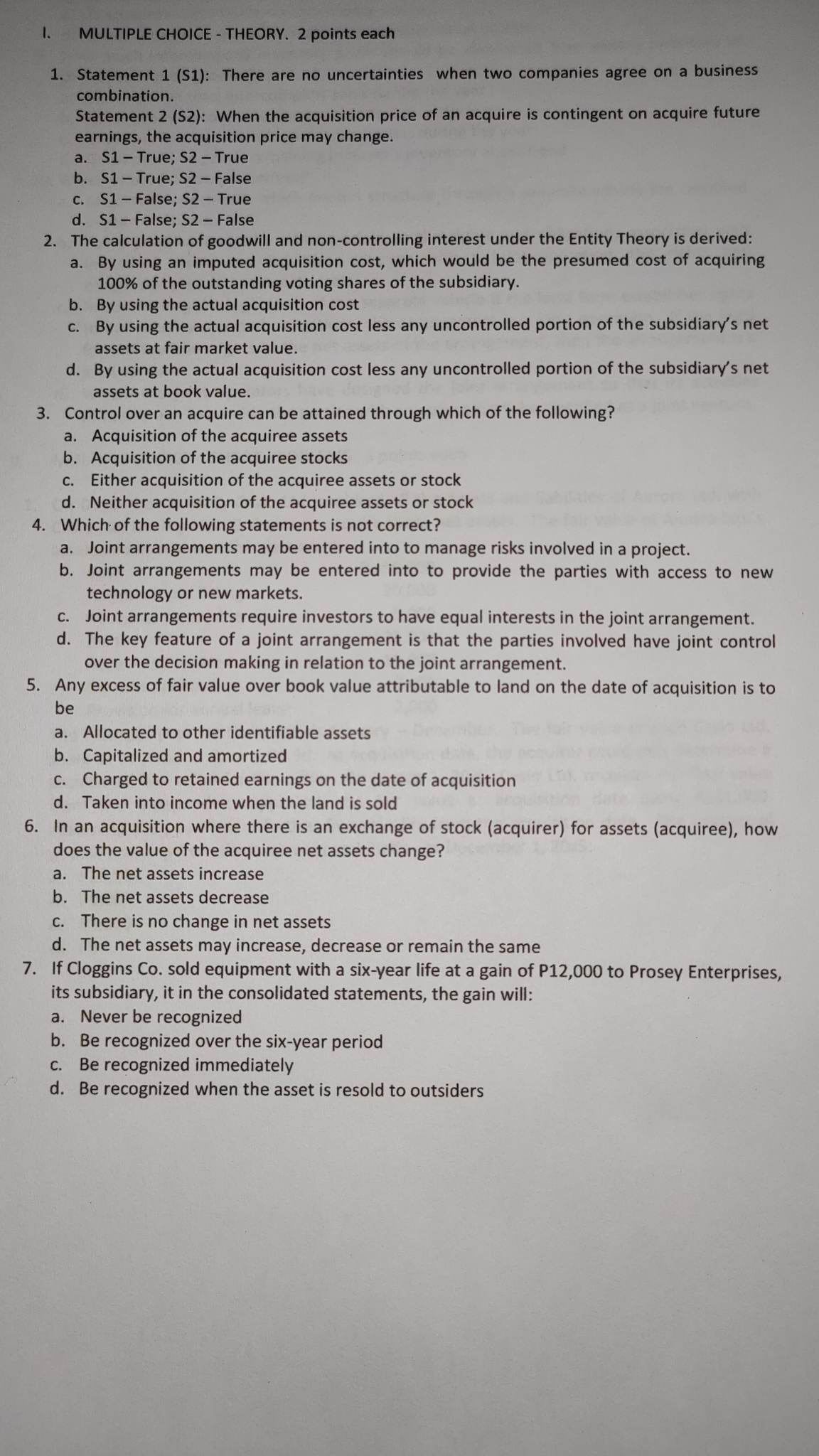

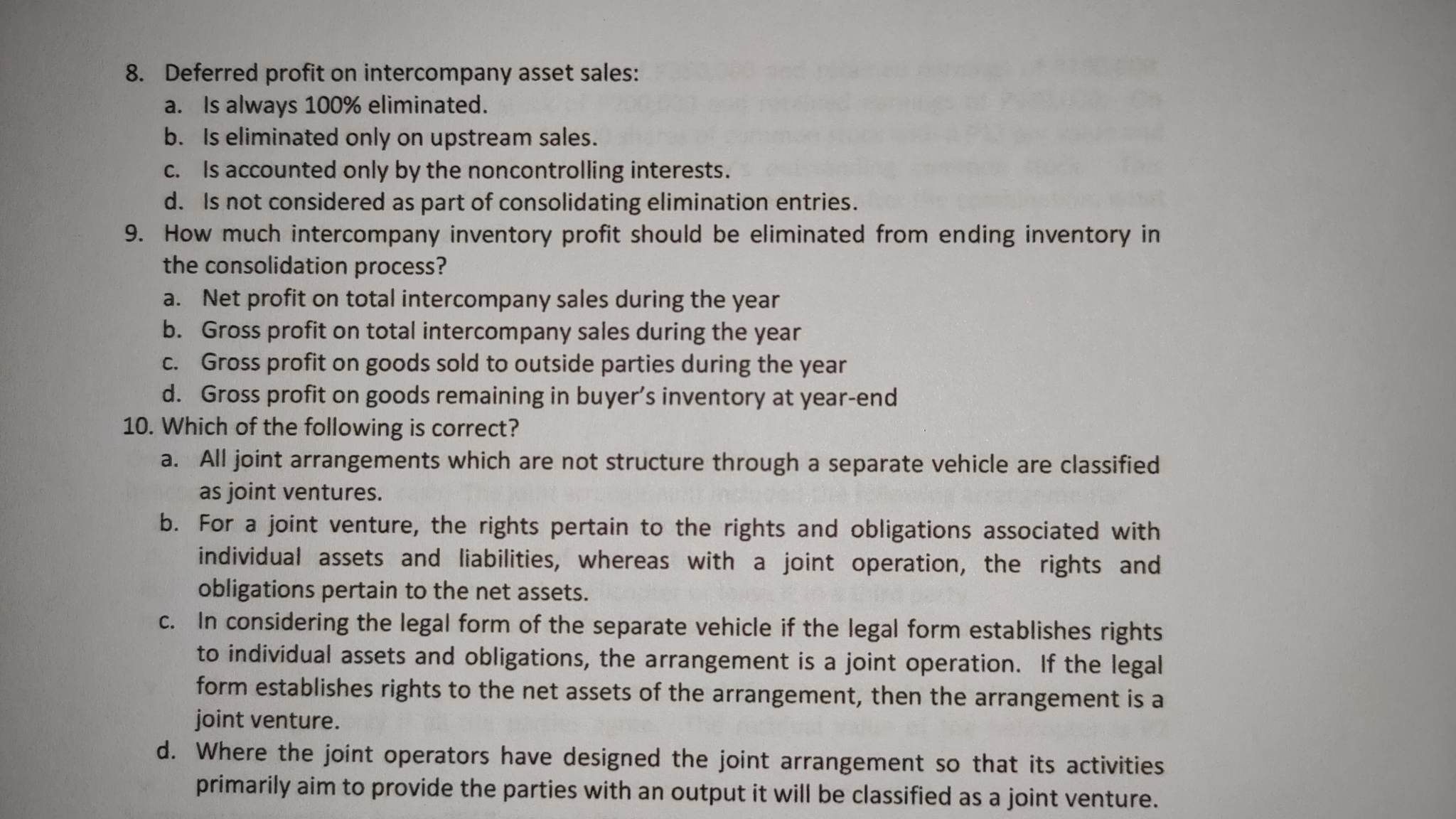

1. MULTIPLE CHOICE - THEORY. 2 points each 1. Statement 1 ($1): There are no uncertainties when two companies agree on a business combination. Statement 2 ($2): When the acquisition price of an acquire is contingent on acquire future earnings, the acquisition price may change. a. S1 - True; $2 - True b. S1 - True; $2 - False c. $1 - False; $2 - True d. S1 - False; $2 - False 2. The calculation of goodwill and non-controlling interest under the Entity Theory is derived: a. By using an imputed acquisition cost, which would be the presumed cost of acquiring 100% of the outstanding voting shares of the subsidiary. b. By using the actual acquisition cost C. By using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at fair market value. d. By using the actual acquisition cost less any uncontrolled portion of the subsidiary's net assets at book value. Control over an acquire can be attained through which of the following? a. Acquisition of the acquiree assets b. Acquisition of the acquiree stocks c. Either acquisition of the acquiree assets or stock d. Neither acquisition of the acquiree assets or stock 4. Which of the following statements is not correct? a. Joint arrangements may be entered into to manage risks involved in a project. b. Joint arrangements may be entered into to provide the parties with access to new technology or new markets. c. Joint arrangements require investors to have equal interests in the joint arrangement. d. The key feature of a joint arrangement is that the parties involved have joint control over the decision making in relation to the joint arrangement. 5. Any excess of fair value over book value attributable to land on the date of acquisition is to be a. Allocated to other identifiable assets b. Capitalized and amortized c. Charged to retained earnings on the date of acquisition d. Taken into income when the land is sold 6. In an acquisition where there is an exchange of stock (acquirer) for assets (acquiree), how does the value of the acquiree net assets change? a. The net assets increase b. The net assets decrease c. There is no change in net assets d. The net assets may increase, decrease or remain the same 7. If Cloggins Co. sold equipment with a six-year life at a gain of P12,000 to Prosey Enterprises, its subsidiary, it in the consolidated statements, the gain will: a. Never be recognized b. Be recognized over the six-year period C. Be recognized immediately d. Be recognized when the asset is resold to outsiders8. Deferred profit on intercompany asset sales: a. Is always 100% eliminated. b. Is eliminated only on upstream sales. C. Is accounted only by the noncontrolling interests. d. Is not considered as part of consolidating elimination entries. 9. How much intercompany inventory profit should be eliminated from ending inventory in the consolidation process? a. Net profit on total intercompany sales during the year b. Gross profit on total intercompany sales during the year c. Gross profit on goods sold to outside parties during the year d. Gross profit on goods remaining in buyer's inventory at year-end 10. Which of the following is correct? a. All joint arrangements which are not structure through a separate vehicle are classified as joint ventures. b. For a joint venture, the rights pertain to the rights and obligations associated with individual assets and liabilities, whereas with a joint operation, the rights and obligations pertain to the net assets. c. In considering the legal form of the separate vehicle if the legal form establishes rights to individual assets and obligations, the arrangement is a joint operation. If the legal form establishes rights to the net assets of the arrangement, then the arrangement is a joint venture. d. Where the joint operators have designed the joint arrangement so that its activities primarily aim to provide the parties with an output it will be classified as a joint venture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts