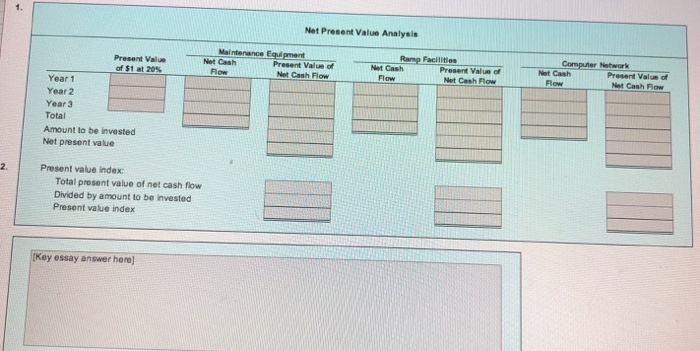

Question: 1. Net Present Value Analysis Computer Network Ramp Facilities Present Value of Net Cash Row Net Cash Row Present Value of Net Cash Fow Net

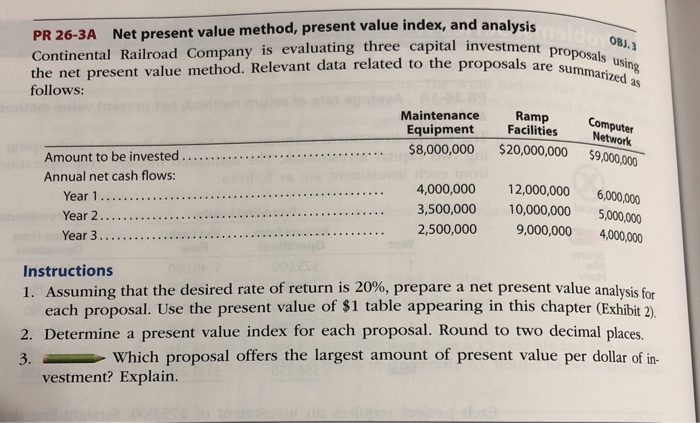

1. Net Present Value Analysis Computer Network Ramp Facilities Present Value of Net Cash Row Net Cash Row Present Value of Net Cash Fow Net Cash ow Present Value Present Value of Net Cash Flow Net Cash of51 at 20% Year 1 Year 2 Year 3 Total Amount to be invested Net present value Present value index 2. Total present value of net cash flow Divided by amount to be invested Present value index [Key essay answer here PR 26-3A Net present value method, present value index, and analysis Continental Railroad Company is evaluating three capital investment the net present value method. Relevant data related to the prop follows: OBJ.3 osals are su mmarized as Maintenance Ramp Equipment Facilities Network $8,000,000 $20,000,000 $9,000,000 .. . Amount to be invested Annual net cash flows: 4,000,000 12,000,000 6,000,000 3,500,000 10,000,000 5,000,000 2,500,000 9,000,000 4000000 Year 3 Instructions I. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use the present value of $1 table appearing in this chapter (Exhibit 2). 2. Determine a present value index for each proposal. Round to two decimal places. 3.Which proposal offers the largest amount of present value per dollar of in- vestment? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts