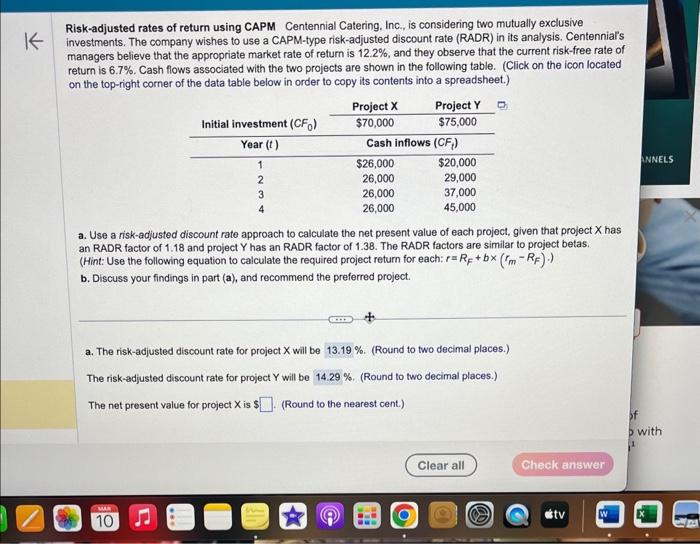

Question: 1. net present value for project x 2. net present value for project y 3. which project is preferref? Risk-adjusted rates of return using CAPM

Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a CAPM-type risk-adjusted discount rate (RADR) in its analysis. Centennials managers believe that the appropriate market rate of return is 12.2%, and they observe that the current risk-free rate of return is 6.7%. Cash flows associated with the two projects are shown in the following table. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) a. Use a risk-adjusted discount rate approach to calculate the net present value of each project, given that project X has an RADR factor of 1.18 and project Y has an RADR factor of 1.38. The RADR factors are similar to project betas. (Hint: Use the following equation to calculate the required project return for each: r=RF+b(rmRF).) b. Discuss your findings in part (a), and recommend the preferred project. a. The risk-adjusted discount rate for project X will be 6. (Round to two decimal places.) The risk-adjusted discount rate for project Y will be \%. (Round to two decimal places.) The net present value for project X is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts